Oh Estimated 2018

What is the oh estimated?

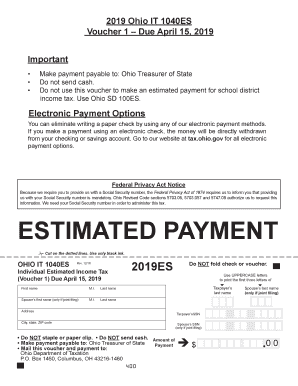

The oh estimated refers to the Ohio estimated income tax, a tax obligation for individuals and businesses that expect to owe a certain amount of tax for the year. This form allows taxpayers to prepay their expected tax liability in quarterly installments. It is essential for those who have income that is not subject to withholding, such as self-employed individuals, freelancers, or those with significant investment income. By filing this form, taxpayers can avoid penalties and interest for underpayment when they file their annual tax return.

How to use the oh estimated

Using the oh estimated involves a few straightforward steps. First, determine your expected annual income and the corresponding tax rate. Then, calculate the estimated tax owed for the year. This amount is divided into four quarterly payments, which are due on specific dates throughout the year. You can complete the form electronically, ensuring that all required information is accurately filled out. Once completed, submit it through the appropriate channels, which may include online submission or mailing a physical copy to the tax authority.

Steps to complete the oh estimated

Completing the oh estimated form involves several key steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your expected annual income and estimated tax liability.

- Fill out the oh estimated form with accurate figures.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail before the deadline.

Ensuring accuracy in these steps is crucial to avoid penalties and ensure compliance with tax regulations.

Legal use of the oh estimated

The legal use of the oh estimated is governed by state tax laws, which require taxpayers to make estimated payments if they expect to owe a certain amount of tax. Compliance with these regulations is essential to avoid penalties for non-compliance. The form must be filled out accurately and submitted on time to ensure that the payments are recognized by the state tax authority. Electronic signatures are legally binding, provided that the eSignature solution used complies with relevant legal frameworks.

Filing Deadlines / Important Dates

Filing deadlines for the oh estimated are critical for compliance. Typically, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. It is important to mark these dates on your calendar to ensure timely submissions. Missing a deadline can result in penalties and interest on the unpaid amounts, making it essential to stay informed about these important dates.

Required Documents

To complete the oh estimated, certain documents are necessary. These may include:

- Previous year’s tax return for reference.

- Documentation of income sources, such as W-2s or 1099s.

- Records of deductions and credits you plan to claim.

- Any relevant financial statements or projections.

Having these documents ready will streamline the process and help ensure that your estimated tax calculations are accurate.

Quick guide on how to complete oh estimated

Complete Oh Estimated effortlessly on any device

Managing documents online has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely archive it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delay. Manage Oh Estimated on any device with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign Oh Estimated with ease

- Find Oh Estimated and click on Get Form to start.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Oh Estimated to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oh estimated

Create this form in 5 minutes!

How to create an eSignature for the oh estimated

How to make an eSignature for your Oh Estimated in the online mode

How to generate an electronic signature for your Oh Estimated in Chrome

How to make an eSignature for signing the Oh Estimated in Gmail

How to generate an electronic signature for the Oh Estimated straight from your mobile device

How to make an electronic signature for the Oh Estimated on iOS devices

How to generate an electronic signature for the Oh Estimated on Android OS

People also ask

-

What is the pricing structure for airSlate SignNow's services?

The pricing for airSlate SignNow is designed to be cost-effective, with various plans to fit your business needs. Each plan includes essential features to help you manage document signing efficiently. With the 'Oh Estimated' pricing model, you can find a plan that offers the best value for your requirements.

-

How does airSlate SignNow ensure document security?

AirSlate SignNow prioritizes document security with advanced encryption and secure storage options. Our platform complies with industry standards to keep your data safe. With the 'Oh Estimated' security protocols, you can trust that your signed documents are protected from unauthorized access.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow comes equipped with a variety of features designed to streamline document management. You can easily create, send, and eSign documents all in one place. The 'Oh Estimated' feature set includes templates, automated workflows, and real-time tracking to enhance your document handling experience.

-

Can I integrate airSlate SignNow with other software applications?

Yes, airSlate SignNow offers seamless integrations with a wide range of software applications, making it easy to incorporate into your existing workflows. With the 'Oh Estimated' integration capabilities, you can connect with popular tools like CRM systems and cloud storage solutions to enhance productivity.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents provides numerous benefits, including increased efficiency and reduced turnaround times. The platform simplifies the signing process, allowing you to get contracts signed faster. With the 'Oh Estimated' benefits, businesses can save time and resources while ensuring compliance.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! AirSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses. With the 'Oh Estimated' pricing plans, you can choose a solution that fits your budget and helps you manage your document signing needs efficiently.

-

How does airSlate SignNow support remote work?

AirSlate SignNow is built to support remote work by enabling users to send and eSign documents from anywhere, at any time. This flexibility is essential for businesses adapting to remote operations. With the 'Oh Estimated' features, you can maintain productivity and collaboration no matter where your team is located.

Get more for Oh Estimated

- Creative professional exemption checklist form

- Executive exemption checklist form

- Factor evaluation system position evaluation summary form

- Administrative exemption checklist form

- Coates canons blog salaried employees and the flsa form

- Application to qualify for the foreign exemption employees must spend all form

- Administrative analysis grade evaluation guide opm form

- Learned professional exemption checklist form

Find out other Oh Estimated

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast