Irs Form 4235 2013

What is the IRS Form 4235

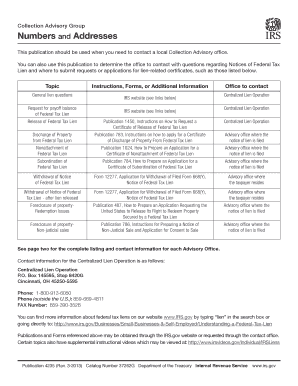

The IRS Form 4235, also known as the IRS Publication 4235, serves as an essential document for taxpayers dealing with the Internal Revenue Service. This form is specifically designed to provide guidance on the IRS collection advisory group addresses. It outlines important information regarding taxpayer rights and responsibilities, as well as the procedures involved in addressing tax-related issues. Understanding the purpose and content of this form is crucial for ensuring compliance with IRS regulations.

How to Obtain the IRS Form 4235

Obtaining the IRS Form 4235 is a straightforward process. Taxpayers can access the form directly from the official IRS website. It is available in a downloadable PDF format, making it easy to print and fill out as needed. Additionally, individuals may request a physical copy by contacting the IRS directly. Ensuring you have the most current version of the form is important, as tax regulations can change frequently.

Steps to Complete the IRS Form 4235

Completing the IRS Form 4235 involves several key steps to ensure accuracy and compliance. Begin by carefully reading the instructions provided with the form. Gather all necessary information, including your taxpayer identification number and any relevant financial documentation. Fill out the form completely, ensuring that all sections are addressed. Once completed, review the form for any errors or omissions before submission.

Legal Use of the IRS Form 4235

The IRS Form 4235 is legally binding when completed and submitted correctly. It is essential to adhere to the guidelines established by the IRS to ensure that the form is accepted. Electronic signatures are permissible, provided they meet the requirements set forth by eSignature laws. Using a reliable platform for electronic document management can enhance the legal validity of your submission.

Key Elements of the IRS Form 4235

Several key elements must be included in the IRS Form 4235 to ensure its effectiveness. These include the taxpayer's personal information, a clear description of the issue being addressed, and any supporting documentation that may be required. Additionally, it is important to provide accurate contact information so that the IRS can reach you if further clarification is needed.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 4235 can vary based on individual circumstances. It is crucial to be aware of any specific deadlines that may apply to your situation to avoid penalties. Generally, forms should be submitted as soon as the relevant information is available. Keeping track of important dates, such as the end of the tax year and any extensions, can help ensure timely filing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the IRS Form 4235 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action by the IRS. Understanding the implications of non-compliance is essential for all taxpayers, as it can affect both personal and financial standing with the IRS.

Quick guide on how to complete irs form 4235

Prepare Irs Form 4235 with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Manage Irs Form 4235 on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Irs Form 4235 effortlessly

- Find Irs Form 4235 and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, text (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 4235 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 4235

Create this form in 5 minutes!

How to create an eSignature for the irs form 4235

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is IRS gov 4235 and how does it relate to airSlate SignNow?

IRS gov 4235 refers to a specific tax guideline related to document signing and submission. Using airSlate SignNow, businesses can efficiently manage their documentation needs in compliance with IRS regulations, including those dictated by IRS gov 4235.

-

How does airSlate SignNow help in complying with IRS gov 4235?

airSlate SignNow ensures compliance with IRS gov 4235 by providing secure and legally binding electronic signatures. Our platform simplifies the process of signing and submitting essential tax documents while adhering to federal guidelines. This streamlines your compliance processes and reduces errors.

-

Are there any costs associated with using airSlate SignNow for IRS gov 4235 documents?

The pricing for airSlate SignNow is competitive and offers various plans to suit different business needs. By evaluating your usage and document requirements, you can choose a plan that helps you manage IRS gov 4235 documents affordably. We also offer a free trial, so you can explore features before committing.

-

What features does airSlate SignNow offer for managing IRS gov 4235 documentation?

airSlate SignNow offers features like customizable templates, automated workflows, and advanced security measures to manage IRS gov 4235 documentation. These features make it easy to prepare, sign, and store necessary documents securely. Additionally, our platform facilitates easy tracking of the signing process for all stakeholders.

-

Can airSlate SignNow integrate with other tools to assist with IRS gov 4235 tasks?

Yes, airSlate SignNow integrates seamlessly with popular tools such as Google Drive, Salesforce, and Microsoft Office. This integration allows you to streamline your workflow when handling IRS gov 4235-related documentation. It enables you to access files and routes from various applications, enhancing your efficiency.

-

How secure is airSlate SignNow for sensitive IRS gov 4235 documents?

Security is a top priority at airSlate SignNow. Our platform implements strong encryption and multi-factor authentication to protect sensitive IRS gov 4235 documents. With compliance to industry standards and regular audits, you can trust that your information is safe and confidential.

-

What benefits do businesses see when using airSlate SignNow for IRS gov 4235?

Businesses using airSlate SignNow for IRS gov 4235 benefit from reduced processing time, increased accuracy, and enhanced security of documents. Our solution also improves collaboration among team members and clients, facilitating faster decision-making and document turnaround times. Ultimately, this elevates overall operational efficiency.

Get more for Irs Form 4235

- Westward expansion supply list form

- Breeding rights contract form

- Form no 15h

- Indo zambia bank internet banking form

- Sanford health plan sftp setup form

- Sftp setup form ndpers nd gov

- Application for marketing agent identification card state of new nj form

- Njdoh lyme disease case investigation form njdoh form cds 14

Find out other Irs Form 4235

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed