CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return 2022-2026

What is the CDTFA 501 WG, Winegrower Tax Return

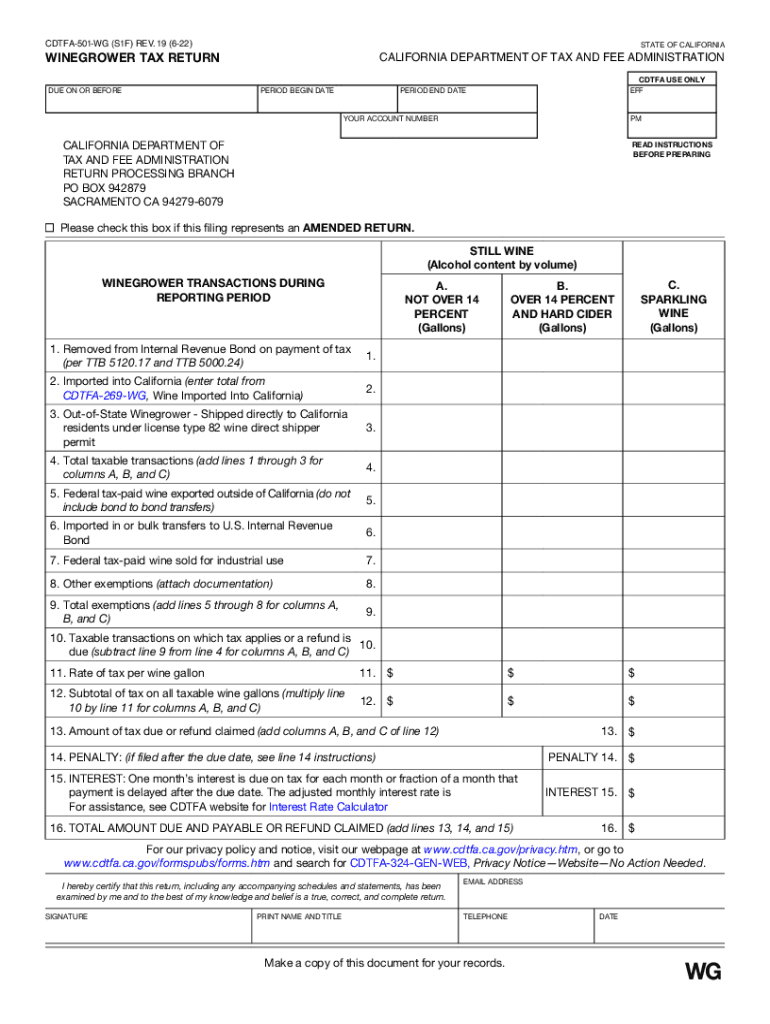

The CDTFA 501 WG, commonly referred to as the Winegrower Tax Return, is a form used by winegrowers in California to report and pay taxes on wine production. This form is essential for compliance with state tax regulations, ensuring that winegrowers accurately report their production volumes and pay the appropriate taxes. The form captures vital information about the wine produced, including the type of wine, the volume, and the applicable tax rates. Understanding the purpose and requirements of the CDTFA 501 WG is crucial for any winegrower operating within California.

Steps to complete the CDTFA 501 WG, Winegrower Tax Return

Completing the CDTFA 501 WG involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your wine production, including production records and sales data. Next, fill out the form with precise details about the types and volumes of wine produced during the reporting period. Be sure to calculate the taxes owed based on the current tax rates applicable to your production. After completing the form, review it thoroughly for any errors before submission. Finally, submit the form either online or via mail, depending on your preference and the guidelines provided by the California Department of Tax and Fee Administration (CDTFA).

How to obtain the CDTFA 501 WG, Winegrower Tax Return

The CDTFA 501 WG can be obtained directly from the California Department of Tax and Fee Administration's website. It is available in a downloadable format, allowing winegrowers to print it for completion. Additionally, winegrowers can request physical copies of the form through the CDTFA’s customer service. Ensuring you have the latest version of the form is important, as tax regulations may change, affecting the information required for reporting.

Legal use of the CDTFA 501 WG, Winegrower Tax Return

The legal use of the CDTFA 501 WG is governed by California tax laws, which require winegrowers to report their production and sales accurately. To be considered legally binding, the form must be completed in accordance with the guidelines set forth by the CDTFA. This includes providing truthful information and adhering to submission deadlines. Failure to comply with these regulations can result in penalties, making it essential for winegrowers to understand their obligations when using the form.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 501 WG are typically set by the California Department of Tax and Fee Administration and can vary based on the reporting period. Generally, winegrowers must submit their tax returns quarterly or annually, depending on their production volume. It is important to stay informed about specific deadlines to avoid late fees and penalties. Keeping a calendar of important dates related to tax filings can help ensure timely submissions.

Required Documents

To complete the CDTFA 501 WG, winegrowers must gather several required documents. These typically include production records that detail the amount and type of wine produced, sales invoices, and any previous tax returns related to wine production. Accurate record-keeping is essential, as it supports the information reported on the tax return and can be crucial in case of audits or inquiries from the CDTFA.

Penalties for Non-Compliance

Non-compliance with the requirements of the CDTFA 501 WG can lead to significant penalties for winegrowers. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial for winegrowers to understand the importance of timely and accurate submissions to avoid these consequences. Regularly reviewing tax obligations and seeking assistance when needed can help mitigate the risk of non-compliance.

Quick guide on how to complete cdtfa 501 wg winegrower tax return winegrower tax return

Effortlessly Prepare CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return on any device with the airSlate SignNow applications for Android or iOS and ease any document-related task today.

The Simplest Method to Edit and eSign CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return with Ease

- Locate CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return and then click Access Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Complete button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 501 wg winegrower tax return winegrower tax return

Create this form in 5 minutes!

People also ask

-

What is 501 wg in relation to airSlate SignNow?

501 wg is a reference to the latest version of airSlate SignNow that enhances document signing processes. This version integrates advanced features to streamline eSigning and document management, making it an essential tool for businesses.

-

How does airSlate SignNow with 501 wg improve document workflows?

With 501 wg, airSlate SignNow provides enhanced automation that simplifies document workflows. Users can effortlessly create, send, and track documents, reducing processing time and ensuring compliance.

-

What pricing plans are available for airSlate SignNow 501 wg?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from a basic plan to advanced options. With the 501 wg features, businesses can find a cost-effective solution that maximizes value while managing their eSigning tasks.

-

Can airSlate SignNow 501 wg be integrated with other applications?

Yes, airSlate SignNow 501 wg seamlessly integrates with numerous applications including CRMs and document management systems. This ensures that users can streamline their workflows and enhance productivity across platforms.

-

What are the key benefits of using airSlate SignNow 501 wg?

The key benefits of using airSlate SignNow 501 wg include faster turnaround times for document approvals, enhanced security for sensitive documents, and user-friendly features that simplify eSigning for all users.

-

Is training available for using airSlate SignNow 501 wg?

Yes, airSlate SignNow provides comprehensive training resources for users of 501 wg. This includes tutorials, webinars, and customer support to ensure businesses can maximize their use of the platform.

-

How secure is airSlate SignNow 501 wg for document management?

airSlate SignNow 501 wg employs advanced security measures including encryption and authentication protocols to protect your documents. This ensures that sensitive data is safeguarded throughout the entire signing process.

Get more for CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return

Find out other CDTFA 501 WG, Winegrower Tax Return Winegrower Tax Return

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer