Sales and Use Tax Forms and Publications California 2022-2026

What is the Sales And Use Tax Forms And Publications California

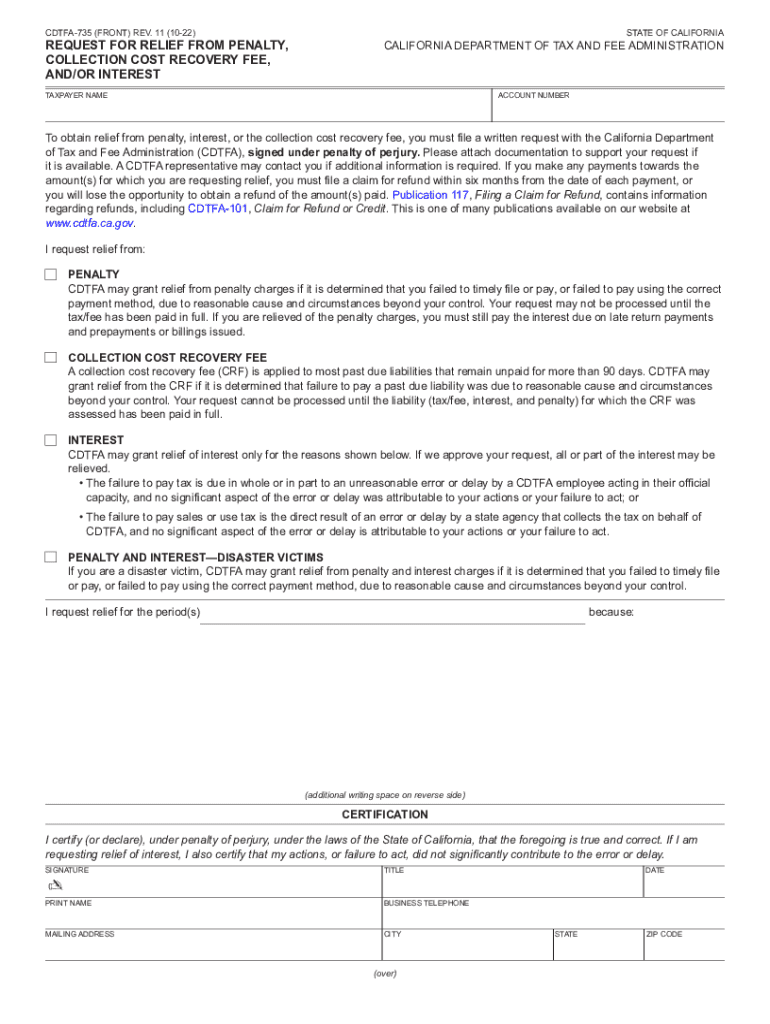

The Sales and Use Tax Forms and Publications in California are essential documents used by businesses and individuals to report and pay sales tax. These forms are designed to help taxpayers comply with California tax laws, ensuring that sales and use taxes are accurately calculated and remitted to the California Department of Tax and Fee Administration (CDTFA). The CDTFA provides various forms, including the CDTFA 735, which specifically addresses interest calculations related to tax liabilities.

Steps to complete the Sales And Use Tax Forms And Publications California

Completing the Sales and Use Tax Forms in California involves several key steps. First, gather all necessary documentation, including sales records and purchase invoices. Next, identify the correct form for your situation, such as the CDTFA 735 for interest-related matters. Fill out the form accurately, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions before submitting it to the CDTFA either online or by mail.

Legal use of the Sales And Use Tax Forms And Publications California

The legal use of Sales and Use Tax Forms in California is governed by state tax laws. These forms must be completed accurately and submitted on time to avoid penalties. The CDTFA recognizes eSignatures as legally binding, which allows taxpayers to complete and submit forms electronically. Compliance with the legal requirements ensures that taxpayers can avoid issues with tax liabilities and penalties, reinforcing the importance of using reliable tools for document execution.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in California have several options for submitting Sales and Use Tax Forms. The most convenient method is online submission through the CDTFA's website, where forms can be filled out and submitted electronically. Alternatively, forms can be mailed to the CDTFA, ensuring they are postmarked by the due date. In-person submissions are also accepted at CDTFA offices, providing taxpayers with direct assistance if needed. Each method has its own advantages, and taxpayers should choose the one that best suits their needs.

Penalties for Non-Compliance

Failure to comply with the requirements for Sales and Use Tax Forms can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action by the CDTFA. Understanding the penalties associated with non-compliance emphasizes the importance of timely and accurate form submission. Taxpayers should stay informed about their obligations and ensure that they meet all deadlines to avoid unnecessary costs.

Who Issues the Form

The California Department of Tax and Fee Administration (CDTFA) is responsible for issuing the Sales and Use Tax Forms, including the CDTFA 735. This agency oversees the collection of sales and use taxes in California, providing guidance and resources to help taxpayers navigate their obligations. The CDTFA also updates forms and publications regularly to reflect changes in tax laws and regulations, ensuring that taxpayers have access to the most current information.

Quick guide on how to complete sales and use tax forms and publications california

Effortlessly Prepare Sales And Use Tax Forms And Publications California on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Handle Sales And Use Tax Forms And Publications California on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and eSign Sales And Use Tax Forms And Publications California with Ease

- Find Sales And Use Tax Forms And Publications California and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Sales And Use Tax Forms And Publications California and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and use tax forms and publications california

Create this form in 5 minutes!

People also ask

-

What is cdtfa 735 interest and why is it important?

CDTFA 735 interest refers to the interest rate applied by the California Department of Tax and Fee Administration on unpaid taxes. Understanding this interest is crucial for businesses to manage their tax obligations effectively and avoid penalties.

-

How can airSlate SignNow help with managing cdtfa 735 interest-related documents?

AirSlate SignNow simplifies the process of sending and eSigning documents related to your cdtfa 735 interest calculations and payments. With its user-friendly interface, you can quickly prepare, sign, and store essential tax documents securely.

-

Is there a cost associated with using airSlate SignNow for cdtfa 735 interest documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The cost is competitive and provides excellent value for the ability to handle all your cdtfa 735 interest documentation efficiently.

-

What features does airSlate SignNow offer to assist with cdtfa 735 interest management?

AirSlate SignNow includes features such as automated document routing, customizable templates, and comprehensive eSignature capabilities. These tools streamline your workflow, making it easier to manage cdtfa 735 interest-related documents.

-

Can I integrate airSlate SignNow with my existing accounting software to handle cdtfa 735 interest?

Yes, airSlate SignNow supports integration with popular accounting software, enabling you to seamlessly manage cdtfa 735 interest calculations alongside your financial records. This integration enhances your workflow and ensures accuracy in document handling.

-

What benefits does airSlate SignNow provide for businesses dealing with cdtfa 735 interest?

By using airSlate SignNow for cdtfa 735 interest documentation, businesses benefit from reduced processing time and improved compliance. The platform's security features also ensure that sensitive tax-related information remains protected.

-

How can I get help if I have questions about cdtfa 735 interest and using airSlate SignNow?

AirSlate SignNow offers robust customer support, including resources such as FAQs and live chat options. If you encounter any issues related to cdtfa 735 interest documents, our team is ready to assist you in finding solutions.

Get more for Sales And Use Tax Forms And Publications California

Find out other Sales And Use Tax Forms And Publications California

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast