Philadelphia Net Profits Tax Fillable Form

What is the Philadelphia Net Profits Tax Fillable Form

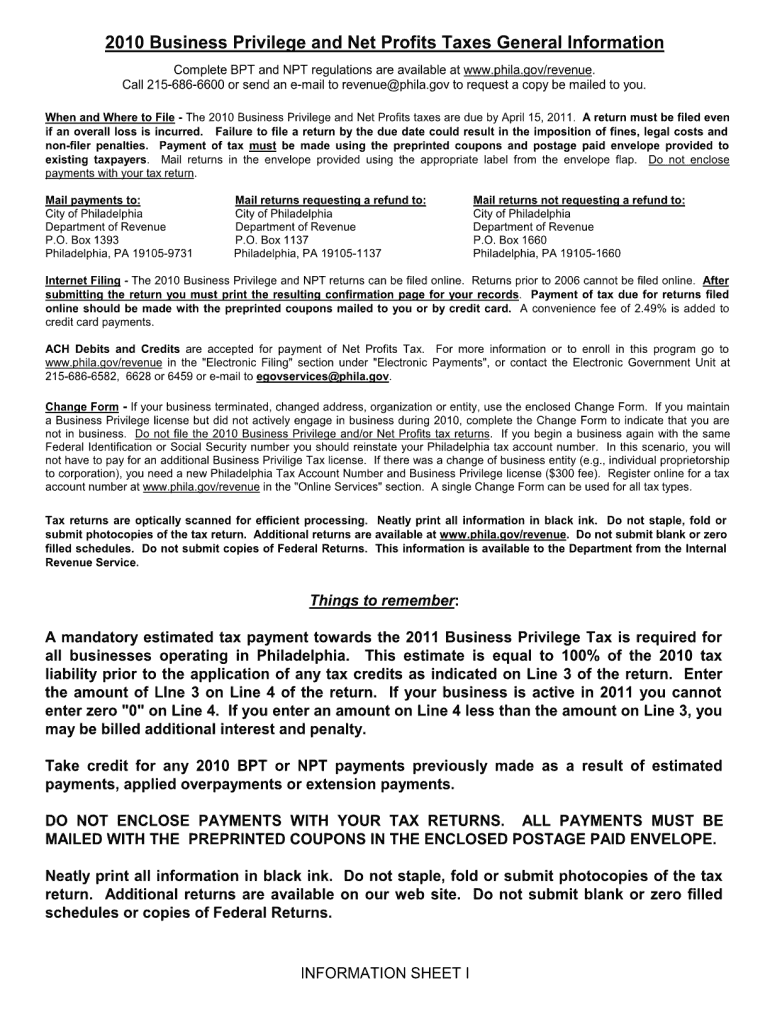

The Philadelphia Net Profits Tax Fillable Form is a crucial document for businesses operating within the city limits of Philadelphia. This form is designed to report the net profits earned by businesses, including sole proprietorships, partnerships, and corporations. The tax is levied on the income generated from business activities conducted in Philadelphia, and it is essential for compliance with local tax regulations.

How to use the Philadelphia Net Profits Tax Fillable Form

Using the Philadelphia Net Profits Tax Fillable Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering your business's net profits and any applicable deductions. Once completed, review the form for accuracy before submitting it. The form can be filled out digitally, allowing for easy corrections and electronic submission.

Steps to complete the Philadelphia Net Profits Tax Fillable Form

Completing the Philadelphia Net Profits Tax Fillable Form requires attention to detail. Follow these steps:

- Download the fillable form from the official Philadelphia tax website.

- Enter your business information, including name, address, and tax identification number.

- Calculate your total net profits by subtracting allowable expenses from gross income.

- Include any applicable credits or deductions that may reduce your tax liability.

- Review all entries for accuracy and completeness.

- Sign and date the form electronically if submitting online.

Legal use of the Philadelphia Net Profits Tax Fillable Form

The legal use of the Philadelphia Net Profits Tax Fillable Form is governed by local tax laws. It is important for businesses to understand that submitting this form is not only a legal requirement but also a way to ensure compliance with the Philadelphia Department of Revenue. Failure to submit the form or inaccuracies in reporting can result in penalties or legal repercussions.

Form Submission Methods

The Philadelphia Net Profits Tax Fillable Form can be submitted through various methods to accommodate different preferences. Businesses can choose to submit the form electronically via the Philadelphia Department of Revenue's online portal, ensuring a quick and efficient process. Alternatively, the completed form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own set of guidelines, so it is advisable to follow the instructions provided with the form.

Penalties for Non-Compliance

Non-compliance with the Philadelphia Net Profits Tax requirements can lead to significant penalties. Businesses that fail to file the form on time may incur late fees and interest on any unpaid taxes. Additionally, persistent non-compliance can result in more severe consequences, including legal action by the city. It is essential for businesses to stay informed about filing deadlines and ensure timely submission to avoid these penalties.

Quick guide on how to complete philadelphia net profits tax fillable form

Effortlessly prepare Philadelphia Net Profits Tax Fillable Form on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed files, as you can obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without complications. Manage Philadelphia Net Profits Tax Fillable Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and electronically sign Philadelphia Net Profits Tax Fillable Form with ease

- Obtain Philadelphia Net Profits Tax Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Philadelphia Net Profits Tax Fillable Form to guarantee excellent communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the philadelphia net profits tax fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Philadelphia Net Profits Tax Fillable Form?

The Philadelphia Net Profits Tax Fillable Form is a document used by businesses operating within Philadelphia to report their net profits for taxation purposes. This form allows users to input their financial data easily and ensures accuracy in tax filings. Using the fillable form simplifies the process and helps avoid common errors.

-

How can I access the Philadelphia Net Profits Tax Fillable Form?

You can access the Philadelphia Net Profits Tax Fillable Form through our airSlate SignNow platform. We provide easy online access to the form, allowing users to fill it out and manage their documentation seamlessly. Simply visit our website to get started.

-

Is there a cost associated with using the Philadelphia Net Profits Tax Fillable Form?

Using the Philadelphia Net Profits Tax Fillable Form on airSlate SignNow is part of our cost-effective eSigning solution. We offer competitive pricing plans that ensure affordability while providing powerful features. Check our pricing page for detailed information and options.

-

What features does the Philadelphia Net Profits Tax Fillable Form offer?

The Philadelphia Net Profits Tax Fillable Form on our platform includes features such as electronic signatures, data validation, and the ability to save and share documents securely. These features improve efficiency and streamline the tax filing process. Users can also track the status of their forms in real time.

-

How does the Philadelphia Net Profits Tax Fillable Form benefit my business?

Utilizing the Philadelphia Net Profits Tax Fillable Form can signNowly reduce the time spent on tax preparation and filing. The form’s intuitive design ensures users can easily navigate complex tax requirements. This ultimately helps businesses save time and reduce stress during tax season.

-

Can I integrate the Philadelphia Net Profits Tax Fillable Form with other software?

Yes, the Philadelphia Net Profits Tax Fillable Form can be integrated with various accounting and business management software through airSlate SignNow's API. This feature improves workflow efficiency by allowing seamless data transfer. Integrations help you maintain accurate financial records and streamline your tax process.

-

What security measures are in place for the Philadelphia Net Profits Tax Fillable Form?

airSlate SignNow prioritizes security with the Philadelphia Net Profits Tax Fillable Form by implementing industry-leading encryption and access controls. All documents are securely stored to prevent unauthorized access and ensure data confidentiality. Your information is protected while you complete your tax filings.

Get more for Philadelphia Net Profits Tax Fillable Form

- Request records form

- Closure estate form

- Stock option agreement form

- Sample letter for aptitude test request form

- Sample letter waiver form

- Shareholders buy sell agreement of stock in a close corporation with agreement of spouse and stock transfer restrictions 497333374 form

- Sample letter workplace form

- Deed conveying 497333376 form

Find out other Philadelphia Net Profits Tax Fillable Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement