Cdtfa 501 Wg 2018

What is the CDTFA 501 WG?

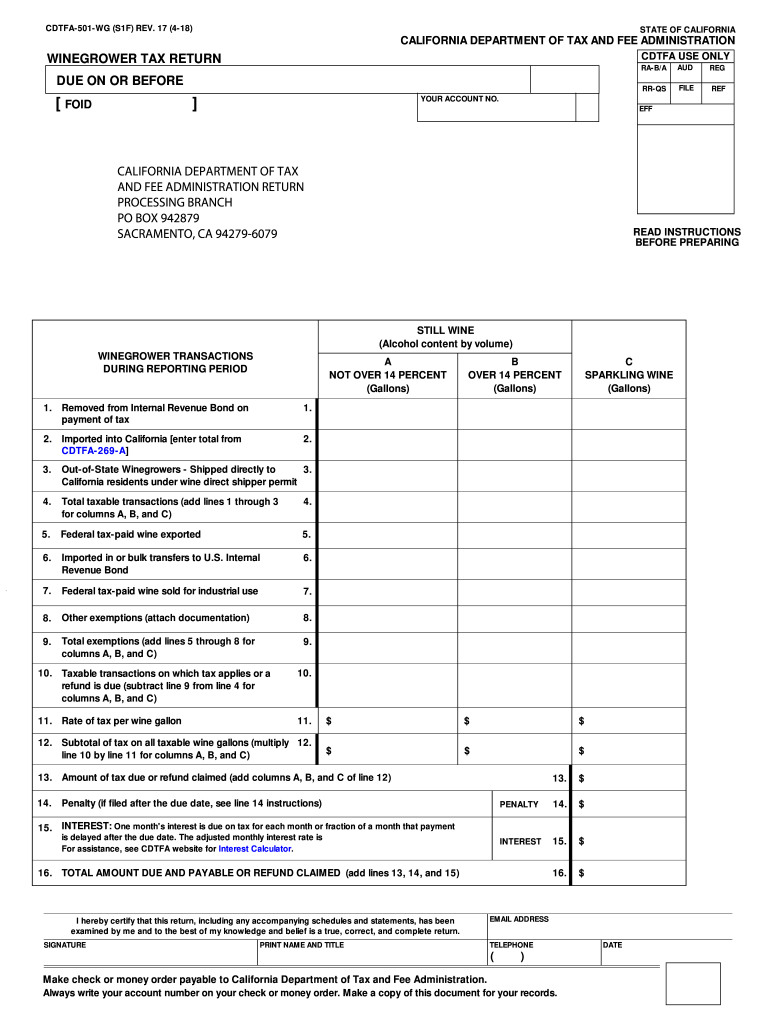

The CDTFA 501 WG is a tax form used by winegrowers in California to report their sales and use tax obligations. This form is essential for businesses involved in the production and sale of wine, allowing them to accurately report their tax liabilities to the California Department of Tax and Fee Administration (CDTFA). The CDTFA 501 WG helps ensure compliance with state tax laws and facilitates the proper assessment of taxes owed by winegrowers.

How to Use the CDTFA 501 WG

Using the CDTFA 501 WG involves several steps to ensure accurate reporting. First, gather all necessary sales data, including the total sales of wine and any applicable deductions or exemptions. Next, fill out the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted either online or via mail, depending on the preference of the winegrower.

Steps to Complete the CDTFA 501 WG

Completing the CDTFA 501 WG requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant sales data, including invoices and receipts.

- Access the CDTFA 501 WG form through the CDTFA website or obtain a physical copy.

- Fill in the required fields, ensuring that all figures are accurate and reflect your sales.

- Review the form for any errors or omissions.

- Submit the completed form online or mail it to the appropriate CDTFA office.

Legal Use of the CDTFA 501 WG

The CDTFA 501 WG must be used in accordance with California tax laws. Winegrowers are legally obligated to report their sales accurately and timely. Failure to comply with these requirements can result in penalties and interest on unpaid taxes. By using the CDTFA 501 WG correctly, winegrowers can ensure they meet their legal obligations and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 501 WG are crucial for compliance. Typically, winegrowers must submit their forms quarterly, with specific deadlines set by the CDTFA. It is essential to stay informed about these dates to avoid late fees or penalties. Mark your calendar for the due dates to ensure timely submission of your tax reports.

Required Documents

To complete the CDTFA 501 WG, certain documents are necessary. These may include:

- Sales invoices and receipts for wine sales.

- Records of any tax-exempt sales or deductions.

- Previous tax returns for reference.

Having these documents ready will streamline the process of completing the form and ensure accuracy in reporting.

Quick guide on how to complete winegrower tax return cdtfa 501 wg

Your assistance manual on how to prepare your Cdtfa 501 Wg

If you’re curious about how to finalize and submit your Cdtfa 501 Wg, here are some brief instructions on how to simplify tax processing.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you handle documentation online. airSlate SignNow is a highly user-friendly and efficient document solution that allows you to modify, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and revisit sections to update details as needed. Streamline your tax oversight with advanced PDF editing, eSigning, and user-friendly sharing options.

Adhere to the steps below to complete your Cdtfa 501 Wg in just a few minutes:

- Create your account and start working on PDFs in a matter of moments.

- Browse our catalog to access any IRS tax document; explore various versions and schedules.

- Click Get form to open your Cdtfa 501 Wg in our editor.

- Complete the necessary fillable sections with your details (text, numeric values, check marks).

- Utilize the Sign Tool to append your legally-recognized eSignature (if required).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to electronically submit your taxes using airSlate SignNow. Please be aware that paper filing can lead to mistakes and delay refunds. Additionally, prior to e-filing your taxes, verify the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct winegrower tax return cdtfa 501 wg

FAQs

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the winegrower tax return cdtfa 501 wg

How to create an electronic signature for the Winegrower Tax Return Cdtfa 501 Wg in the online mode

How to create an electronic signature for the Winegrower Tax Return Cdtfa 501 Wg in Chrome

How to generate an eSignature for putting it on the Winegrower Tax Return Cdtfa 501 Wg in Gmail

How to create an eSignature for the Winegrower Tax Return Cdtfa 501 Wg straight from your mobile device

How to create an electronic signature for the Winegrower Tax Return Cdtfa 501 Wg on iOS

How to generate an electronic signature for the Winegrower Tax Return Cdtfa 501 Wg on Android devices

People also ask

-

What is form 501 and how can airSlate SignNow help with it?

Form 501 refers to a specific legal and administrative document that requires electronic signatures for validation. airSlate SignNow simplifies the process of preparing, sending, and signing form 501 through a user-friendly platform that enhances document workflow efficiency.

-

What features does airSlate SignNow offer for managing form 501?

airSlate SignNow provides various features tailored for managing form 501, including customizable templates, robust API integrations, and secure storage. These features ensure that your form 501 is easily accessible, editable, and compliant with legal standards for electronic signatures.

-

How does pricing for airSlate SignNow work for users needing form 501?

Pricing for airSlate SignNow is designed to be cost-effective, especially for businesses that frequently handle form 501. Plans are based on the number of users and features required, allowing users to choose an option that fits their budget while meeting their needs for managing form 501 effectively.

-

Can I customize my form 501 with airSlate SignNow?

Yes, airSlate SignNow allows users to customize their form 501 according to specific needs. You can add fields, branding elements, and instructions within the document to ensure that it aligns perfectly with your business requirements.

-

What security measures does airSlate SignNow implement for form 501?

Security is a top priority at airSlate SignNow, especially for sensitive documents like form 501. The platform uses encryption, secure servers, and compliance with industry regulations to ensure that your form 501 is protected from unauthorized access and data bsignNowes.

-

How does airSlate SignNow integrate with other tools for handling form 501?

airSlate SignNow seamlessly integrates with various business tools to manage form 501 efficiently. This includes CRM systems, cloud storage services, and productivity applications, ensuring that your document management workflow is streamlined and effective.

-

What are the benefits of using airSlate SignNow for form 501 over traditional methods?

Using airSlate SignNow for form 501 provides numerous benefits, including faster processing times, reduced paper waste, and enhanced accessibility. This digital approach helps businesses save time and resources while ensuring compliance and security.

Get more for Cdtfa 501 Wg

- Impact aid source check form

- Residents rights quiz answers form

- Application form for japaneseorm translation of foreign drivers license

- Mcps central records form

- Nys opt out letter form

- Gp9725 59 page 1 of 7 spanish sp121 23 102015 disability form

- Exclusive agency agreement template form

- Excluded license agreement template form

Find out other Cdtfa 501 Wg

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later