Collection Advisory Offices Contact Information IRS Tax Forms 2022-2026

Understanding the Collection Advisory Offices Contact Information

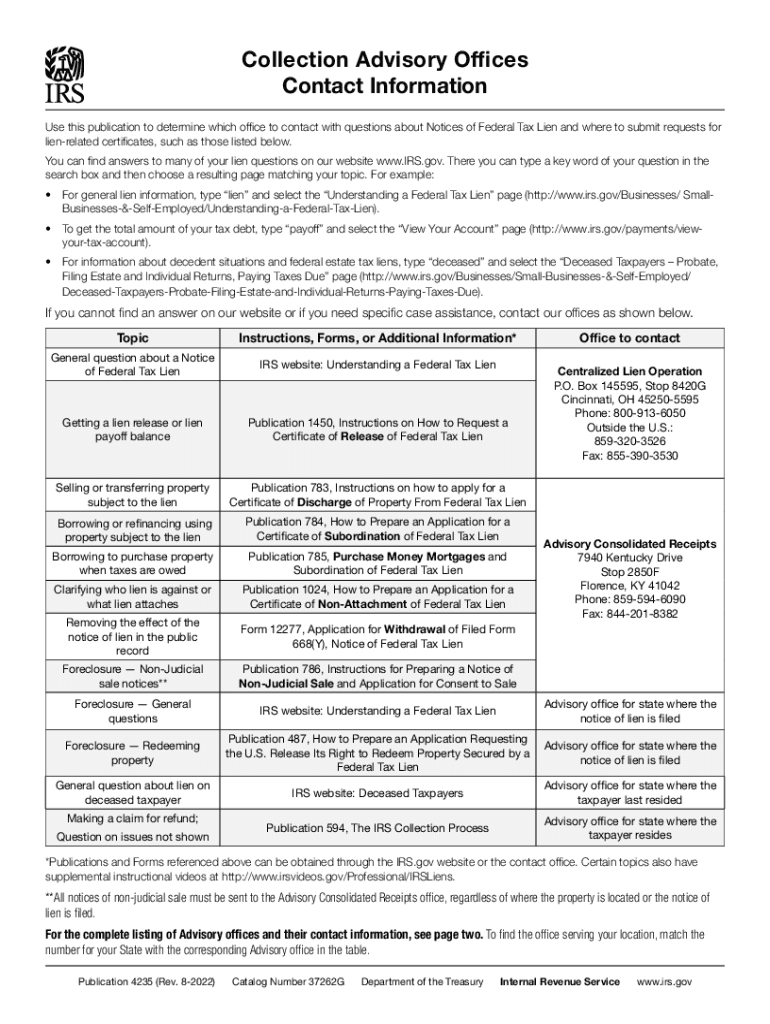

The Collection Advisory Offices are essential resources for taxpayers needing assistance with their IRS-related queries. This information is crucial for individuals and businesses seeking to resolve tax issues or obtain guidance on compliance matters. The contact details for these offices can vary based on the specific needs of the taxpayer, including the nature of the inquiry and the geographic location. It is advisable to have the relevant details on hand when reaching out to ensure a smooth communication process.

Steps to Use the Collection Advisory Offices Contact Information

To effectively utilize the Collection Advisory Offices contact information, follow these steps:

- Identify the specific issue or inquiry related to your tax situation.

- Locate the appropriate Collection Advisory Office based on your state or region.

- Gather all necessary documentation and personal information to facilitate the discussion.

- Contact the office using the provided phone number or email address.

- Document the conversation for future reference, including names, dates, and key points discussed.

Legal Use of the Collection Advisory Offices Contact Information

Using the Collection Advisory Offices contact information is legally permissible and encouraged for taxpayers seeking clarity on their obligations. Engaging with these offices can help ensure compliance with IRS regulations and provide insights into tax-related matters. It is important to approach these communications professionally and respectfully, as they are designed to assist taxpayers in understanding their rights and responsibilities.

Filing Deadlines and Important Dates Related to IRS Forms

Awareness of filing deadlines is critical for taxpayers. The IRS sets specific dates for the submission of various forms, including those related to collection advisories. Missing these deadlines can result in penalties or complications with your tax status. It is advisable to check the IRS website or consult with a Collection Advisory Office for the most current deadlines relevant to your situation.

Required Documents for Collection Advisory Inquiries

When contacting the Collection Advisory Offices, having the right documents prepared can streamline the process. Commonly required documents may include:

- Your most recent tax return.

- Any correspondence received from the IRS.

- Identification information, such as Social Security numbers or Employer Identification Numbers.

- Supporting documents related to the tax issue at hand.

Ensuring that these documents are organized and accessible will help facilitate a productive dialogue with IRS representatives.

Examples of Using the Collection Advisory Offices Contact Information

There are various scenarios where contacting the Collection Advisory Offices can be beneficial. For instance, if you receive a notice about a tax lien or levy, reaching out to these offices can provide clarity on your options. Additionally, if you are unsure about the tax implications of a recent financial decision, these offices can offer guidance tailored to your specific circumstances. Each interaction can help clarify your tax responsibilities and options for resolution.

Quick guide on how to complete collection advisory offices contact information irs tax forms

Effortlessly prepare Collection Advisory Offices Contact Information IRS Tax Forms on any device

Managing documents online has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly option to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your paperwork swiftly without any holdups. Handle Collection Advisory Offices Contact Information IRS Tax Forms on any platform with airSlate SignNow's applications for Android or iOS and enhance any document-focused task today.

How to edit and electronically sign Collection Advisory Offices Contact Information IRS Tax Forms with ease

- Locate Collection Advisory Offices Contact Information IRS Tax Forms and click Get Form to begin.

- Use the features we provide to complete your form.

- Select important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and select the Done button to save your changes.

- Decide how you want to send your form: via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Collection Advisory Offices Contact Information IRS Tax Forms and guarantee excellent communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct collection advisory offices contact information irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the significance of 4235 in airSlate SignNow?

The number 4235 represents an essential feature code in airSlate SignNow that streamlines document management. By utilizing this code, users can enhance their workflow, ensuring efficient eSignature processes. Understanding this code can greatly improve your experience with our platform.

-

How does the pricing structure work for 4235 users?

For users leveraging the 4235 feature, airSlate SignNow offers an affordable pricing model. This ensures that businesses can utilize top-notch eSignature solutions without breaking the bank. Our competitive pricing is tailored to accommodate different needs while maximizing value.

-

What features does the 4235 plan include?

The 4235 plan includes an array of robust features designed to cater to diverse business needs. Users can access advanced eSignature tools, document tracking, and secure cloud storage. These features empower businesses to optimize their document workflows effortlessly.

-

How can 4235 enhance my document signing process?

Integrating the 4235 feature into your workflow can signNowly enhance your document signing process. It allows for quick and secure eSignatures, reducing turnaround time for important documents. This efficiency leads to improved productivity and better customer satisfaction.

-

Are there any integrations available for the 4235 feature?

Yes, airSlate SignNow's 4235 feature seamlessly integrates with various third-party applications. This includes popular tools such as Salesforce, Google Drive, and Dropbox, making it easy to manage documents in one place. These integrations ensure that your workflow remains efficient and cohesive.

-

What benefits can businesses expect from the 4235 solution?

Businesses can expect numerous benefits from using the 4235 solution, including increased efficiency, cost savings, and enhanced security. By simplifying the eSigning process, companies can focus more on core operations. Ultimately, this leads to smoother business transactions and happier clients.

-

Is technical support available for users of the 4235 feature?

Absolutely! airSlate SignNow provides comprehensive technical support for all features, including the 4235 feature. Our dedicated support team is available to assist you with any inquiries or technical issues you may encounter. We are committed to ensuring that you have a smooth experience with our product.

Get more for Collection Advisory Offices Contact Information IRS Tax Forms

- Amendment to prenuptial or premarital agreement new york form

- Financial statements only in connection with prenuptial premarital agreement new york form

- Revocation of premarital or prenuptial agreement new york form

- New york divorce 497321124 form

- Uncontested divorce package for dissolution of marriage with no children with or without property and debts property and or form

- New york business corporation form

- New york corporation buy form

- New york confidentiality form

Find out other Collection Advisory Offices Contact Information IRS Tax Forms

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself