Www Tax Brackets Orgnewmexicotaxformsform Pit BNew MexicoAllocation & Apportionment of Income Schedule 2021

What is the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule

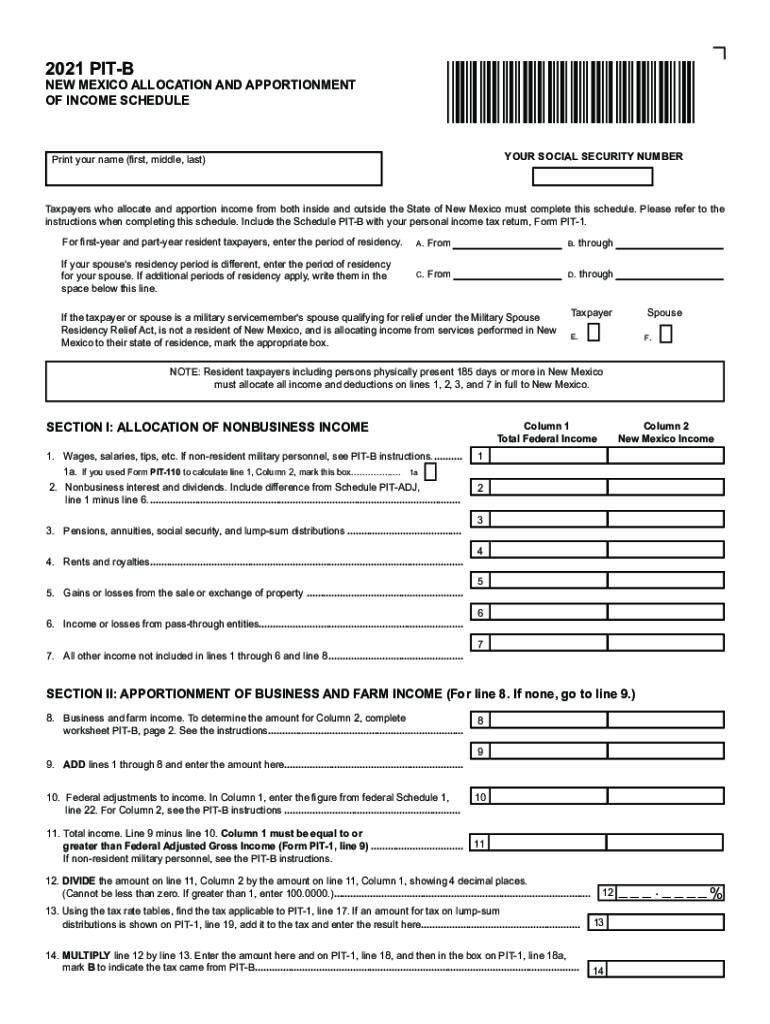

The Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule is a crucial document for individuals and businesses operating in New Mexico. This form is used to allocate and apportion income among various jurisdictions, ensuring compliance with state tax laws. Understanding this form is essential for accurate tax reporting and to avoid potential penalties. It helps determine how much income is taxable in New Mexico versus other states, which is particularly important for businesses operating across state lines.

Steps to complete the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule

Completing the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Determine the total income earned in New Mexico and other states.

- Calculate the allocation percentages based on the business operations in each state.

- Fill out the form accurately, ensuring all figures are correctly represented.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule

The legal use of the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule is governed by state tax regulations. It is essential to ensure that the form is filled out accurately to reflect the true income allocation. Misrepresenting information can lead to audits, penalties, and legal repercussions. Utilizing a reliable eSignature solution can further enhance the legal standing of the document, ensuring that all signatures are valid and compliant with eSignature laws.

State-specific rules for the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule

New Mexico has specific rules regarding the allocation and apportionment of income that must be adhered to when completing the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule. These rules include:

- Determining the correct apportionment formula based on the type of business.

- Adhering to state-defined thresholds for income earned in New Mexico.

- Understanding how to treat different types of income, such as capital gains or dividends.

Examples of using the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule

Examples of using the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule can help clarify its application:

- A business operating in New Mexico and Texas needs to allocate its income based on the revenue generated in each state.

- A self-employed individual who works remotely for clients in multiple states must report their income accurately to avoid double taxation.

- A corporation with subsidiaries in different states must apportion its income according to New Mexico's tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule are critical to ensure compliance. Typically, the deadline aligns with the state income tax return due date. It is important to stay informed about any changes to these dates, which can vary from year to year. Late submissions may incur penalties, so timely filing is essential.

Quick guide on how to complete wwwtax bracketsorgnewmexicotaxformsform pit bnew mexicoallocation ampamp apportionment of income schedule

Prepare Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly without any hold-ups. Manage Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule with ease

- Obtain Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule and guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtax bracketsorgnewmexicotaxformsform pit bnew mexicoallocation ampamp apportionment of income schedule

Create this form in 5 minutes!

People also ask

-

What is the process for using Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule?

Using the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule is straightforward. Simply access the form online, fill it out accurately with your details, and eSign it using airSlate SignNow. This process streamlines document submission and ensures compliance with New Mexico tax regulations.

-

How does airSlate SignNow ensure the security of my documents related to Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule?

AirSlate SignNow prioritizes your document security through advanced encryption and secure cloud storage. All documents, including those linked to Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule, are protected against unauthorized access, ensuring that your sensitive information remains secure.

-

What are the costs associated with using airSlate SignNow for Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule?

AirSlate SignNow offers various pricing plans suitable for businesses of all sizes. Using it for facilitating documents like the Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule can save you time and money compared to traditional methods, with plans designed to fit any budget.

-

Can airSlate SignNow integrate with other applications for managing Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule?

Yes, airSlate SignNow offers seamless integrations with a variety of applications. This connectivity enhances your workflow while working with documents such as Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule, allowing for a streamlined and efficient management process.

-

What features should I expect from airSlate SignNow when handling Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule?

AirSlate SignNow provides a range of features that simplify the eSigning process for documents like Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule. Key features include customizable templates, automated workflows, and user-friendly mobile access, making it easy to manage and sign documents on the go.

-

How can airSlate SignNow benefit my business when dealing with Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule?

Utilizing airSlate SignNow can signNowly streamline your document processes related to Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule. By reducing the need for physical paperwork and speeding up signature collection, it allows your business to operate more efficiently and focus on core activities.

-

How do I get started with airSlate SignNow for Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule?

Getting started with airSlate SignNow is simple! You can quickly sign up online, choose your plan, and begin uploading documents, including Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule. The platform is designed to be user-friendly, allowing you to start eSigning within minutes.

Get more for Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule

- Bill of sale of automobile and odometer statement for as is sale new york form

- Construction contract cost plus or fixed fee new york form

- Painting contract for contractor new york form

- Trim carpenter contract for contractor new york form

- Fencing contract for contractor new york form

- Hvac contract for contractor new york form

- Landscape contract for contractor new york form

- Commercial contract for contractor new york form

Find out other Www tax brackets orgnewmexicotaxformsform pit bNew MexicoAllocation & Apportionment Of Income Schedule

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement