WINEGROWER TAX RETURN BOE 501 WG 2011

What is the WINEGROWER TAX RETURN BOE 501 WG

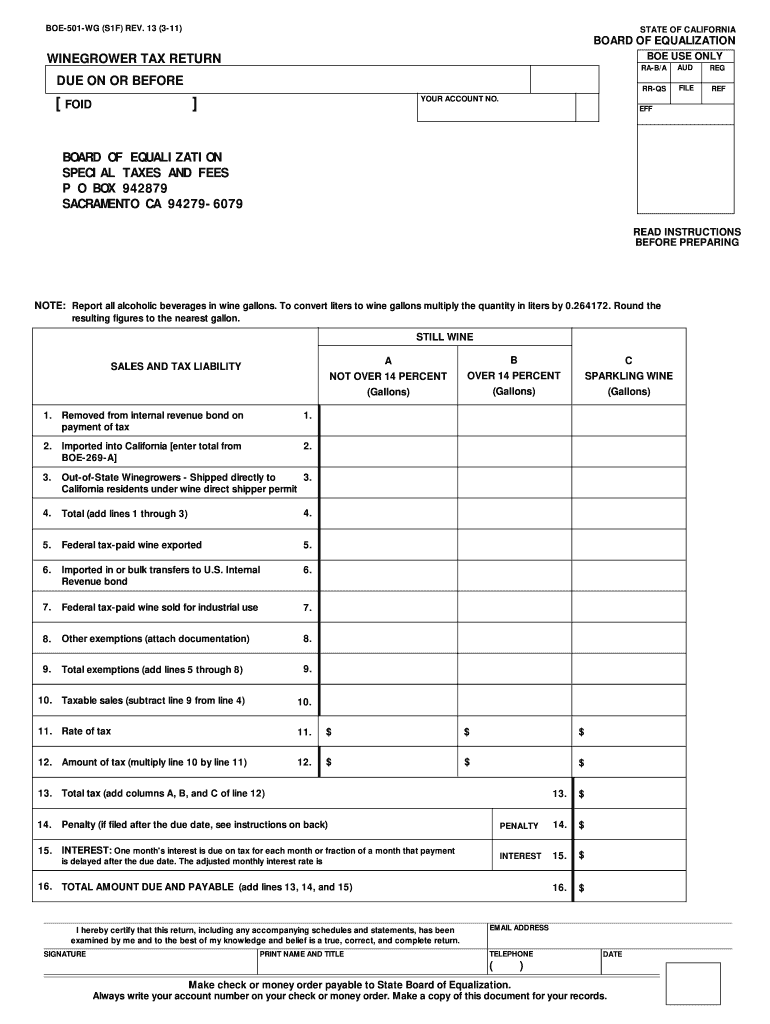

The WINEGROWER TAX RETURN BOE 501 WG is a specific tax form designed for winegrowers in the United States. This form allows winegrowers to report their income and expenses related to their vineyards and wine production. It is essential for ensuring compliance with state tax regulations and for calculating any applicable taxes owed. The form is structured to capture detailed information about the winegrower's operations, including production volume, sales, and any deductions they may qualify for.

Steps to complete the WINEGROWER TAX RETURN BOE 501 WG

Completing the WINEGROWER TAX RETURN BOE 501 WG involves several key steps:

- Gather necessary documents: Collect financial records, including income statements, expense receipts, and any relevant tax documents.

- Fill out the form: Input accurate information regarding your vineyard operations, including production figures and sales data.

- Review for accuracy: Double-check all entries to ensure compliance with IRS guidelines and state regulations.

- Sign the form: Utilize a secure eSignature solution to sign the document electronically, ensuring it meets legal requirements.

- Submit the form: Send the completed form to the appropriate tax authority, either online or by mail.

How to use the WINEGROWER TAX RETURN BOE 501 WG

Using the WINEGROWER TAX RETURN BOE 501 WG effectively requires understanding its structure and purpose. Start by carefully reading the instructions provided with the form. Each section is designed to capture specific information about your wine production and sales. Ensure that you provide accurate data, as this will affect your tax calculations. After filling out the form, utilize an eSignature platform for signing, which streamlines the submission process and enhances security.

Filing Deadlines / Important Dates

It is crucial to adhere to filing deadlines when submitting the WINEGROWER TAX RETURN BOE 501 WG. Typically, the form must be filed by a specific date each year, often coinciding with the federal tax deadline. Failure to file on time may result in penalties or interest on any taxes owed. Always check with the state tax authority for the exact due dates and any changes that may occur annually.

Legal use of the WINEGROWER TAX RETURN BOE 501 WG

The WINEGROWER TAX RETURN BOE 501 WG is legally recognized as a valid tax document when completed accurately and submitted according to state regulations. It is important to ensure that all information provided is truthful and reflects your business activities. The use of an eSignature is permissible and legally binding, provided it complies with the ESIGN Act. This allows for a more efficient and paperless filing process.

Key elements of the WINEGROWER TAX RETURN BOE 501 WG

Key elements of the WINEGROWER TAX RETURN BOE 501 WG include:

- Identification information: Taxpayer identification number and business details.

- Production data: Information on the quantity of grapes harvested and wine produced.

- Sales figures: Total sales revenue generated from wine sales.

- Expenses: Detailed breakdown of costs incurred in wine production, including labor, materials, and operational expenses.

Quick guide on how to complete winegrower tax return boe 501 wg

Your assistance manual on how to prepare your WINEGROWER TAX RETURN BOE 501 WG

If you're interested in understanding how to generate and submit your WINEGROWER TAX RETURN BOE 501 WG, here are some straightforward guidelines to simplify tax reporting.

To begin, simply create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax paperwork with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and return to update details as necessary. Streamline your tax organization with advanced PDF modifications, eSigning, and intuitive sharing capabilities.

Follow the instructions below to complete your WINEGROWER TAX RETURN BOE 501 WG in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your WINEGROWER TAX RETURN BOE 501 WG in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that paper filing can lead to increased errors and delayed refunds. As a reminder, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct winegrower tax return boe 501 wg

FAQs

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the winegrower tax return boe 501 wg

How to generate an electronic signature for your Winegrower Tax Return Boe 501 Wg in the online mode

How to generate an electronic signature for your Winegrower Tax Return Boe 501 Wg in Chrome

How to generate an electronic signature for signing the Winegrower Tax Return Boe 501 Wg in Gmail

How to make an eSignature for the Winegrower Tax Return Boe 501 Wg straight from your smart phone

How to make an eSignature for the Winegrower Tax Return Boe 501 Wg on iOS

How to make an eSignature for the Winegrower Tax Return Boe 501 Wg on Android

People also ask

-

What is the WINEGROWER TAX RETURN BOE 501 WG?

The WINEGROWER TAX RETURN BOE 501 WG is a specialized tax form required for agricultural businesses in the wine industry. It helps winemakers report their income and expenses accurately while ensuring compliance with tax regulations.

-

How can airSlate SignNow assist with the WINEGROWER TAX RETURN BOE 501 WG?

airSlate SignNow streamlines the process of preparing and submitting your WINEGROWER TAX RETURN BOE 501 WG. Our platform allows you to easily create, send, and eSign your tax documents, ensuring a smooth filing experience.

-

Is there a cost associated with using airSlate SignNow for the WINEGROWER TAX RETURN BOE 501 WG?

Yes, airSlate SignNow offers affordable pricing plans tailored for businesses of all sizes. You can choose a plan that best fits your needs for processing the WINEGROWER TAX RETURN BOE 501 WG efficiently.

-

What features does airSlate SignNow offer for the WINEGROWER TAX RETURN BOE 501 WG?

Our platform offers features such as customizable templates, secure eSigning, and document tracking specifically designed for tax returns like the WINEGROWER TAX RETURN BOE 501 WG. These tools help simplify your tax preparation process.

-

Can I integrate airSlate SignNow with other software for my WINEGROWER TAX RETURN BOE 501 WG?

Absolutely! airSlate SignNow integrates seamlessly with accounting and tax software, making it easy to manage your WINEGROWER TAX RETURN BOE 501 WG alongside your existing systems. This integration enhances workflow efficiency.

-

What are the benefits of using airSlate SignNow for my WINEGROWER TAX RETURN BOE 501 WG?

Using airSlate SignNow for your WINEGROWER TAX RETURN BOE 501 WG provides benefits like enhanced security, faster processing times, and improved collaboration with your tax advisors. These advantages enable you to focus more on your business.

-

How do I get started with airSlate SignNow for the WINEGROWER TAX RETURN BOE 501 WG?

Getting started with airSlate SignNow is simple! Sign up for an account, choose the plan that fits your needs, and begin creating your WINEGROWER TAX RETURN BOE 501 WG documents right away. Our easy-to-use interface will guide you through the process.

Get more for WINEGROWER TAX RETURN BOE 501 WG

- Please make all checks and bmoney ordersb payable to dss bb mobar form

- Horizons la county form

- Zyvox patient assistance program form

- Kbc money transfer receipt form

- Ahrp retirement form

- Wwo542 form

- Application packet graduates of foreign nursing programs njconsumeraffairs form

- Marital separation agreement template form

Find out other WINEGROWER TAX RETURN BOE 501 WG

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document