Form 8889 2023

What is the Form 8889

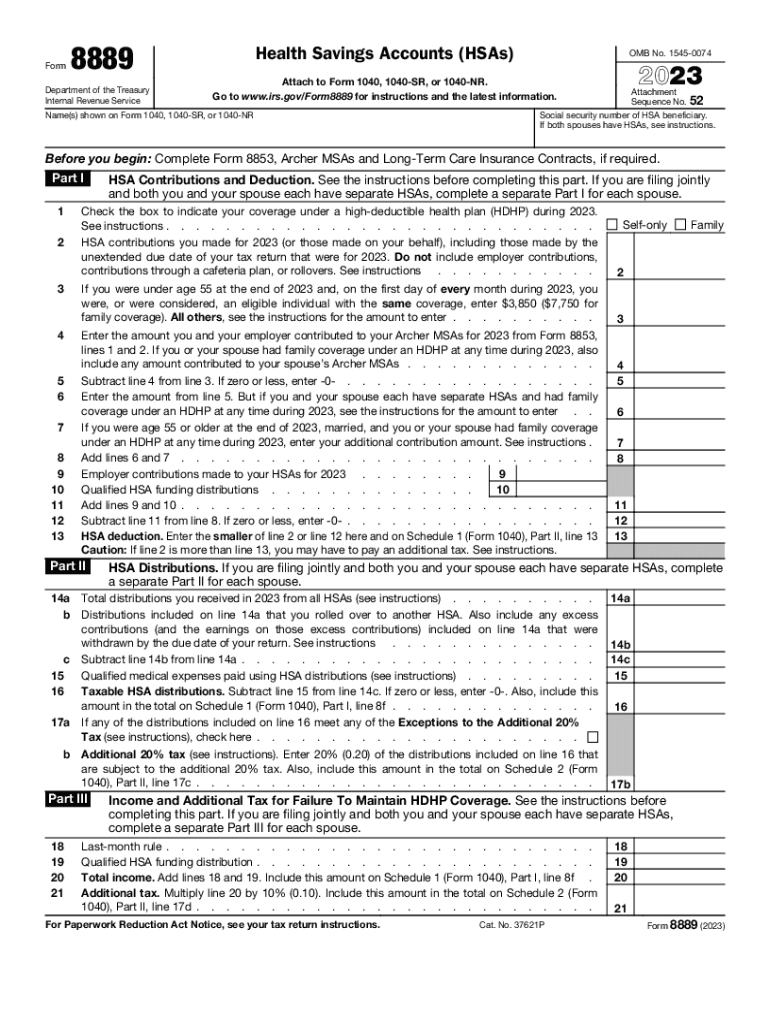

The Form 8889 is a tax form used by individuals to report Health Savings Account (HSA) contributions and distributions. This form is essential for taxpayers who have established an HSA, allowing them to claim tax deductions for contributions made during the tax year. Additionally, it helps in reporting any distributions taken from the account, which may be used for qualified medical expenses. Understanding the purpose and requirements of Form 8889 is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

How to use the Form 8889

Using Form 8889 involves several steps to accurately report your HSA activities. First, taxpayers must fill out Part I to report contributions made to the HSA, including those made by the employer. In Part II, individuals report distributions from the HSA, detailing whether the funds were used for qualified medical expenses. Completing the form correctly ensures that you receive the appropriate tax deductions and do not incur penalties for incorrect reporting. It is advisable to keep records of all contributions and distributions for reference when completing the form.

Steps to complete the Form 8889

Completing Form 8889 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including W-2 forms, HSA account statements, and receipts for medical expenses.

- Fill out Part I to report contributions, including any employer contributions and the total amount contributed during the tax year.

- Complete Part II to report distributions, specifying the amounts used for qualified medical expenses versus non-qualified expenses.

- Transfer the totals from Form 8889 to your Form 1040, ensuring that all amounts are accurately reflected.

- Review the completed form for accuracy before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing Form 8889, which include eligibility criteria for HSAs and instructions on how to report contributions and distributions. Taxpayers should refer to the IRS instructions for Form 8889 for detailed information on eligibility requirements, contribution limits, and the tax implications of HSA distributions. Staying informed about IRS guidelines helps ensure compliance and maximizes the benefits of using an HSA.

Filing Deadlines / Important Dates

Form 8889 must be filed along with your federal income tax return by the tax filing deadline, which is typically April 15 of the following year. For the 2022 tax year, the deadline is April 18, 2023, due to the Emancipation Day holiday in Washington, D.C. Taxpayers should be aware of this deadline to avoid late filing penalties. Additionally, if you are filing for an extension, it is important to ensure that Form 8889 is included in your extended return submission.

Required Documents

To accurately complete Form 8889, certain documents are required. These include:

- Your W-2 forms, which show any employer contributions to your HSA.

- Bank statements or account statements from your HSA provider detailing contributions and distributions.

- Receipts for qualified medical expenses that were paid using HSA funds.

- Any other documentation that supports your contributions and distributions for the tax year.

Quick guide on how to complete form 8889

Effortlessly Prepare Form 8889 on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to easily create, edit, and electronically sign your documents without delays. Manage Form 8889 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Form 8889 without hassle

- Find Form 8889 and click on Get Form to begin.

- Make use of the tools we supply to fill out your form.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you would prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 8889 and ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8889

Create this form in 5 minutes!

How to create an eSignature for the form 8889

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8889 2022 and who needs to file it?

Form 8889 2022 is used by individuals to report Health Savings Account (HSA) contributions and distributions. If you are an account holder of an HSA for the tax year 2022, you need to file this form when submitting your federal income tax return.

-

How can airSlate SignNow help with completing form 8889 2022?

airSlate SignNow provides a user-friendly platform for filling out and eSigning form 8889 2022. With our solution, you can easily access templates, enter your information, and ensure that your form is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 8889 2022?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to your needs. Depending on the features you require for managing documents like form 8889 2022, there is a plan suitable for both individuals and businesses.

-

What features does airSlate SignNow offer for form 8889 2022 management?

With airSlate SignNow, you can benefit from features such as easy document sharing, customizable templates, and secure eSigning for form 8889 2022. These capabilities streamline your filing process and ensure compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other software for filing form 8889 2022?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software to help you manage form 8889 2022. This integration simplifies your workflow and enhances your eSigning experience.

-

What are the benefits of using airSlate SignNow for form 8889 2022?

Using airSlate SignNow for form 8889 2022 allows for increased efficiency, reduced errors, and secure document management. Our platform ensures that you can focus on completing your taxes without worrying about the hassles of traditional paperwork.

-

Is there customer support available for issues with form 8889 2022 on airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist you with any issues you may encounter while completing form 8889 2022. Our support team is available to help you navigate the platform and resolve any questions you have during the process.

Get more for Form 8889

Find out other Form 8889

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF