Form 735 Cdtfa 2017

What is the Form 735 Cdtfa

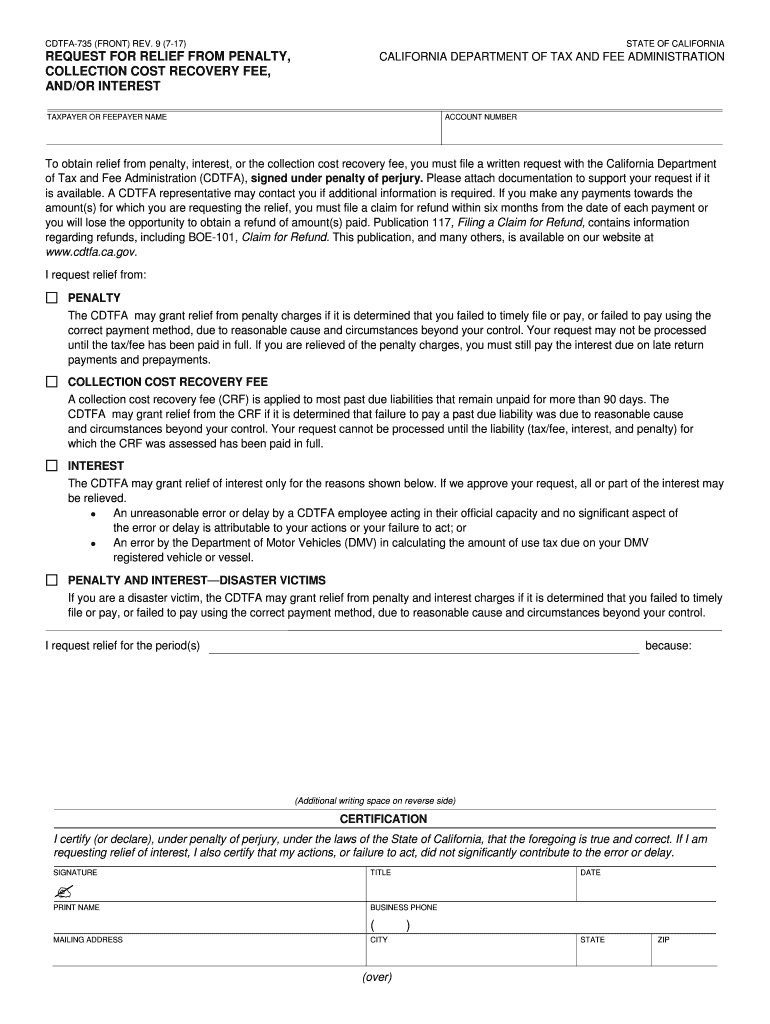

The Form 735 Cdtfa is a document used by businesses in California to report and pay certain taxes, specifically related to sales and use tax. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately report their taxable sales and purchases. The California Department of Tax and Fee Administration (CDTFA) oversees the administration of this form, which is crucial for maintaining proper tax records and fulfilling legal obligations.

How to use the Form 735 Cdtfa

Using the Form 735 Cdtfa involves several key steps. First, gather all necessary financial records, including sales receipts and purchase invoices. Next, accurately fill out the form, ensuring that all information is complete and correct. This includes detailing taxable sales, exempt sales, and any applicable deductions. Once the form is completed, it can be submitted electronically or via mail, depending on the preference of the filer. Utilizing digital tools can simplify this process, making it easier to track and manage submissions.

Steps to complete the Form 735 Cdtfa

Completing the Form 735 Cdtfa requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, such as sales records and purchase receipts.

- Fill in the business information, including name, address, and account number.

- Report total sales, including taxable and exempt amounts.

- Calculate the total tax due based on the reported sales.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring it is sent by the due date.

Legal use of the Form 735 Cdtfa

The legal use of the Form 735 Cdtfa is governed by California state tax laws. To be considered valid, the form must be filled out accurately and submitted on time. This ensures that businesses comply with tax obligations and avoid potential penalties. Additionally, electronic submissions are legally recognized, provided they meet the requirements set forth by the CDTFA and relevant eSignature laws. It is essential for businesses to keep copies of submitted forms for their records.

Key elements of the Form 735 Cdtfa

The Form 735 Cdtfa includes several key elements that filers must complete:

- Business Information: Name, address, and account number of the business.

- Sales Information: Total sales, including taxable and exempt sales.

- Tax Calculation: Calculation of the total tax due based on reported sales.

- Signature: Required signature of the business owner or authorized representative.

- Submission Date: Date the form is submitted to the CDTFA.

Form Submission Methods

The Form 735 Cdtfa can be submitted through various methods to accommodate different preferences:

- Online Submission: Filers can complete and submit the form electronically through the CDTFA's online portal.

- Mail: The completed form can be printed and mailed to the appropriate CDTFA address.

- In-Person: Businesses may also choose to deliver the form in person at a local CDTFA office.

Quick guide on how to complete form 735 cdtfa

Prepare Form 735 Cdtfa effortlessly on any device

Managing documents online has become widely accepted by businesses and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Form 735 Cdtfa on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign Form 735 Cdtfa seamlessly

- Find Form 735 Cdtfa and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 735 Cdtfa to guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 735 cdtfa

Create this form in 5 minutes!

How to create an eSignature for the form 735 cdtfa

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the form 735 cdtfa used for?

The form 735 cdtfa is used to report and pay taxes related to California's sales and use tax. Businesses in California need to file this form accurately to stay compliant with state tax regulations.

-

How can airSlate SignNow help with the form 735 cdtfa?

airSlate SignNow simplifies the process of filling out the form 735 cdtfa by allowing users to eSign and send documents securely. This ensures that your tax forms are completed accurately and submitted on time.

-

Is there a pricing plan for filing the form 735 cdtfa using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective to manage documents like the form 735 cdtfa. You can choose a plan that fits your budget and volume of document handling.

-

What features does airSlate SignNow offer for the form 735 cdtfa?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and mobile access, making it easy to prepare and file the form 735 cdtfa from anywhere. These features enhance efficiency and reduce the chances of errors.

-

Can I integrate airSlate SignNow with other software when filing the form 735 cdtfa?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications, allowing you to streamline your workflow while preparing the form 735 cdtfa. This integration helps in managing your documents and data more effectively.

-

What are the benefits of using airSlate SignNow for the form 735 cdtfa?

Using airSlate SignNow for the form 735 cdtfa brings numerous benefits, including faster turnaround times and secure document management. This not only enhances productivity but also ensures that your tax filings are completed securely and efficiently.

-

How user-friendly is airSlate SignNow for completing the form 735 cdtfa?

airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the form 735 cdtfa without extensive training. The intuitive interface guides users through the process, ensuring a smooth experience.

Get more for Form 735 Cdtfa

- Delta sigma theta sorority inc scholarship application form

- Environmental impact statement for an early site permit esp form

- Incident report oak lawn hometown school district 123 d123 form

- South holland oversize load permit bapplicationb village of south bb southholland form

- Application for city of springfield plumbing permit springfield il form

- Oh application water service form

- Payment form 45169282

- Proclamation request application norwich township form

Find out other Form 735 Cdtfa

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure