Content Disposition HTTP MDN 2020

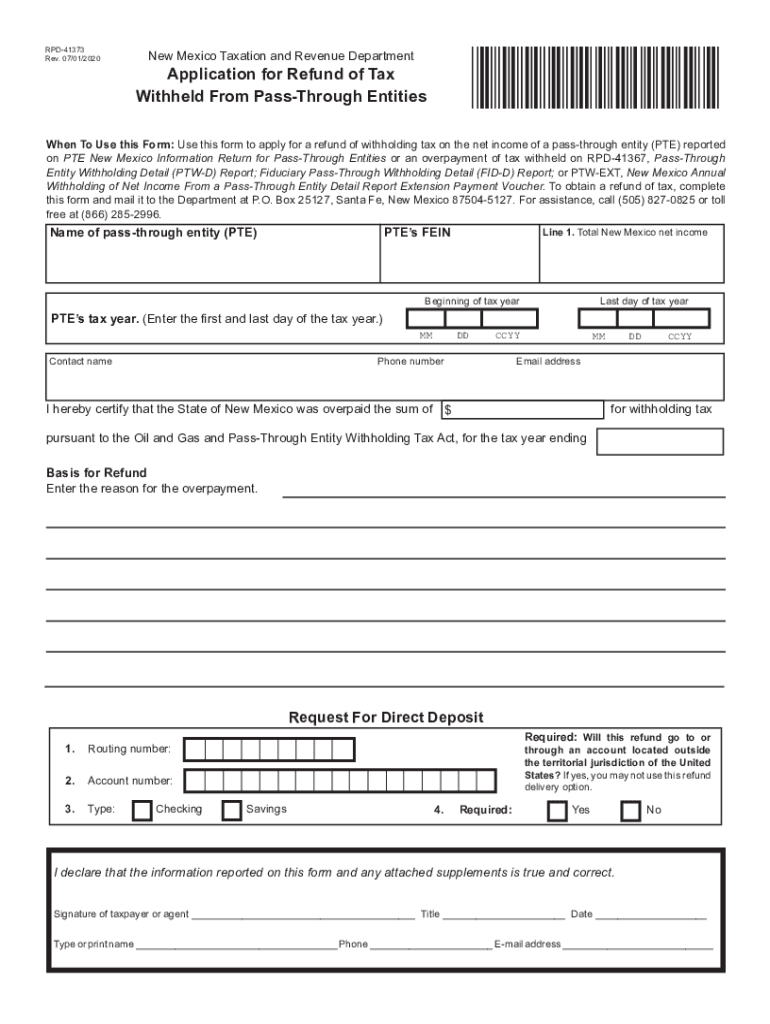

Understanding the rpd 41373 Tax Form

The rpd 41373 is a tax form used in New Mexico, primarily for reporting specific tax-related information. It is essential for individuals and businesses to understand the purpose of this form to ensure compliance with state tax regulations. The rpd 41373 may be required for various tax filings, including property tax assessments and other financial disclosures.

Eligibility Criteria for the rpd 41373

To complete the rpd 41373, individuals and businesses must meet specific eligibility criteria. Generally, this form is applicable to property owners, businesses, or entities that are subject to taxation within New Mexico. It is crucial to verify your eligibility before attempting to fill out the form to avoid any compliance issues.

Required Documents for Filing the rpd 41373

When preparing to file the rpd 41373, certain documents are necessary to ensure accurate completion. Commonly required documents may include:

- Property ownership documentation

- Previous tax returns

- Financial statements

- Any correspondence from the New Mexico Taxation and Revenue Department

Gathering these documents ahead of time can facilitate a smoother filing process.

Form Submission Methods for the rpd 41373

The rpd 41373 can be submitted through various methods, offering flexibility to filers. Options typically include:

- Online submission through the New Mexico Taxation and Revenue Department’s website

- Mailing a physical copy to the appropriate tax office

- In-person submission at designated state offices

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Filing Deadlines for the rpd 41373

Awareness of filing deadlines is crucial for compliance with New Mexico tax laws. The deadlines for submitting the rpd 41373 may vary based on the specific tax year and type of filing. Generally, it is advisable to check the New Mexico Taxation and Revenue Department’s official announcements for the most current deadlines to avoid penalties.

Penalties for Non-Compliance with the rpd 41373

Failure to comply with the requirements of the rpd 41373 can result in penalties. These may include fines, interest on unpaid taxes, and potential legal consequences. Understanding the implications of non-compliance emphasizes the importance of timely and accurate filing.

Quick guide on how to complete content disposition http mdn 549395077

Effortlessly Prepare Content Disposition HTTP MDN on Any Device

Web-based document organization has become increasingly favored by both businesses and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly and without hindrances. Manage Content Disposition HTTP MDN on any device using the airSlate SignNow applications available for Android or iOS, and streamline your document-related processes today.

How to Edit and eSign Content Disposition HTTP MDN with Ease

- Find Content Disposition HTTP MDN and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the specialized tools airSlate SignNow provides.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal significance as a standard handwritten signature.

- Verify the details, then click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Content Disposition HTTP MDN and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct content disposition http mdn 549395077

Create this form in 5 minutes!

How to create an eSignature for the content disposition http mdn 549395077

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is rpd 41373 and how does it relate to airSlate SignNow?

RPD 41373 refers to a specialized document processing feature within airSlate SignNow. This feature streamlines the signing process, allowing businesses to efficiently manage documents and approvals. By integrating rpd 41373, you can enhance your electronic signature workflow while ensuring compliance.

-

How much does airSlate SignNow cost for features related to rpd 41373?

The pricing for airSlate SignNow, including features associated with rpd 41373, varies based on the subscription plan you choose. Typically, plans start at a competitive price, offering flexibility for businesses of all sizes. You can easily select the best plan that includes rpd 41373 functionalities to fit your needs.

-

What features does rpd 41373 offer within airSlate SignNow?

RPD 41373 provides various features within airSlate SignNow, such as customized templates, advanced signing options, and robust security measures. These features are designed to simplify the eSigning process while ensuring documents remain secure and compliant. Utilizing rpd 41373 optimizes your document workflow dramatically.

-

What are the benefits of using rpd 41373 in airSlate SignNow?

Using rpd 41373 with airSlate SignNow offers signNow benefits, including increased efficiency and reduced turnaround times for document signing. It enhances collaboration among teams and ensures that all signatures are tracked and managed seamlessly. This ultimately leads to improved productivity and lower costs.

-

Can rpd 41373 integrate with other software solutions?

Yes, rpd 41373 can seamlessly integrate with various software solutions, enhancing the overall functionality of airSlate SignNow. This includes popular CRM systems, document management tools, and productivity software. With these integrations, your business can manage documents more effectively and improve workflow automation.

-

Is rpd 41373 suitable for small businesses?

Absolutely, rpd 41373 is designed to be scalable and suitable for small businesses looking for efficient document signing solutions. Its ease of use and affordability make it an attractive option for small teams that require reliable electronic signatures without complex setups. This ensures that small businesses can enjoy the benefits of rpd 41373 without breaking the bank.

-

How secure is the rpd 41373 feature in airSlate SignNow?

The rpd 41373 feature in airSlate SignNow is built with top-notch security protocols, including data encryption and secure storage options. This ensures that all signed documents remain safe and confidential. The focus on security in rpd 41373 gives users peace of mind while managing their important documents.

Get more for Content Disposition HTTP MDN

Find out other Content Disposition HTTP MDN

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo