PIT B *240580200* NEW MEXICO ALLOCATION and a 2024-2026

Understanding the New Mexico PIT B Form

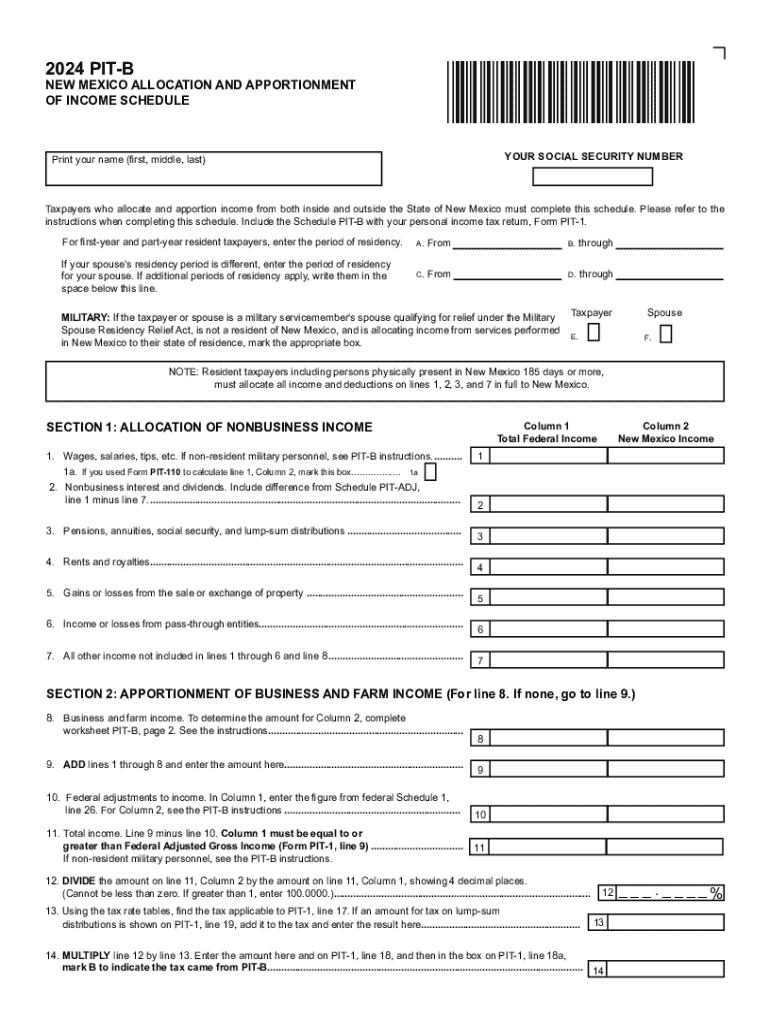

The New Mexico PIT B form, also known as the PIT B *240580200* New Mexico Allocation and A, is a critical document for individuals and businesses that need to report income and allocate it appropriately for state tax purposes. This form is specifically designed for taxpayers who have income that needs to be apportioned based on their business activities within New Mexico. Understanding the purpose and requirements of this form is essential for compliance with state tax regulations.

Steps to Complete the New Mexico PIT B Form

Completing the New Mexico PIT B form involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Determine the income that is subject to allocation based on your business activities in New Mexico.

- Fill out the PIT B form by entering your personal information, income details, and allocation percentages.

- Review the completed form for accuracy to avoid any errors that could lead to penalties.

- Submit the form by the designated filing deadline to ensure compliance with state tax laws.

Key Elements of the New Mexico PIT B Form

Understanding the key elements of the New Mexico PIT B form is crucial for effective completion. The form includes sections for:

- Taxpayer Information: This section requires your name, address, and Social Security number or taxpayer identification number.

- Income Details: Report all income sources that need to be allocated, including wages, business income, and other earnings.

- Allocation Percentages: Specify the percentage of income that is allocated to New Mexico based on your business activities.

- Signature: The form must be signed and dated to validate the information provided.

Legal Use of the New Mexico PIT B Form

The New Mexico PIT B form is legally required for taxpayers who have income that must be allocated for state tax purposes. Failing to file this form when necessary can result in penalties and interest on unpaid taxes. It is important to ensure that the form is completed accurately and submitted on time to avoid legal complications.

Filing Deadlines for the New Mexico PIT B Form

Filing deadlines for the New Mexico PIT B form are typically aligned with the state tax filing deadlines. Taxpayers should be aware of these dates to ensure timely submission. Generally, the form must be filed by April 15 of the year following the tax year being reported. However, it is advisable to check for any specific changes or extensions that may apply.

Required Documents for the New Mexico PIT B Form

To complete the New Mexico PIT B form accurately, taxpayers will need to gather several key documents, including:

- Income statements from all sources, including W-2s and 1099s.

- Records of business expenses that may affect income allocation.

- Previous year’s tax returns for reference and consistency.

Create this form in 5 minutes or less

Find and fill out the correct pit b 240580200 new mexico allocation and a

Create this form in 5 minutes!

How to create an eSignature for the pit b 240580200 new mexico allocation and a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Mexico PIT B form?

The New Mexico PIT B form is a tax document used by businesses to report income and calculate personal income tax in New Mexico. It is essential for ensuring compliance with state tax regulations. Understanding this form is crucial for any business operating in New Mexico.

-

How can airSlate SignNow help with the New Mexico PIT B form?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the New Mexico PIT B form. Our solution simplifies the document management process, making it easier to handle tax forms securely and quickly. This ensures that your submissions are timely and compliant.

-

What are the pricing options for using airSlate SignNow for the New Mexico PIT B form?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while allowing you to manage the New Mexico PIT B form effectively. Check our website for detailed pricing information.

-

Are there any features specifically designed for the New Mexico PIT B form?

Yes, airSlate SignNow includes features that streamline the completion and submission of the New Mexico PIT B form. These features include customizable templates, automated reminders, and secure storage options. This ensures that your tax documents are handled efficiently and securely.

-

What are the benefits of using airSlate SignNow for tax forms like the New Mexico PIT B form?

Using airSlate SignNow for the New Mexico PIT B form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick electronic signatures, which can save time and reduce the risk of errors. This ultimately leads to a smoother tax filing process.

-

Can I integrate airSlate SignNow with other software for managing the New Mexico PIT B form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to manage the New Mexico PIT B form alongside your existing tools. This integration enhances your workflow and ensures that all your documents are in one place, making tax management easier.

-

Is airSlate SignNow compliant with New Mexico tax regulations for the PIT B form?

Yes, airSlate SignNow is designed to comply with New Mexico tax regulations, including those related to the PIT B form. Our platform ensures that all electronic signatures and document submissions meet the necessary legal standards. This gives you peace of mind when filing your tax documents.

Get more for PIT B *240580200* NEW MEXICO ALLOCATION AND A

- Saf reimbursement form meredith college meredith

- Relationship details humanservices gov form

- Communications amp marketing request form www1 villanova

- Jv 800 2016 2019 form

- Motion and order for continuance forms and instructions packet number 18c courts oregon

- Cori form page 1

- Careplus authorization bformb

- Orr russwurm memorial scholarship university of mississippi umc form

Find out other PIT B *240580200* NEW MEXICO ALLOCATION AND A

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney