NM RPD 41373 Fill Out Tax Template Online US Legal Forms 2022-2026

What is the NM RPD 41373?

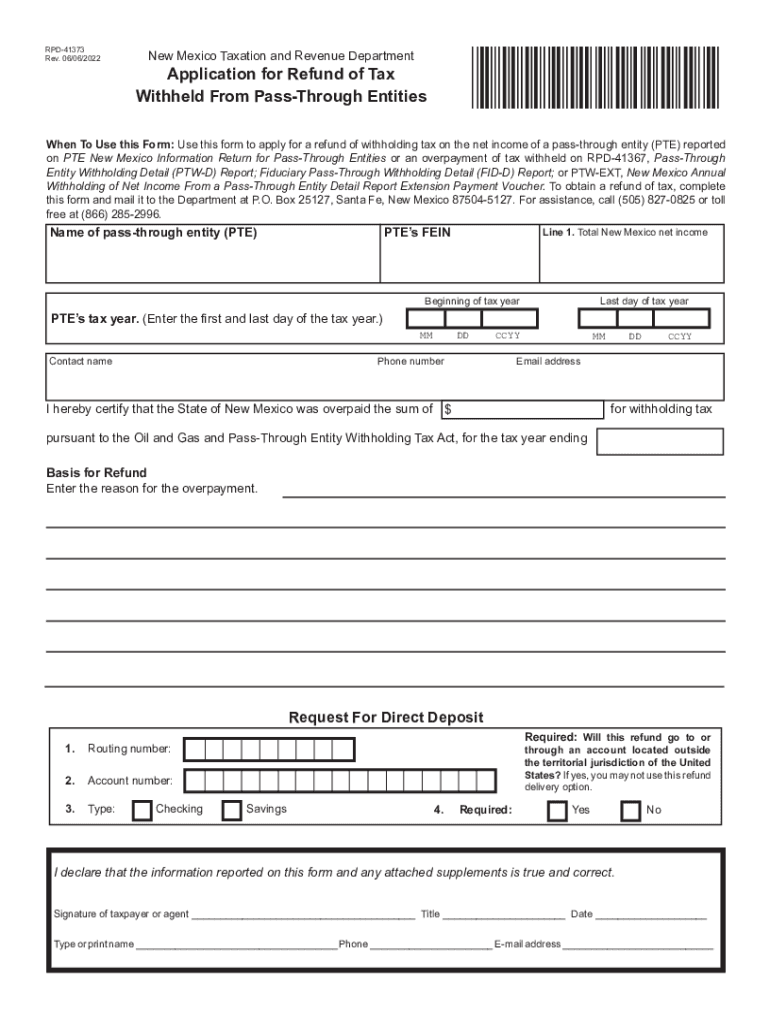

The NM RPD 41373 is a tax form used in New Mexico to report state tax withheld from various types of income. This form is essential for individuals and entities who have had taxes withheld and need to claim a refund or ensure compliance with state tax regulations. Understanding the purpose and details of the NM RPD 41373 can help taxpayers accurately report their withheld taxes and avoid potential issues with the New Mexico Taxation and Revenue Department.

Steps to Complete the NM RPD 41373

Completing the NM RPD 41373 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms or 1099s that detail your income and the amount of tax withheld. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Then, report the total amount of tax withheld as indicated on your documents. Finally, review the completed form for any errors before submitting it to the appropriate state agency.

Legal Use of the NM RPD 41373

The NM RPD 41373 is legally binding when filled out correctly and submitted in accordance with state tax laws. It is important to ensure that all information provided is accurate and complete, as discrepancies can lead to penalties or delays in processing your refund. Utilizing a reliable electronic signature solution can enhance the legitimacy of your submission, ensuring compliance with eSignature regulations such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the NM RPD 41373 vary depending on the tax year and the specific circumstances of the taxpayer. Generally, the form must be submitted by the state’s tax deadline, which aligns with the federal tax filing date. It is crucial to stay informed about any changes to these deadlines, as late submissions may result in penalties or loss of refund eligibility.

Required Documents

To complete the NM RPD 41373, you will need several key documents. These typically include your W-2 forms or 1099s, which detail your income and the taxes withheld. Additionally, any prior tax returns or documentation related to your income may be useful for reference. Having these documents readily available will streamline the completion process and help ensure accuracy.

Form Submission Methods

The NM RPD 41373 can be submitted through various methods, including online, by mail, or in person. Submitting the form electronically is often the most efficient option, allowing for quicker processing and confirmation of receipt. If you choose to mail the form, ensure it is sent to the correct address and consider using a trackable mailing service to confirm delivery.

Eligibility Criteria

Eligibility to file the NM RPD 41373 generally includes individuals or entities who have had New Mexico state taxes withheld from their income. This includes employees, independent contractors, and certain business entities. It is essential to review the specific criteria outlined by the New Mexico Taxation and Revenue Department to determine your eligibility and ensure proper filing.

Quick guide on how to complete nm rpd 41373 2020 2022 fill out tax template online us legal forms

Complete NM RPD 41373 Fill Out Tax Template Online US Legal Forms seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage NM RPD 41373 Fill Out Tax Template Online US Legal Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign NM RPD 41373 Fill Out Tax Template Online US Legal Forms with ease

- Find NM RPD 41373 Fill Out Tax Template Online US Legal Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require new document printouts. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign NM RPD 41373 Fill Out Tax Template Online US Legal Forms to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nm rpd 41373 2020 2022 fill out tax template online us legal forms

Create this form in 5 minutes!

People also ask

-

What is the significance of '41373 tax withheld' in document signing?

The '41373 tax withheld' refers to a specific tax implication that may arise in certain financial documents. Understanding how this tax impacts your transactions is crucial when eSigning documents in airSlate SignNow. Our platform ensures compliance by allowing users to easily manage documents that reflect such tax details.

-

How does airSlate SignNow help with '41373 tax withheld' documents?

airSlate SignNow provides tools for creating and managing documents that need '41373 tax withheld' annotations. Our solution allows you to customize document templates efficiently, ensuring all necessary tax information is included for seamless agreements. This guarantees that both parties are aware of tax implications during eSigning.

-

Are there any costs associated with managing '41373 tax withheld' documents on airSlate SignNow?

Using airSlate SignNow comes with a range of pricing plans based on your features and usage needs. Our platform offers cost-effective solutions that include managing documents involving '41373 tax withheld.' You can choose a plan that fits your budget while ensuring tax compliance in your agreements.

-

Can I integrate airSlate SignNow with other applications to manage '41373 tax withheld' effectively?

Yes, airSlate SignNow integrates with a variety of applications, enhancing your ability to manage '41373 tax withheld' documents. This integration enables you to streamline workflows by connecting to accounting and tax preparation software. Automating document management can simplify handling tax-related paperwork.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, like those involving '41373 tax withheld,' offers numerous benefits. It simplifies the signing process, reduces errors, and ensures that both parties can easily agree to the necessary tax terms. This efficient solution helps businesses remain compliant with tax regulations while saving time.

-

Is airSlate SignNow secure for handling sensitive information like '41373 tax withheld'?

Absolutely! airSlate SignNow prioritizes security, providing advanced encryption and compliance standards to protect sensitive information, including '41373 tax withheld.' We ensure that your data is secure during the signing process, giving you peace of mind when dealing with financial documents.

-

How can my business benefit from using airSlate SignNow for eSigning '41373 tax withheld' documents?

airSlate SignNow streamlines the eSigning process for '41373 tax withheld' documents, improving turnaround times for approvals. This efficiency allows your business to focus on core operations rather than paperwork. By reducing the hassle associated with document handling, you can enhance productivity and compliance.

Get more for NM RPD 41373 Fill Out Tax Template Online US Legal Forms

- Fencing contractor package nevada form

- Hvac contractor package nevada form

- Landscaping contractor package nevada form

- Commercial contractor package nevada form

- Excavation contractor package nevada form

- Renovation contractor package nevada form

- Concrete mason contractor package nevada form

- Demolition contractor package nevada form

Find out other NM RPD 41373 Fill Out Tax Template Online US Legal Forms

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement