New York Commercial Rent Tax 2023-2026

What is the New York Commercial Rent Tax

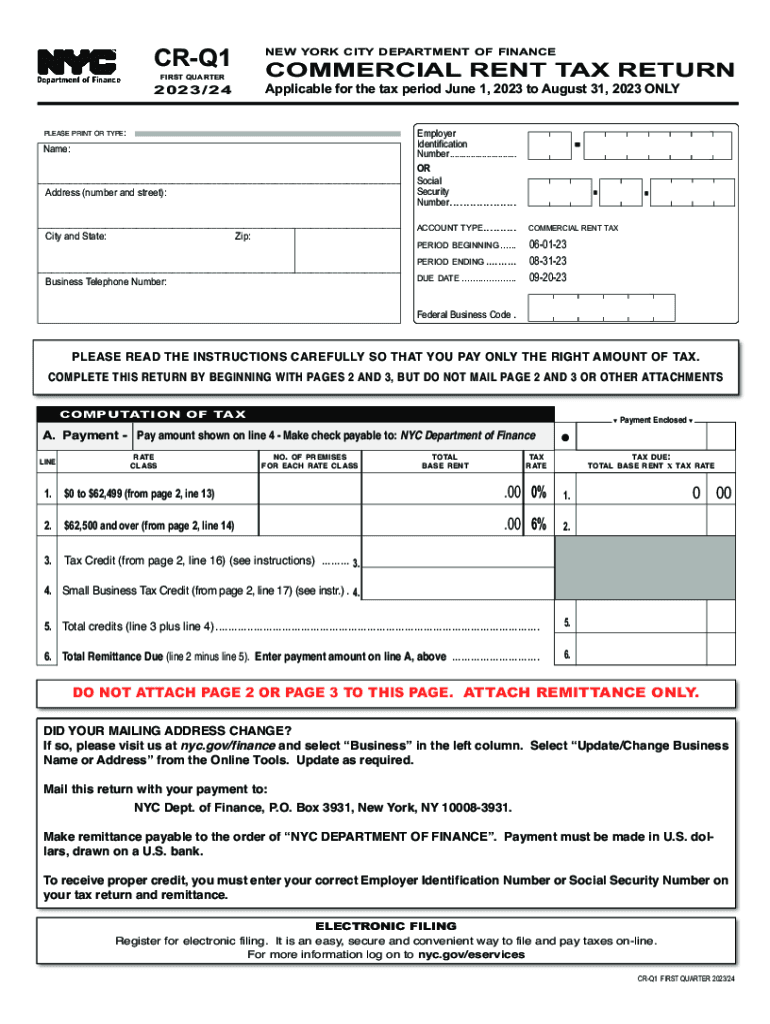

The New York Commercial Rent Tax is a tax imposed on businesses that rent commercial space in Manhattan. This tax applies to businesses with an annual rent exceeding $250,000. The tax rate is based on the total rent paid, and it is calculated to ensure that commercial tenants contribute to the city's revenue. The tax is particularly relevant for businesses operating in designated areas of Manhattan, where commercial activity is prevalent.

Steps to complete the New York Commercial Rent Tax

Completing the New York Commercial Rent Tax form involves several key steps. First, gather all necessary documentation related to your commercial lease, including the total rent amount and any additional charges. Next, download the commercial rent tax form 2024, ensuring you have the correct version for the current tax year. Fill out the form accurately, providing details about your business and the rental agreement. Once completed, review the form for any errors before submission. Finally, submit the form by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

For the 2024 tax year, the filing deadline for the New York Commercial Rent Tax is typically set for the end of the first quarter. It is crucial to be aware of this date to ensure timely submission. Late filings may incur penalties, so keeping track of important dates is essential for compliance. Additionally, businesses should stay informed about any changes in deadlines that may arise due to legislative updates or city regulations.

Required Documents

When preparing to file the New York Commercial Rent Tax, several documents are required. These include your commercial lease agreement, proof of rent payments, and any relevant financial statements that demonstrate your business's rental expenses. Having these documents organized will facilitate the completion of the tax form and ensure that all necessary information is available for review and submission.

Form Submission Methods (Online / Mail / In-Person)

The New York Commercial Rent Tax form can be submitted through various methods to accommodate different preferences. Businesses may choose to file online through the city's official tax portal, which offers a streamlined process for electronic submission. Alternatively, forms can be mailed directly to the appropriate tax office or submitted in person at designated locations. Each method has its own guidelines, so it is important to follow the instructions specific to the chosen submission method.

Penalties for Non-Compliance

Failure to comply with the New York Commercial Rent Tax requirements can result in significant penalties. Businesses that miss the filing deadline may face late fees, which can accumulate over time. Additionally, underreporting rental amounts or submitting inaccurate information can lead to further legal ramifications. It is essential for businesses to understand these penalties and take proactive steps to ensure compliance with all tax obligations.

Quick guide on how to complete new york commercial rent tax

Complete New York Commercial Rent Tax effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage New York Commercial Rent Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign New York Commercial Rent Tax with ease

- Find New York Commercial Rent Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and electronically sign New York Commercial Rent Tax to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york commercial rent tax

Create this form in 5 minutes!

How to create an eSignature for the new york commercial rent tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the commercial rent tax form 2024?

The commercial rent tax form 2024 is a mandatory document for businesses operating in tax zones. It outlines the rental income subject to taxation and is crucial for compliance. Completing this form accurately ensures that businesses meet their tax obligations efficiently.

-

How can airSlate SignNow assist with the commercial rent tax form 2024?

airSlate SignNow streamlines the process of completing the commercial rent tax form 2024 by providing an intuitive eSignature solution. Users can easily fill out the form online, obtain signatures, and securely send it to the necessary authorities. This reduces paperwork and helps ensure accurate submissions.

-

Is there a cost associated with using airSlate SignNow for the commercial rent tax form 2024?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. The cost may vary based on features and the number of users needed to complete the commercial rent tax form 2024. Investing in this solution can save time and reduce the risk of errors.

-

What features does airSlate SignNow offer for managing the commercial rent tax form 2024?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage, specifically designed for forms like the commercial rent tax form 2024. These features enhance efficiency and ensure that documents are easily accessible when needed.

-

Can I integrate airSlate SignNow with other software for the commercial rent tax form 2024?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, making it easier to manage the commercial rent tax form 2024. This functionality helps streamline workflows and keeps all documentation connected within your existing systems.

-

How secure is airSlate SignNow when handling the commercial rent tax form 2024?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption methods to protect sensitive information entered on the commercial rent tax form 2024. Users can confidently eSign documents knowing their data is secure from unauthorized access.

-

What are the benefits of using airSlate SignNow for the commercial rent tax form 2024?

Using airSlate SignNow for the commercial rent tax form 2024 offers numerous benefits, including increased efficiency and reduced processing time. The platform allows for quick eSignatures, minimizing delays in submission. Additionally, it helps maintain compliance with regulatory requirements.

Get more for New York Commercial Rent Tax

- Letter of protection form

- W2 reconciliation worksheet form

- Daman claim form

- National criminal record check consent form nsw health

- State of louisiana application for boat title form

- New vendor disclosures form c 0576 mass

- Association of realtors commercial lease agreement template form

- Association of realtors residential lease agreement template form

Find out other New York Commercial Rent Tax

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy