About Notice 797, Possible Federal Tax Refund Due to the 2023

Understanding Notice 797: Possible Federal Tax Refund

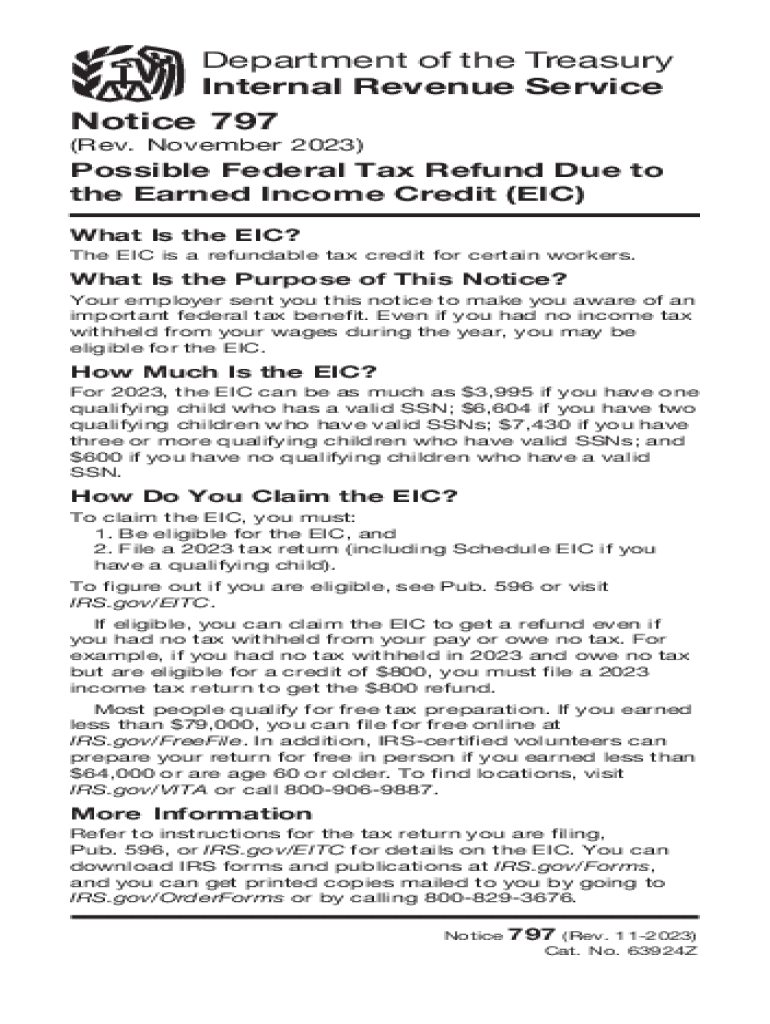

Notice 797 is an important communication from the Internal Revenue Service (IRS) that informs taxpayers about a potential federal tax refund. This notice typically indicates that the IRS has identified an Earned Income Tax Credit (EITC) or other refundable credits that may apply to the taxpayer's situation. It is essential for recipients to understand the implications of this notice, as it can affect their tax filing and refund expectations.

How to Use Notice 797 for Your Tax Filing

When you receive Notice 797, it is crucial to review the information carefully. The notice provides details on the refund amount and any necessary actions you may need to take. If you believe you qualify for the credits mentioned, ensure that you include the relevant forms, such as the tax earned income credit form, when filing your taxes. This will help expedite the processing of your refund.

Obtaining Notice 797: What You Need to Know

If you do not receive Notice 797 but believe you may be eligible for a federal tax refund, you can contact the IRS directly to request a copy. It is advisable to have your tax information ready, including your Social Security number and filing details, to facilitate the process. The IRS can provide guidance on how to obtain this notice and any additional documentation you may need.

Key Elements of Notice 797

Notice 797 includes several key elements that taxpayers should be aware of:

- Refund Amount: The notice specifies the potential refund amount you may be eligible for.

- Credits Applied: It outlines any credits, such as the Earned Income Tax Credit, that have been applied to your account.

- Next Steps: The notice may include instructions on how to proceed if you wish to claim the refund.

IRS Guidelines for Filing with Notice 797

The IRS provides specific guidelines for taxpayers who receive Notice 797. It is important to follow these guidelines closely to ensure compliance and to maximize your refund potential. This may include filing your tax return electronically or submitting required forms by mail. Always refer to the IRS website or contact them directly for the most current information regarding your tax situation.

Eligibility Criteria for Refunds Related to Notice 797

To qualify for the federal tax refund indicated in Notice 797, taxpayers must meet certain eligibility criteria. This typically includes having earned income and meeting the income thresholds set by the IRS for the Earned Income Tax Credit. Additionally, other factors such as filing status and the number of dependents can influence eligibility. It is advisable to review these criteria carefully to determine your qualification for the refund.

Quick guide on how to complete about notice 797 possible federal tax refund due to the

Effortlessly Manage About Notice 797, Possible Federal Tax Refund Due To The on Any Device

The management of online documents has gained traction among companies and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed forms, allowing you to obtain the correct document and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without hassles. Handle About Notice 797, Possible Federal Tax Refund Due To The on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Modify and eSign About Notice 797, Possible Federal Tax Refund Due To The with Ease

- Locate About Notice 797, Possible Federal Tax Refund Due To The and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

No more lost or misplaced documents, tedious searches for forms, or errors necessitating the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign About Notice 797, Possible Federal Tax Refund Due To The to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about notice 797 possible federal tax refund due to the

Create this form in 5 minutes!

How to create an eSignature for the about notice 797 possible federal tax refund due to the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help streamline the IRS federal tax refund process?

airSlate SignNow provides a user-friendly platform that simplifies the signing and sending of essential tax documents. By utilizing our eSignature solutions, you can expedite the filing process for your IRS federal tax refund, ensuring timely submission and reducing the risk of errors.

-

What pricing plans does airSlate SignNow offer for businesses dealing with IRS federal tax refunds?

airSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes. Our plans are cost-effective, allowing you to choose the best option based on your needs while ensuring seamless processing of documents related to your IRS federal tax refund.

-

What are the main features of airSlate SignNow that support IRS federal tax refund submissions?

Key features of airSlate SignNow include easy document editing, multi-party signing, and secure cloud storage. These functionalities facilitate efficient handling of the documents necessary for an IRS federal tax refund, making the process faster and hassle-free.

-

How does airSlate SignNow ensure the security of documents related to IRS federal tax refunds?

Security is a top priority at airSlate SignNow. We implement advanced encryption standards and compliance with industry regulations to protect sensitive information about your IRS federal tax refund transactions, ensuring that all documents remain confidential and secure.

-

Can airSlate SignNow integrate with other tools for processing IRS federal tax refunds?

Yes, airSlate SignNow seamlessly integrates with numerous software applications, enhancing your workflow. This capability allows you to connect with accounting software and tax platforms to manage your IRS federal tax refund documents effortlessly.

-

What benefits does using airSlate SignNow offer for businesses managing IRS federal tax refund claims?

Using airSlate SignNow can signNowly enhance your efficiency and reduce turnaround times for IRS federal tax refund claims. Our platform allows for quick document preparation and electronic signatures, which can save you valuable time during tax season.

-

Is airSlate SignNow suitable for individuals or only businesses dealing with IRS federal tax refunds?

airSlate SignNow caters to both individuals and businesses. Whether you're submitting a personal IRS federal tax refund or managing documents for your company, our platform is designed to meet diverse user needs, providing flexibility and ease of use.

Get more for About Notice 797, Possible Federal Tax Refund Due To The

- Contrat de travail qubec form

- Sw 1 bmp worksheet less than 1 acre county of ventura portal countyofventura form

- Data breach form

- Really good stuff order form 44131751

- 1310 form

- Internship time log form has vcu

- Personal trainer job application form pdf

- Students form 2150 nondiscrimination and student rights searches by school personnel student lockers acknowledgement concerning

Find out other About Notice 797, Possible Federal Tax Refund Due To The

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple