Content Disposition HTTP MDN 2019

IRS Guidelines

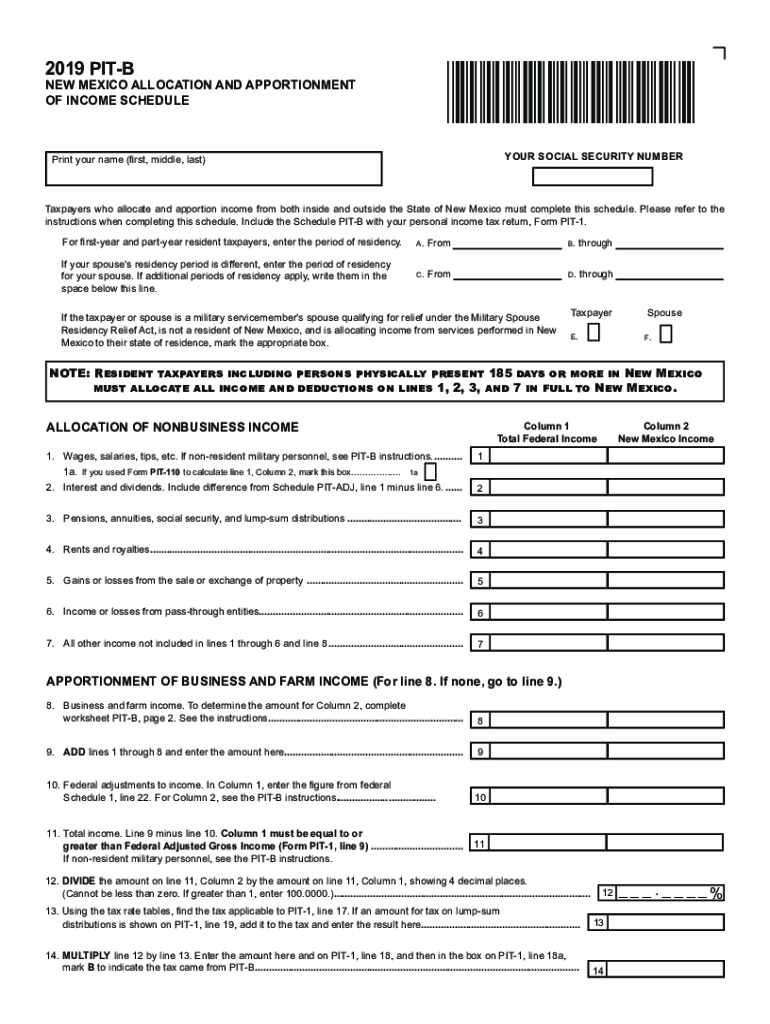

The IRS provides specific guidelines for completing the NM tax form PIT-B. This form is essential for reporting personal income tax in New Mexico. Understanding the IRS requirements ensures that taxpayers accurately report their income and claim any applicable deductions or credits. It is crucial to refer to the latest IRS publications and instructions related to state tax forms, as these documents outline the necessary steps and criteria for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the NM tax form PIT-B are typically aligned with federal tax deadlines. Taxpayers should be aware that the standard deadline for filing personal income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes in deadlines, as New Mexico may announce extensions or specific dates for state tax filings.

Required Documents

To successfully complete the NM tax form PIT-B, taxpayers must gather several key documents. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting income and deductions.

Form Submission Methods (Online / Mail / In-Person)

The NM tax form PIT-B can be submitted through various methods. Taxpayers have the option to file online, which is often the fastest and most efficient method. Alternatively, forms can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the method that aligns with the taxpayer’s needs and timeline.

Penalties for Non-Compliance

Failure to file the NM tax form PIT-B by the deadline can result in penalties. The state imposes fines for late submissions, which can accumulate over time. Additionally, taxpayers may face interest charges on any unpaid taxes. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Digital vs. Paper Version

Taxpayers can choose between a digital version and a paper version of the NM tax form PIT-B. The digital version often offers advantages such as easier calculations, automatic error checks, and faster submission times. On the other hand, some individuals may prefer the traditional paper format for its familiarity. Regardless of the chosen method, ensuring that the form is completed accurately is essential for compliance.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios may affect how the NM tax form PIT-B is completed. For instance, self-employed individuals may need to report additional income and expenses, while retirees might have different income sources to consider. Students may be eligible for specific deductions or credits based on their education expenses. Understanding these scenarios helps taxpayers accurately report their financial situations and maximize their potential refunds.

Quick guide on how to complete content disposition http mdn 536028013

Easily Create Content Disposition HTTP MDN on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to craft, modify, and electronically sign your documents swiftly without hesitation. Handle Content Disposition HTTP MDN on any device using airSlate SignNow’s Android or iOS applications and streamline any document-driven procedure today.

How to Edit and eSign Content Disposition HTTP MDN Effortlessly

- Locate Content Disposition HTTP MDN and click Get Form to begin.

- Use the tools provided to fill in your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Edit and eSign Content Disposition HTTP MDN to maintain exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct content disposition http mdn 536028013

Create this form in 5 minutes!

How to create an eSignature for the content disposition http mdn 536028013

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the nm tax form pit b?

The nm tax form pit b is a specific tax form used in New Mexico for reporting personal income. This form is essential for individuals and businesses to ensure proper tax compliance in the state. Understanding how to complete and submit the nm tax form pit b accurately can prevent issues with the New Mexico taxation authorities.

-

How can airSlate SignNow help with the nm tax form pit b?

airSlate SignNow provides an efficient platform that allows you to eSign and send the nm tax form pit b securely. With its user-friendly interface, you can quickly gather signatures and ensure your tax documents are filed on time. This saves you time and enhances your productivity during tax season.

-

What are the pricing options for using airSlate SignNow for nm tax form pit b?

airSlate SignNow offers flexible pricing plans to cater to various business needs when managing documents like the nm tax form pit b. You can choose from monthly or annual subscription options, which provide access to essential features without breaking the bank. For specific pricing details, visit our pricing page or contact our sales team.

-

What features does airSlate SignNow offer for eSigning the nm tax form pit b?

airSlate SignNow includes several features that enhance the eSigning process for the nm tax form pit b. Some key features include mobile signing, real-time tracking, and customizable templates. These features help streamline your document management, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for my nm tax form pit b management?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easier to manage your nm tax form pit b. Integrate with tools like Google Drive, Dropbox, or CRM platforms to create a more efficient workflow. This ensures your documents are better organized and easily accessible.

-

What benefits does airSlate SignNow provide for handling the nm tax form pit b?

Using airSlate SignNow for the nm tax form pit b delivers numerous benefits, including enhanced accuracy and reduced processing time. The platform helps eliminate manual errors, ensuring your tax documents are correctly completed. Moreover, its eSigning capabilities allow for faster approvals and submissions, streamlining the tax filing process.

-

Is airSlate SignNow secure for managing sensitive documents like the nm tax form pit b?

Absolutely, airSlate SignNow prioritizes the security of your documents, including the nm tax form pit b. With industry-standard encryption and secure data storage, you can trust that your sensitive information is protected. Our platform also complies with various regulations to ensure your documents are handled safely.

Get more for Content Disposition HTTP MDN

- Living trust for husband and wife with minor and or adult children vermont form

- Amendment to living trust vermont form

- Living trust property record vermont form

- Financial account transfer to living trust vermont form

- Assignment to living trust vermont form

- Notice of assignment to living trust vermont form

- Revocation of living trust vermont form

- Letter to lienholder to notify of trust vermont form

Find out other Content Disposition HTTP MDN

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF