1095 B2020 PDF 560118 Form 1095 B 1 Do Not Attach to Your Tax Return

Understanding the 1095 B 2022 Form

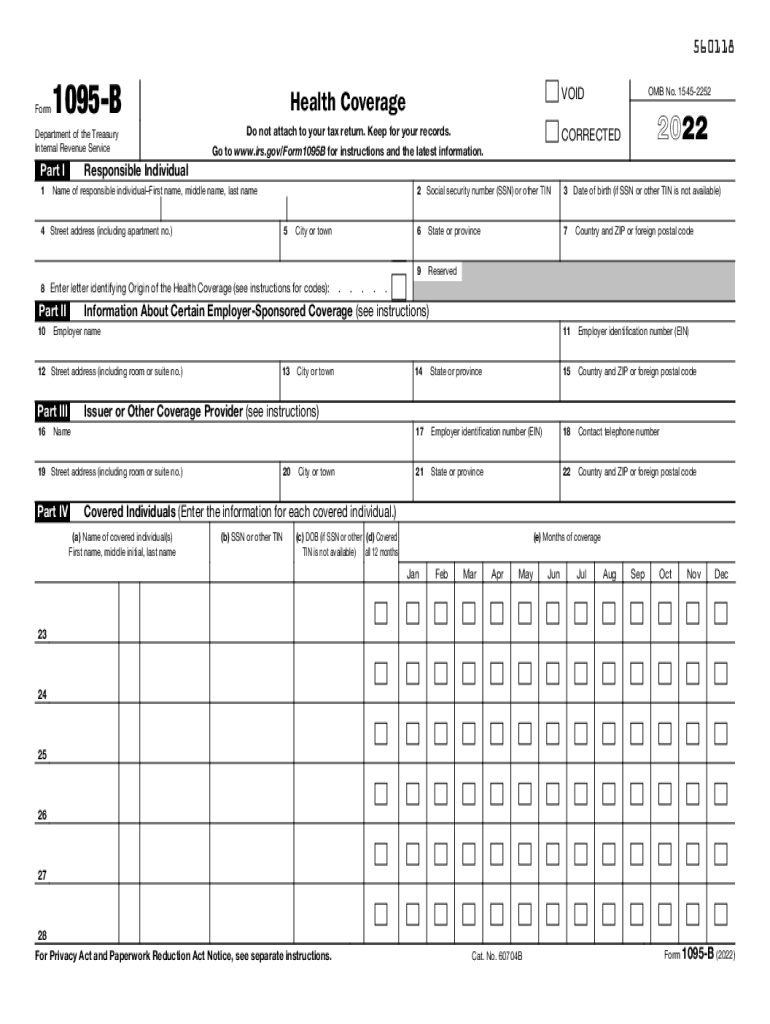

The 1095 B 2022 form is an important document for individuals and families who received health coverage during the tax year. This form is used to report information about health insurance coverage provided to individuals by insurance providers. It is essential for verifying compliance with the Affordable Care Act (ACA) and for taxpayers who need to demonstrate their health coverage when filing their federal tax returns. The form includes details such as the name of the insured, the months of coverage, and the provider's information.

Steps to Complete the 1095 B 2022 Form

Completing the 1095 B 2022 form involves several key steps:

- Gather necessary information, including personal details and health coverage information.

- Fill out the form accurately, ensuring all sections are completed, including the insured's name, address, and coverage period.

- Review the form for any errors or omissions before submission.

- Submit the form as required, typically to the IRS and to individuals covered under the plan.

Who Issues the 1095 B 2022 Form?

The 1095 B 2022 form is issued by health insurance providers, including employers who provide self-insured health plans. These entities are responsible for reporting the information about the coverage they provided. It is important for recipients of the form to ensure they receive it from their provider, as it is necessary for tax filing purposes.

Filing Deadlines for the 1095 B 2022 Form

Understanding the deadlines for filing the 1095 B 2022 form is crucial for compliance. Generally, the form must be provided to individuals by January 31 of the year following the coverage year. Additionally, the form must be filed with the IRS by the last day of February if filing by paper, or by March 31 if filing electronically. Adhering to these deadlines helps avoid penalties and ensures proper reporting of health coverage.

Legal Use of the 1095 B 2022 Form

The 1095 B 2022 form serves a legal purpose in the context of health insurance reporting. It is used to demonstrate compliance with the ACA's individual mandate, which requires individuals to have health coverage. The information provided on the form can be used by the IRS to verify that individuals had the required coverage during the tax year, and it may be requested in the event of an audit.

Key Elements of the 1095 B 2022 Form

Several key elements are included in the 1095 B 2022 form that are essential for accurate reporting:

- The name and address of the insured individual.

- The name and contact information of the insurance provider.

- The months during which the individual was covered under the health plan.

- Details regarding any dependents covered under the same plan.

Quick guide on how to complete 1095 b2020pdf 560118 form 1095 b 1 do not attach to your tax return

Complete 1095 B2020 pdf 560118 Form 1095 B 1 Do Not Attach To Your Tax Return seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly substitute to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly, without any holdups. Handle 1095 B2020 pdf 560118 Form 1095 B 1 Do Not Attach To Your Tax Return on any system with airSlate SignNow Android or iOS applications and streamline any document-related task today.

Steps to modify and electronically sign 1095 B2020 pdf 560118 Form 1095 B 1 Do Not Attach To Your Tax Return effortlessly

- Obtain 1095 B2020 pdf 560118 Form 1095 B 1 Do Not Attach To Your Tax Return and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you wish to share your form—via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 1095 B2020 pdf 560118 Form 1095 B 1 Do Not Attach To Your Tax Return to ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 1095b form for 2022?

The 1095b form for 2022 is a tax document provided by health insurance providers that outlines the coverage provided to the insured during the tax year. This form is essential for individuals to report their health insurance status on their tax returns and ensure compliance with the Affordable Care Act.

-

How can airSlate SignNow help with 1095b 2022 forms?

airSlate SignNow streamlines the process of sending and signing 1095b 2022 forms electronically, making it easy for businesses to manage their documentation. With its user-friendly interface, you can quickly send these forms to recipients for eSignature, ensuring compliance and minimizing paperwork.

-

Is there a cost associated with using airSlate SignNow for 1095b 2022 forms?

While airSlate SignNow offers various pricing plans to fit different business needs, the cost of using the platform for 1095b 2022 forms is affordable. The pricing depends on the features you choose, making it a cost-effective solution for managing electronic signatures.

-

What features does airSlate SignNow offer for 1095b 2022 document management?

airSlate SignNow includes features like customizable templates, automated reminders, and secure cloud storage, which are essential for efficiently managing 1095b 2022 documents. These tools help ensure that your forms are completed accurately and on time.

-

Can I integrate airSlate SignNow with other software for 1095b 2022 forms?

Yes, airSlate SignNow offers integrations with popular software tools such as Google Drive, Salesforce, and more, making it easy to handle 1095b 2022 forms. This ensures that you can seamlessly incorporate eSignature capabilities into your existing workflows.

-

What are the benefits of eSigning 1095b 2022 forms with airSlate SignNow?

By eSigning 1095b 2022 forms with airSlate SignNow, you gain faster turnaround times and improved security compared to traditional paper signing. This modern approach not only saves time but also enhances the organization's efficiency and reduces paper waste.

-

How secure is airSlate SignNow when handling 1095b 2022 forms?

Security is a top priority for airSlate SignNow, particularly when handling sensitive documents like 1095b 2022 forms. The platform uses advanced encryption and security protocols to protect your information, ensuring that your data remains safe and confidential.

Get more for 1095 B2020 pdf 560118 Form 1095 B 1 Do Not Attach To Your Tax Return

Find out other 1095 B2020 pdf 560118 Form 1095 B 1 Do Not Attach To Your Tax Return

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document