CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW 2022

What is the CR Q1 Commercial Rent Tax Return?

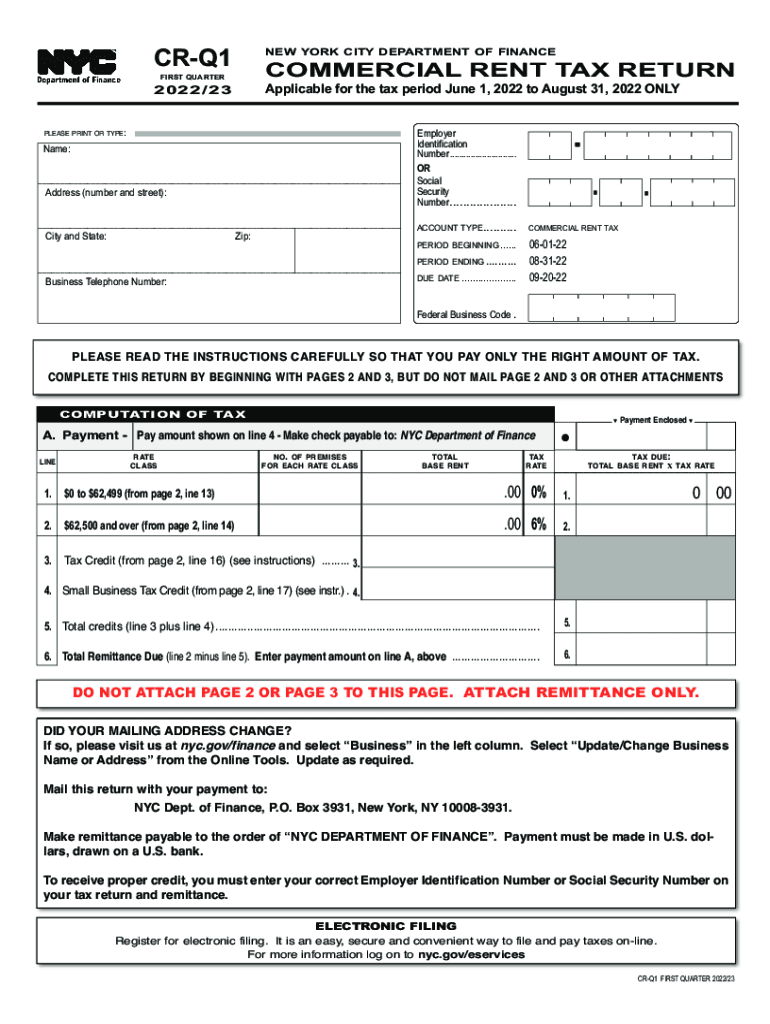

The CR Q1 Commercial Rent Tax Return is a specific form used by businesses in New York City to report and pay the commercial rent tax. This tax applies to businesses renting commercial space within the city, and the CR Q1 form is specifically designed for the first quarter of the tax year. Understanding this form is essential for compliance with local tax regulations.

How to Use the CR Q1 Commercial Rent Tax Return

To effectively use the CR Q1 Commercial Rent Tax Return, businesses must gather all necessary financial information related to their commercial leases. This includes the total rent paid during the reporting period and any applicable deductions. Once the information is compiled, the form can be filled out, ensuring all sections are completed accurately to avoid penalties.

Steps to Complete the CR Q1 Commercial Rent Tax Return

Completing the CR Q1 Commercial Rent Tax Return involves several key steps:

- Gather necessary documentation, including lease agreements and payment records.

- Fill out personal and business information on the form.

- Report total rent paid during the quarter.

- Calculate the tax owed based on the applicable rate.

- Review the completed form for accuracy.

- Submit the form by the designated deadline.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines for the CR Q1 Commercial Rent Tax Return. Typically, the deadline for submitting this form is within a specific timeframe after the end of the first quarter. Staying informed about these dates helps avoid late fees and penalties associated with non-compliance.

Required Documents for the CR Q1 Commercial Rent Tax Return

When preparing to file the CR Q1 Commercial Rent Tax Return, businesses should have the following documents ready:

- Lease agreements detailing rental terms.

- Payment records for the rent paid during the quarter.

- Any previous tax returns for reference.

- Documentation supporting any deductions claimed.

Penalties for Non-Compliance

Failure to comply with the requirements of the CR Q1 Commercial Rent Tax Return can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to file accurately and on time to avoid these repercussions.

Quick guide on how to complete cr q1 finance commercial rent tax return new

Effortlessly Prepare CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Edit and Electronically Sign CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW Seamlessly

- Obtain CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with specialized tools offered by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr q1 finance commercial rent tax return new

Create this form in 5 minutes!

People also ask

-

What is the New York commercial rent tax?

The New York commercial rent tax is a tax imposed on businesses that rent commercial space in certain areas of New York City. It generally affects tenants in Manhattan whose total rent exceeds a specified threshold. Understanding this tax is crucial for businesses to effectively manage their expenses.

-

How can airSlate SignNow help with documenting New York commercial rent tax obligations?

airSlate SignNow provides businesses with the ability to easily create, sign, and store documents related to their New York commercial rent tax obligations. With its user-friendly interface, users can streamline their documentation process, ensuring compliance and timely submissions. This efficiency can save businesses valuable time and resources.

-

What are the benefits of utilizing airSlate SignNow for managing New York commercial rent tax paperwork?

Using airSlate SignNow for managing your New York commercial rent tax paperwork offers several benefits, including enhanced organization and reduced processing time. Our secure eSignature features enable you to sign documents quickly, while our cloud storage keeps your documents accessible from anywhere. This simplifies your tax preparation and filing process.

-

Can I integrate airSlate SignNow with my existing accounting software to manage New York commercial rent tax records?

Yes, airSlate SignNow can integrate seamlessly with various accounting software solutions. This allows you to manage your New York commercial rent tax records more efficiently by automating data entry and providing a consolidated view of your financials. These integrations help keep your business compliant and ensure accurate record-keeping.

-

Is airSlate SignNow cost-effective for small businesses dealing with New York commercial rent tax?

Absolutely! airSlate SignNow offers competitive pricing plans tailored for small businesses, making it an affordable option for managing New York commercial rent tax documentation. By reducing paperwork and enhancing efficiency, you can save money while ensuring compliance with tax regulations. Our cost-effective solutions facilitate a positive return on investment.

-

How secure is airSlate SignNow when handling sensitive New York commercial rent tax documents?

Security is a top priority for airSlate SignNow. We implement advanced encryption protocols and secure data storage practices to protect your sensitive New York commercial rent tax documents. Our platform adheres to stringent compliance standards to ensure that your business information stays safe and confidential at all times.

-

What features does airSlate SignNow provide for managing contracts affected by New York commercial rent tax?

airSlate SignNow offers features such as customizable templates, automatic reminders, and real-time tracking for contracts related to the New York commercial rent tax. These features help streamline contract management, ensuring that you are always aware of rental obligations and tax deadlines. Efficient contract handling reduces the risk of oversight.

Get more for CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW

- Assumption agreement of mortgage and release of original mortgagors new mexico form

- New mexico foreign judgment enrollment new mexico form

- Small estate affidavit for estates under 50000 new mexico form

- Eviction unlawful detainer form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house new 497320232 form

- Annual minutes new mexico new mexico form

- Notices resolutions simple stock ledger and certificate new mexico form

- Minutes for organizational meeting new mexico new mexico form

Find out other CR Q1 FINANCE COMMERCIAL RENT TAX RETURN NEW

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe