Cdtfa 735 2018

What is the CDTFA 735?

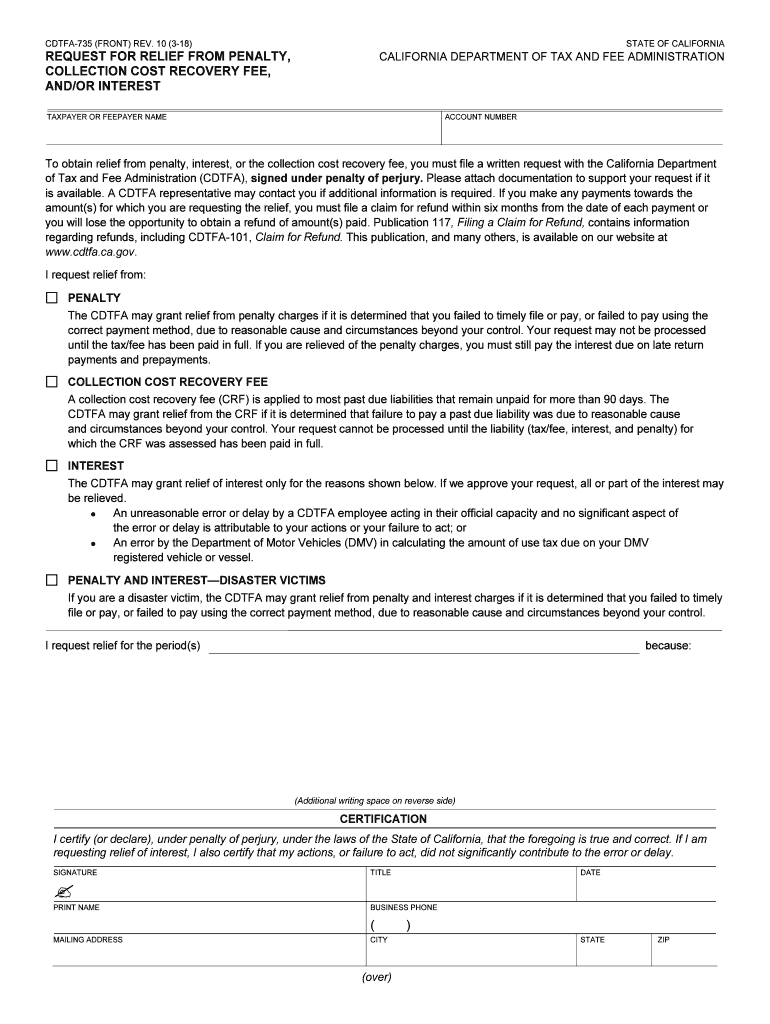

The CDTFA 735 form, also known as the California 735, is a document used by taxpayers in California to request relief from penalties imposed by the California Department of Tax and Fee Administration (CDTFA). This form is specifically designed for individuals or businesses seeking to address issues related to penalty assessments, often due to late payments or non-compliance with tax regulations. Understanding the purpose and implications of this form is essential for ensuring compliance and minimizing potential financial repercussions.

How to Use the CDTFA 735

To effectively utilize the CDTFA 735 form, taxpayers should first gather all necessary documentation related to their tax situation. This includes records of payments, correspondence with the CDTFA, and any relevant financial statements. Once the form is obtained, it should be filled out accurately, providing detailed information about the circumstances that led to the penalties. After completing the form, it can be submitted online or via mail, depending on the taxpayer's preference. It is crucial to retain copies of all submitted documents for future reference.

Steps to Complete the CDTFA 735

Completing the CDTFA 735 form involves several important steps:

- Gather necessary documents, including tax returns and payment records.

- Obtain the CDTFA 735 form from the official CDTFA website or other authorized sources.

- Fill out the form with accurate and complete information, explaining the reasons for the penalty relief request.

- Review the form for any errors or omissions before submission.

- Submit the completed form online through the CDTFA portal or mail it to the appropriate address.

Legal Use of the CDTFA 735

The CDTFA 735 form is legally recognized as a valid request for penalty relief under California tax law. For the submission to be considered legally binding, it must meet specific requirements outlined by the CDTFA. This includes providing a clear rationale for the request and ensuring that all information is truthful and accurate. Utilizing a secure platform for submission can also enhance the legal standing of the document, ensuring compliance with electronic signature regulations.

Penalties for Non-Compliance

Failing to comply with tax regulations, including the timely submission of the CDTFA 735 form, can lead to significant penalties. Taxpayers may face additional fees, interest on unpaid taxes, and potential legal action from the CDTFA. Understanding the consequences of non-compliance emphasizes the importance of addressing any penalties promptly and accurately through the CDTFA 735 form.

Required Documents

When completing the CDTFA 735 form, certain documents are required to support the request for penalty relief. These may include:

- Copies of relevant tax returns.

- Payment receipts or proof of payment.

- Correspondence with the CDTFA regarding the penalties.

- Any additional documentation that provides context for the penalty assessment.

Having these documents ready will facilitate a smoother application process and strengthen the case for relief.

Quick guide on how to complete cdtfa 735

Effortlessly Prepare Cdtfa 735 on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Cdtfa 735 on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related process right now.

How to Edit and eSign Cdtfa 735 with Ease

- Obtain Cdtfa 735 and then select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and then click the Done button to save your updates.

- Select your preferred method to share your form, whether it be via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Cdtfa 735 to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 735

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 735

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is cdtfa 735 and how does it relate to airSlate SignNow?

The cdtfa 735 is a specific document related to California tax compliance. airSlate SignNow provides an efficient platform for businesses to prepare, sign, and manage cdtfa 735 forms digitally, ensuring a streamlined compliance process.

-

How can airSlate SignNow help me fill out the cdtfa 735 form?

With airSlate SignNow, you can easily upload and fill out the cdtfa 735 form online. Our intuitive interface allows you to input data, make edits, and sign the document, saving you time and reducing errors in the process.

-

Is airSlate SignNow a cost-effective solution for managing cdtfa 735 documents?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By providing a cost-effective solution for managing cdtfa 735 documents, our platform helps you minimize paper usage and storage costs.

-

What features does airSlate SignNow offer for cdtfa 735 document handling?

airSlate SignNow includes features such as e-signature capabilities, document templates, and secure storage for cdtfa 735 documents. These features streamline your workflow and enhance document security, making compliance easier.

-

Can I integrate airSlate SignNow with other applications for cdtfa 735 workflows?

Yes, airSlate SignNow offers integrations with various applications like Google Drive, Dropbox, and Salesforce. These integrations facilitate seamless workflows for managing cdtfa 735 documents alongside other business processes.

-

What are the benefits of using airSlate SignNow for cdtfa 735 compliance?

Using airSlate SignNow for cdtfa 735 compliance provides signNow advantages, including reduced processing time, improved accuracy, and enhanced security. By digitizing your workflow, you can focus more on your business instead of paperwork.

-

Is airSlate SignNow user-friendly for first-time users dealing with cdtfa 735?

Yes, airSlate SignNow is designed with user-friendliness in mind. First-time users can navigate the platform easily, allowing them to complete and manage cdtfa 735 documents without any technical expertise.

Get more for Cdtfa 735

Find out other Cdtfa 735

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement