About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health 2022

What is Form 8889?

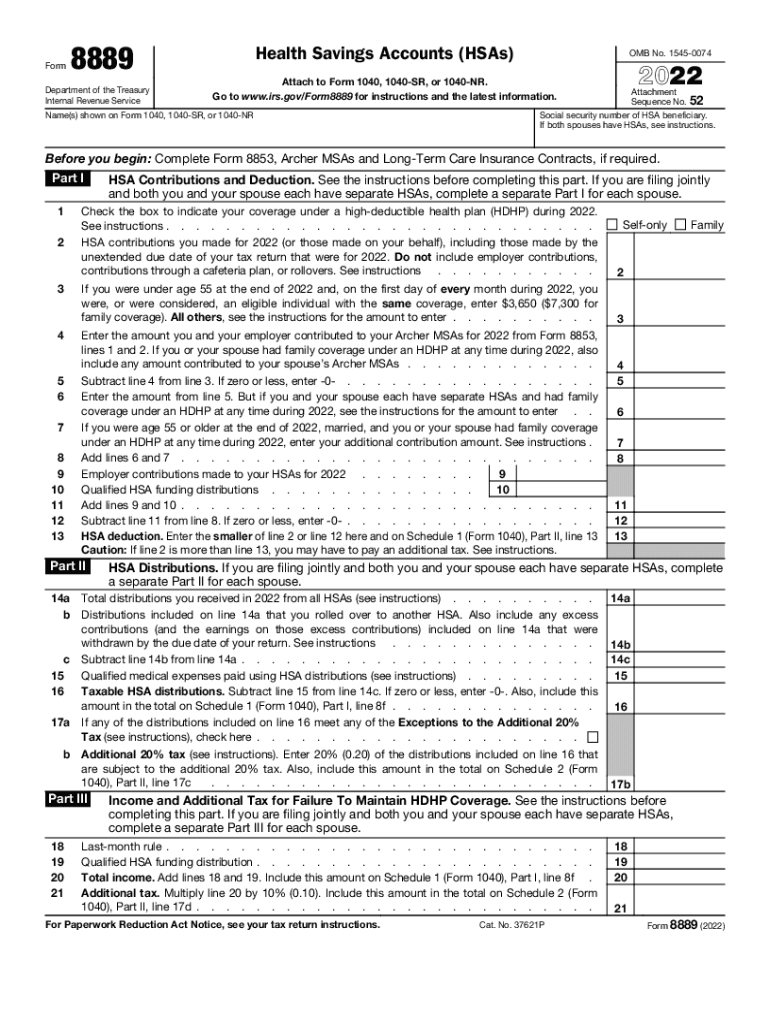

Form 8889 is an IRS document used to report Health Savings Account (HSA) contributions and distributions. This form is essential for individuals who have an HSA, allowing them to calculate the tax benefits associated with their contributions and withdrawals. The information provided on Form 8889 helps determine if the taxpayer is eligible for tax deductions and ensures compliance with IRS regulations.

Steps to Complete Form 8889

Completing Form 8889 involves several key steps:

- Gather necessary documents, including records of HSA contributions and distributions.

- Fill out Part I to report contributions to your HSA, including those made by your employer.

- Complete Part II to report distributions from your HSA, detailing how the funds were used.

- Calculate any taxable amounts and potential penalties for non-qualified distributions.

- Transfer the totals from Form 8889 to your main tax return, typically Form 1040.

Eligibility Criteria for HSAs

To contribute to an HSA and use Form 8889, you must meet specific eligibility requirements:

- You must be covered by a high-deductible health plan (HDHP).

- You cannot be enrolled in Medicare.

- You cannot be claimed as a dependent on someone else's tax return.

Filing Deadlines for Form 8889

The deadline for filing Form 8889 aligns with the tax return deadline, typically April 15 of each year. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 8889 accurately or on time can result in penalties. The IRS may impose fines for incorrect reporting of contributions or distributions, and any excess contributions not withdrawn may be subject to additional taxes. Understanding these penalties can help ensure compliance and avoid unnecessary costs.

Digital vs. Paper Version of Form 8889

Form 8889 can be completed either digitally or on paper. The digital version offers benefits such as easier calculations and automatic error checks, while the paper version may be preferred by those who are not comfortable with technology. Regardless of the method chosen, it is essential to ensure that the form is filled out accurately to maintain compliance with IRS regulations.

Quick guide on how to complete about form 8889 health savings accounts hsasinternalfederal form 8889 health savings accounts hsas 2020federal form 8889 health

Complete About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health effortlessly on any gadget

Web-based document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without interruption. Manage About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest method to modify and eSign About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health with ease

- Locate About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health and click Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your alterations.

- Select your desired method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing fresh copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8889 health savings accounts hsasinternalfederal form 8889 health savings accounts hsas 2020federal form 8889 health

Create this form in 5 minutes!

People also ask

-

What is Form 8889 and why is it important?

Form 8889 is the IRS form used to report Health Savings Account (HSA) contributions and distributions. It's important for individuals who wish to maintain compliance with tax regulations regarding HSAs, ensuring they can maximize their tax benefits.

-

How does airSlate SignNow facilitate the signing of Form 8889?

With airSlate SignNow, you can quickly create, send, and eSign Form 8889 with ease. Our platform allows you to streamline the signing process, ensuring all parties can review and sign the document seamlessly and securely.

-

Can I integrate airSlate SignNow with other business tools for Form 8889?

Yes, airSlate SignNow offers integrations with several popular business tools such as Google Drive, Dropbox, and Zapier. This makes it easy to manage Form 8889 alongside other documents and streamline your workflows.

-

Is there a cost associated with using airSlate SignNow for Form 8889?

airSlate SignNow provides a cost-effective solution for managing Form 8889, with various pricing plans tailored to your needs. We offer a free trial, allowing you to experience the benefits of our platform before committing to a subscription.

-

What features does airSlate SignNow offer for Form 8889 processing?

Our platform includes features such as document templates, real-time tracking, and secure cloud storage, specifically designed to simplify the handling of Form 8889. These features ensure that your document processing is efficient and secure.

-

How can I ensure the security of my Form 8889 when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including Form 8889. We use advanced encryption technologies and comply with industry security standards to keep your data safe throughout the signing process.

-

What support does airSlate SignNow offer for questions related to Form 8889?

AirSlate SignNow offers comprehensive customer support for all inquiries related to Form 8889. You can access our help center, chat with support representatives, or consult our extensive knowledge base for guidance.

Get more for About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health

- Landlord tenant lease co signer agreement nevada form

- Application for sublease nevada form

- Inventory and condition of leased premises for pre lease and post lease nevada form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out nevada form

- Property manager agreement nevada form

- Agreement for delayed or partial rent payments nevada form

- Tenants maintenance repair request form nevada

- Guaranty attachment to lease for guarantor or cosigner nevada form

Find out other About Form 8889, Health Savings Accounts HSAsInternalFederal Form 8889 Health Savings Accounts HSAs 2020Federal Form 8889 Health

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure