Tax Ohio Gov Static Forms2022 Ohio it 1040ES Voucher 1 Due April 18, Electronic 2022

Understanding the Ohio Estimated Tax Form IT 1040ES

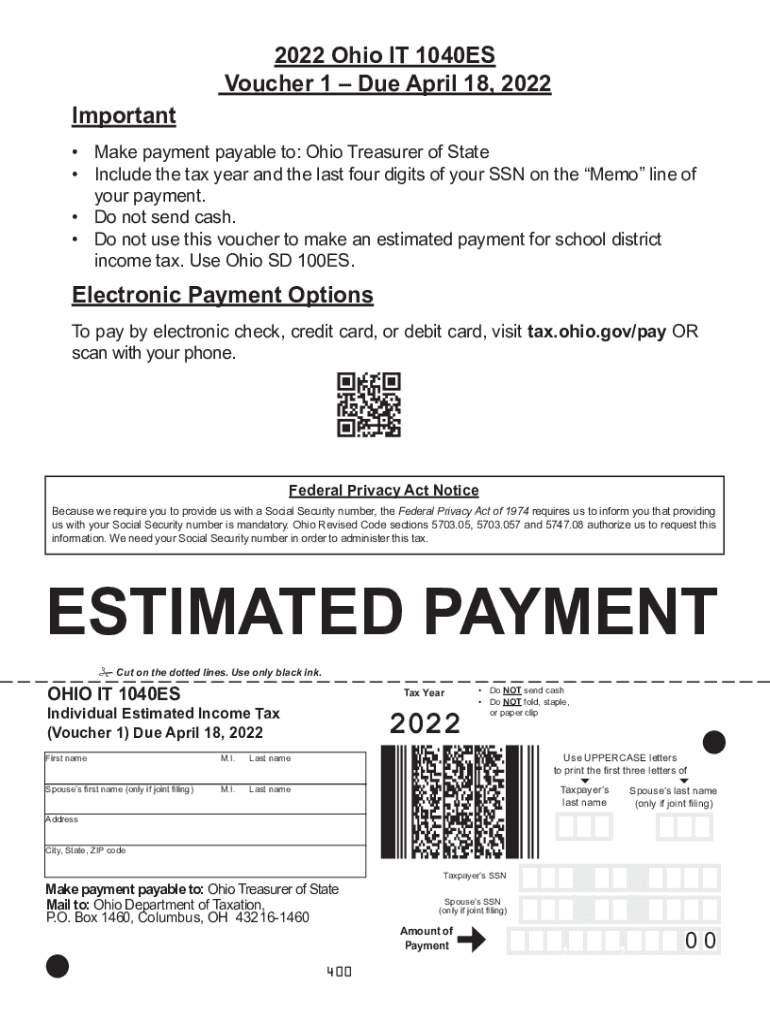

The Ohio Estimated Tax Form IT 1040ES is essential for taxpayers who expect to owe tax of $500 or more when filing their annual return. This form allows individuals to make estimated tax payments throughout the year, ensuring they meet their tax obligations. By submitting the IT 1040ES, taxpayers can avoid penalties for underpayment and manage their finances more effectively.

Steps to Complete the Ohio IT 1040ES Form

Filling out the Ohio IT 1040ES form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected annual income and tax liability for the year.

- Determine the amount of estimated tax you need to pay, which is typically based on your expected income.

- Fill out the IT 1040ES form with your personal information and estimated tax amounts.

- Review the form for accuracy before submission.

- Submit the form electronically or by mail, ensuring it is sent by the due date.

Filing Deadlines for the Ohio IT 1040ES

Timely submission of the Ohio IT 1040ES is crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- First payment: April 18

- Second payment: June 15

- Third payment: September 15

- Fourth payment: January 15 of the following year

Taxpayers should mark these dates on their calendars to ensure compliance.

Legal Use of the Ohio IT 1040ES Form

The Ohio IT 1040ES form is legally recognized for making estimated tax payments. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Ohio Department of Taxation. This includes providing accurate information and submitting the form by the specified deadlines. Using a reliable electronic signature solution can enhance the legitimacy of the submission.

Required Documents for the Ohio IT 1040ES

Before completing the Ohio IT 1040ES form, gather the following documents:

- Previous year’s tax return

- Income statements (W-2s, 1099s)

- Records of any tax credits or deductions

- Any other relevant financial documents

Having these documents on hand will streamline the process and help ensure accuracy.

Form Submission Methods for the Ohio IT 1040ES

Taxpayers can submit the Ohio IT 1040ES form through various methods:

- Online: Use the Ohio Department of Taxation’s e-filing system for quick and secure submission.

- Mail: Send a printed version of the form to the appropriate address provided by the Ohio Department of Taxation.

- In-Person: Visit a local tax office for assistance and submission.

Choosing the right method can depend on personal preference and the urgency of the submission.

Quick guide on how to complete taxohiogov static forms2022 ohio it 1040es voucher 1 due april 18 2022 electronic

Complete Tax ohio gov Static Forms2022 Ohio IT 1040ES Voucher 1 Due April 18, Electronic effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers a suitable eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Tax ohio gov Static Forms2022 Ohio IT 1040ES Voucher 1 Due April 18, Electronic on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Tax ohio gov Static Forms2022 Ohio IT 1040ES Voucher 1 Due April 18, Electronic with ease

- Find Tax ohio gov Static Forms2022 Ohio IT 1040ES Voucher 1 Due April 18, Electronic and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Tax ohio gov Static Forms2022 Ohio IT 1040ES Voucher 1 Due April 18, Electronic and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxohiogov static forms2022 ohio it 1040es voucher 1 due april 18 2022 electronic

Create this form in 5 minutes!

People also ask

-

What is the Ohio estimated form and why is it important?

The Ohio estimated form is a tax document that allows businesses and individuals to estimate their state income tax obligations. This form is crucial for ensuring compliance with Ohio tax laws and avoiding penalties. By accurately completing the Ohio estimated form, taxpayers can manage their tax liabilities effectively throughout the year.

-

How can I fill out the Ohio estimated form using airSlate SignNow?

Using airSlate SignNow, you can easily complete the Ohio estimated form online. Our platform provides an intuitive interface where you can fill in your details and eSign the document securely. This eliminates the hassle of paper forms and allows for quick submission to the state.

-

Are there any costs associated with using airSlate SignNow for the Ohio estimated form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different needs, including those focused on handling the Ohio estimated form. With our cost-effective solutions, you can choose an option that fits your budget and still access powerful features for managing documents.

-

What features does air Slate SignNow offer for completing the Ohio estimated form?

airSlate SignNow offers several features that simplify the process of completing the Ohio estimated form. These include eSignature capabilities, document templates, real-time collaboration tools, and secure cloud storage. These features enhance the efficiency of managing your tax documents.

-

Can I integrate airSlate SignNow with other software for my Ohio estimated form preparation?

Absolutely! airSlate SignNow supports integration with various third-party applications, enabling seamless workflow for Ohio estimated form preparation. Whether you use accounting software or CRM systems, integrating will streamline your document management tasks.

-

How does airSlate SignNow ensure the security of my Ohio estimated form data?

airSlate SignNow takes security seriously. We utilize advanced encryption methods and secure data storage to protect your Ohio estimated form and personal information. You can trust that your documents are safe and only accessible to authorized users.

-

Is there customer support available for questions about the Ohio estimated form?

Yes, airSlate SignNow provides customer support to assist you with any inquiries regarding the Ohio estimated form. Our dedicated team can help you navigate the platform, resolve issues, and ensure you successfully manage your tax documents.

Get more for Tax ohio gov Static Forms2022 Ohio IT 1040ES Voucher 1 Due April 18, Electronic

Find out other Tax ohio gov Static Forms2022 Ohio IT 1040ES Voucher 1 Due April 18, Electronic

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template