ESTIMATED PAYMENT Ohio Department of Taxation 2020

What is the estimated payment Ohio Department of Taxation?

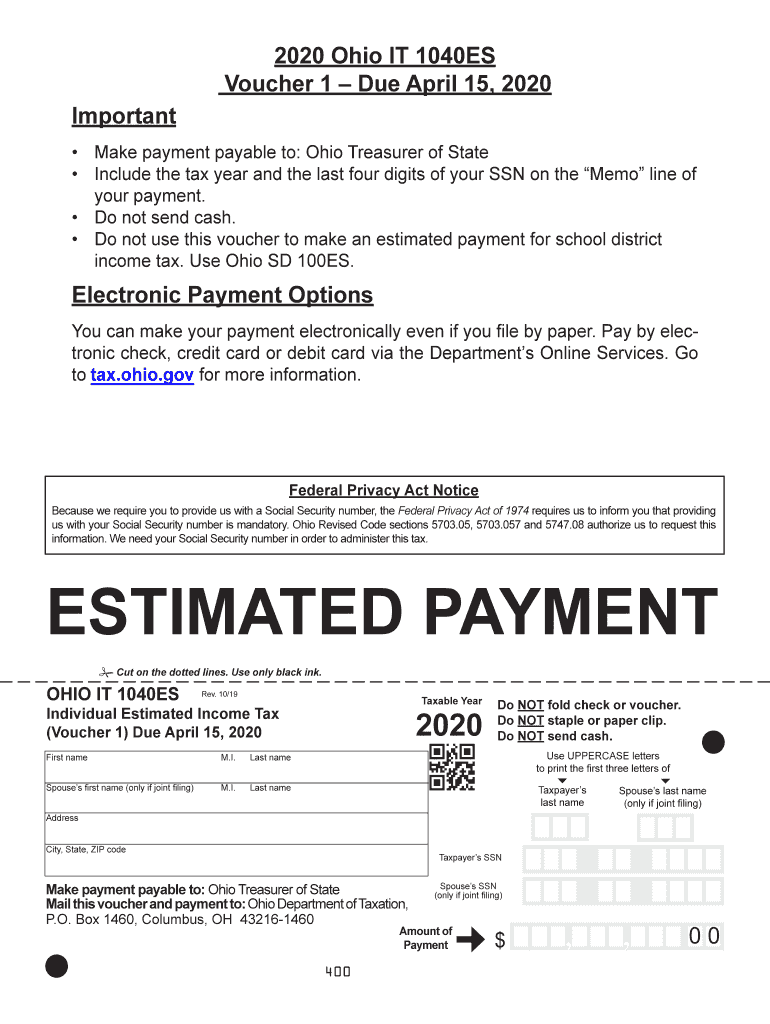

The estimated payment Ohio Department of Taxation refers to the advance payments made by taxpayers to cover their anticipated state income tax liability for the year. This process is crucial for individuals and businesses who expect to owe tax at the end of the year. By making these payments, taxpayers can avoid penalties and interest associated with underpayment of taxes. The Ohio estimated tax is typically required for those whose expected tax liability exceeds a certain threshold, ensuring that they remain compliant with state tax laws.

How to use the estimated payment Ohio Department of Taxation

Using the estimated payment Ohio Department of Taxation involves a few straightforward steps. First, calculate your expected income and deductions for the year to determine your tax liability. Next, divide this amount by the number of payment periods, which is usually four in Ohio. Payments can be made online through the Ohio Department of Taxation website, by mail, or in person at designated locations. It is essential to keep accurate records of these payments for your tax filings.

Steps to complete the estimated payment Ohio Department of Taxation

Completing the estimated payment Ohio Department of Taxation requires the following steps:

- Determine your expected annual income and deductions.

- Calculate your estimated tax liability using the current Ohio tax rates.

- Divide your estimated tax liability by the number of payment periods.

- Choose your payment method: online, by mail, or in person.

- Submit your payment by the due date to avoid penalties.

Filing deadlines / Important dates

Filing deadlines for estimated payments in Ohio are typically set for four quarterly periods. The due dates are usually April 15, June 15, September 15, and January 15 of the following year. It is crucial to adhere to these deadlines to avoid penalties for late payments. Taxpayers should also be aware of any changes in deadlines due to holidays or state-specific regulations.

Penalties for non-compliance

Failure to make the required estimated payments to the Ohio Department of Taxation can result in penalties and interest charges. If a taxpayer does not pay enough throughout the year, they may face an underpayment penalty, which is calculated based on the amount owed and the duration of the underpayment. It is essential to stay informed about your payment obligations to avoid these financial repercussions.

Eligibility criteria

Eligibility for making estimated payments in Ohio generally applies to individuals and businesses that expect to owe a certain amount of state income tax. Typically, if your expected tax liability exceeds $500 for individuals or $1,000 for businesses, you are required to make estimated payments. Additionally, those who have income from self-employment, rental properties, or other sources not subject to withholding must also consider making these payments.

Quick guide on how to complete estimated payment ohio department of taxation

Effortlessly Prepare ESTIMATED PAYMENT Ohio Department Of Taxation on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the tools needed to generate, alter, and electronically sign your documents promptly without delays. Manage ESTIMATED PAYMENT Ohio Department Of Taxation on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign ESTIMATED PAYMENT Ohio Department Of Taxation with Ease

- Obtain ESTIMATED PAYMENT Ohio Department Of Taxation and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or disorganized files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign ESTIMATED PAYMENT Ohio Department Of Taxation to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estimated payment ohio department of taxation

Create this form in 5 minutes!

How to create an eSignature for the estimated payment ohio department of taxation

How to create an eSignature for your Estimated Payment Ohio Department Of Taxation in the online mode

How to create an electronic signature for the Estimated Payment Ohio Department Of Taxation in Google Chrome

How to generate an eSignature for signing the Estimated Payment Ohio Department Of Taxation in Gmail

How to make an eSignature for the Estimated Payment Ohio Department Of Taxation from your mobile device

How to generate an electronic signature for the Estimated Payment Ohio Department Of Taxation on iOS devices

How to make an eSignature for the Estimated Payment Ohio Department Of Taxation on Android

People also ask

-

What is the oh estimated form and how can airSlate SignNow help?

The oh estimated form is a document that helps businesses estimate and report income, expenses, and tax obligations. With airSlate SignNow, you can easily create, send, and eSign your oh estimated form securely and efficiently, streamlining your workflow.

-

Is there a cost associated with using the airSlate SignNow for the oh estimated form?

Yes, airSlate SignNow offers various pricing plans to cater to your needs. Our plans are designed to be cost-effective while providing full access to features that simplify the process of managing your oh estimated form.

-

What features does airSlate SignNow provide for handling the oh estimated form?

AirSlate SignNow provides key features such as document templates, electronic signatures, and real-time tracking for your oh estimated form. These features help enhance collaboration and ensure your documents are processed quickly.

-

How does eSigning an oh estimated form with airSlate SignNow work?

With airSlate SignNow, eSigning an oh estimated form is straightforward. Simply upload your document, add the necessary signers, and send it out for signatures—all in a few clicks, ensuring a quick turnaround.

-

Can I integrate airSlate SignNow with other tools for my oh estimated form?

Absolutely! AirSlate SignNow integrates seamlessly with various tools such as CRM systems, cloud storage, and productivity apps. This allows you to effectively manage your oh estimated form alongside other business processes.

-

How secure is my oh estimated form when using airSlate SignNow?

Security is our top priority at airSlate SignNow. Your oh estimated form is protected with bank-level encryption and complies with international security standards, ensuring that your data remains safe and confidential.

-

Can airSlate SignNow help with tracking the status of my oh estimated form?

Yes! AirSlate SignNow provides real-time notifications and tracking features for your oh estimated form. You can easily see who has signed, who is pending, and the overall status of your documents at any time.

Get more for ESTIMATED PAYMENT Ohio Department Of Taxation

- Employment security tax forms ampamp publications alaska

- Sr 19c financial responsibility information request form

- Dl 127 route restricted drivers license application form

- Com search for medicalvision conditions for completion of form

- Da 1618 form

- Gov ptin 2017 2019 form 464471547

- An irs individual taxpayer identification number itin is for u form

- Form911 rev 5 2019 request for taxpayer advocate service assistance and application for taxpayer assistance order

Find out other ESTIMATED PAYMENT Ohio Department Of Taxation

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF