Cr Q1 2018

What is the Cr Q1

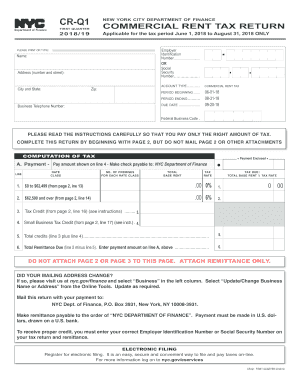

The Cr Q1 form, also known as the NYC Commercial Rent Tax Return, is a tax document required for businesses that rent commercial space in New York City. This form is specifically designed for entities that meet certain criteria regarding their rental payments. The purpose of the Cr Q1 is to report the total rent paid and calculate the applicable tax owed to the city. Understanding this form is crucial for compliance with local tax laws and ensuring that businesses fulfill their financial obligations accurately.

How to use the Cr Q1

Using the Cr Q1 form involves several steps to ensure accurate reporting. First, gather all necessary financial documents related to your commercial lease, including rental agreements and payment records. Next, fill out the form with precise information regarding your rental payments, including any adjustments or credits applicable to your situation. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. Utilizing electronic tools can streamline this process, making it easier to manage and submit your form securely.

Steps to complete the Cr Q1

Completing the Cr Q1 form requires careful attention to detail. Follow these steps:

- Collect all relevant documentation, such as lease agreements and payment receipts.

- Access the Cr Q1 form through the appropriate channels, ensuring you have the latest version.

- Fill in your business information, including your name, address, and tax identification number.

- Report the total rent paid during the reporting period, including any applicable deductions.

- Calculate the tax owed based on the provided rates.

- Sign and date the form to validate your submission.

- Submit the completed form by the designated deadline, either electronically or via mail.

Legal use of the Cr Q1

The legal use of the Cr Q1 form is governed by New York City tax regulations. To ensure compliance, businesses must accurately report their rental payments and pay the corresponding tax. The form serves as a legal declaration of the rent paid and the tax owed, which can be subject to review by tax authorities. It is essential to maintain accurate records and submit the form within the specified deadlines to avoid penalties and ensure that your business remains in good standing with local laws.

Filing Deadlines / Important Dates

Filing deadlines for the Cr Q1 form are critical for compliance. Typically, the form must be submitted quarterly, with specific due dates set by the New York City Department of Finance. Businesses should be aware of these dates to avoid late fees and penalties. It is advisable to mark these deadlines on your calendar and prepare your documents well in advance to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Cr Q1 form can be submitted through various methods to accommodate different preferences. Businesses can file the form online using the NYC Department of Finance's electronic filing system, which offers a convenient and secure way to submit tax returns. Alternatively, the form can be mailed to the designated tax office or submitted in person at specified locations. Each method has its own set of guidelines, so it is important to follow the instructions carefully to ensure successful submission.

Quick guide on how to complete cr q1 form 2018 2019

Complete Cr Q1 effortlessly on any device

Online document management has become increasingly popular with organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with every tool necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Cr Q1 on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Cr Q1 with ease

- Locate Cr Q1 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors requiring new document prints. airSlate SignNow meets all your requirements in document management with just a few clicks from any device you prefer. Modify and eSign Cr Q1 while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr q1 form 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the cr q1 form 2018 2019

How to make an electronic signature for your Cr Q1 Form 2018 2019 in the online mode

How to create an eSignature for your Cr Q1 Form 2018 2019 in Google Chrome

How to make an eSignature for putting it on the Cr Q1 Form 2018 2019 in Gmail

How to make an eSignature for the Cr Q1 Form 2018 2019 right from your mobile device

How to generate an eSignature for the Cr Q1 Form 2018 2019 on iOS devices

How to make an electronic signature for the Cr Q1 Form 2018 2019 on Android

People also ask

-

What is the NYC CR Q1 form and why is it important?

The NYC CR Q1 form is a crucial document for businesses operating in New York City, as it reports changes in business activities and address information. Accurately completing the NYC CR Q1 form helps ensure compliance with local regulations and avoid potential fines. Understanding this form is essential for maintaining good standing with the New York City Department of Finance.

-

How can airSlate SignNow help with the NYC CR Q1 form?

airSlate SignNow simplifies the process of preparing and eSigning the NYC CR Q1 form through its user-friendly platform. With just a few clicks, you can upload, fill out, and securely sign documents. This streamlines your workflow and helps ensure that your submissions are timely and compliant.

-

What is the pricing structure for using airSlate SignNow for the NYC CR Q1 form?

airSlate SignNow offers various pricing plans tailored to meet the needs of different users, from individual professionals to larger enterprises. Additionally, users can take advantage of a free trial to explore features relevant to handling the NYC CR Q1 form. Our cost-effective solution ensures that you don’t overspend while managing your documentation needs.

-

Are there any integrations available that can assist with the NYC CR Q1 form?

Yes, airSlate SignNow provides integrations with various productivity tools and platforms, making it easier to manage your NYC CR Q1 form. You can connect with apps like Google Workspace, Microsoft Office, and more, enhancing your document management processes. These integrations allow for seamless workflows and ensure you can access your documents when you need them.

-

What features does airSlate SignNow offer for completing the NYC CR Q1 form?

airSlate SignNow includes features such as customizable templates, reusable fields, and advanced editing tools designed to facilitate the completion of the NYC CR Q1 form. You can also set reminders for important deadlines to ensure timely submissions. These features combined help reduce errors and improve the efficiency of your document management.

-

Can I access the NYC CR Q1 form on mobile with airSlate SignNow?

Absolutely, airSlate SignNow allows you to access and manage the NYC CR Q1 form on any mobile device. The mobile app provides the same user-friendly experience as the desktop version, enabling you to fill out, sign, and share documents on the go. This flexibility ensures you can handle important tasks anytime, anywhere.

-

Is airSlate SignNow secure for submitting the NYC CR Q1 form?

Yes, airSlate SignNow prioritizes security, providing advanced encryption and compliance with international security standards. When submitting the NYC CR Q1 form through our platform, your data is protected at all stages, ensuring that sensitive business information remains confidential. Rest assured that your signature and document integrity are safeguarded.

Get more for Cr Q1

- Vehicle change form for spotsylvania county

- Standard form sjb 1000

- Lucie notice form

- St tammany department of environmental services form

- Certificate of ordination filing stearns county mn form

- Physicians certificate of medical examination for mental illness co titus tx form

- Faa anti drug and alcohol misuse prevention plan tooele county co tooele ut form

- Non custodial parent affidavit of direct payment for travis county traviscountytx form

Find out other Cr Q1

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form