R 1048 121 Louisiana Department of Revenue 2022

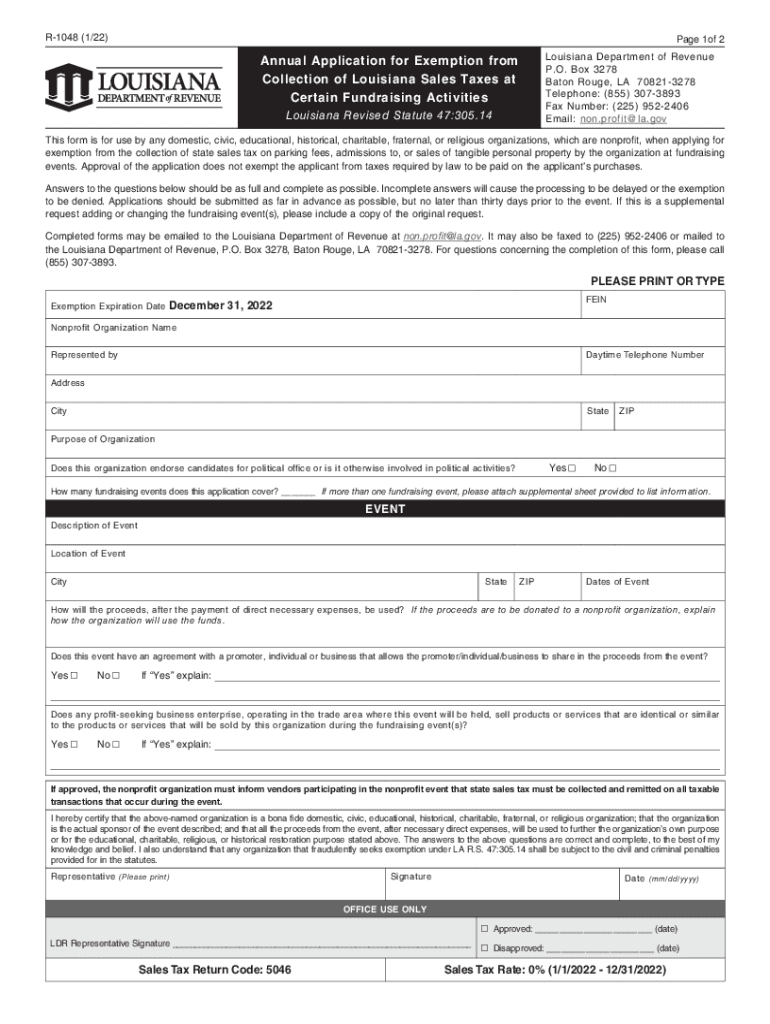

What is the R 1048 form?

The R 1048 form, also known as the Louisiana Application for Exemption, is a document issued by the Louisiana Department of Revenue. This form is used by certain organizations to apply for exemptions from state sales and use taxes. It is particularly relevant for non-profit entities and specific types of businesses that meet criteria set forth by the state. Understanding this form is essential for those seeking to operate within Louisiana’s tax regulations while maximizing their financial resources.

Steps to complete the R 1048 form

Completing the R 1048 form requires careful attention to detail. Here are the steps to follow:

- Gather required information: Collect necessary documents, including proof of your organization’s non-profit status or other qualifying criteria.

- Fill out the form: Provide accurate information in the designated fields, ensuring that all entries are clear and legible.

- Review your application: Double-check all information for accuracy, as errors can delay processing.

- Submit the form: Choose your submission method, whether online, by mail, or in person, based on your preference and convenience.

Eligibility Criteria for the R 1048 form

To qualify for the R 1048 form, applicants must meet specific eligibility requirements. Generally, the following criteria apply:

- Organizations must be classified as non-profit under IRS guidelines.

- Applicants must demonstrate that their activities align with the purposes outlined in Louisiana state law.

- Entities must provide documentation supporting their claims for exemption, such as articles of incorporation or bylaws.

Form Submission Methods

The R 1048 form can be submitted through various methods to accommodate different preferences:

- Online submission: Many applicants prefer this method for its convenience and speed. Ensure you have a reliable internet connection and follow the online instructions.

- Mail: If you choose to send the form by mail, ensure it is properly addressed to the Louisiana Department of Revenue and consider using certified mail for tracking.

- In-person: You may also submit the form directly at designated offices of the Louisiana Department of Revenue for immediate processing.

Key elements of the R 1048 form

The R 1048 form includes several key elements that applicants must complete for successful submission:

- Organization details: Name, address, and contact information of the applying entity.

- Type of exemption sought: Clearly indicate the specific exemption category applicable to your organization.

- Supporting documentation: Attach required documents that validate your eligibility for the exemption.

Legal use of the R 1048 form

The R 1048 form is legally binding once submitted and approved. It is essential for organizations to ensure compliance with all state regulations when using this form. Misrepresentation or failure to adhere to the guidelines can result in penalties or denial of the exemption. Therefore, applicants should maintain accurate records and ensure that their activities align with the claims made in the application.

Quick guide on how to complete r 1048 121 louisiana department of revenue

Complete R 1048 121 Louisiana Department Of Revenue effortlessly on any device

Digital document management has gained traction with both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and eSign your documents swiftly without interruptions. Manage R 1048 121 Louisiana Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign R 1048 121 Louisiana Department Of Revenue effortlessly

- Find R 1048 121 Louisiana Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Decide how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in several clicks from any device you choose. Modify and eSign R 1048 121 Louisiana Department Of Revenue while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 1048 121 louisiana department of revenue

Create this form in 5 minutes!

People also ask

-

What is the r 1048 and how can it benefit my business?

The r 1048 is a powerful document management tool that allows businesses to streamline their document workflow. With airSlate SignNow, the r 1048 enables seamless eSigning and document sharing, helping to improve efficiency and save time. By utilizing the r 1048, you can reduce paper usage and enhance collaboration within your team.

-

What features are included in the r 1048 plan?

The r 1048 plan includes essential features such as unlimited document templates, personalized branding options, and secure cloud storage. Additionally, the r 1048 allows for multiple user access, enabling your team to work together effortlessly. These features are designed to enhance your document management processes and improve overall productivity.

-

How much does the r 1048 plan cost?

The pricing for the r 1048 plan is competitive, making it a cost-effective solution for businesses of all sizes. For exact pricing details, visit our airSlate SignNow pricing page where you can explore various plans tailored to meet your needs. Choosing the r 1048 means getting great value without compromising on features.

-

Can I integrate the r 1048 with other software?

Absolutely! The r 1048 is designed to integrate seamlessly with a range of popular software applications. Whether you are using CRM systems like Salesforce or productivity tools like Google Workspace, integrating the r 1048 into your existing workflow is straightforward, making your document management even more efficient.

-

Is the r 1048 secure for my sensitive documents?

Yes, security is a top priority when it comes to the r 1048. airSlate SignNow implements industry-standard encryption and security measures to protect your sensitive information. With features like document access controls and audit trails, you can trust that your documents remain safe and compliant.

-

What types of documents can I handle with the r 1048?

With the r 1048, you can handle a wide range of documents, including contracts, agreements, and forms. The flexibility of the r 1048 allows you to create, send, and eSign any document type effortlessly. This versatility ensures that your business can manage all necessary documentation within a single platform.

-

How easy is it to use the r 1048 for new users?

The r 1048 is known for its user-friendly interface, designed to require minimal training for new users. With straightforward navigation and helpful tutorials available, you'll be able to start using the r 1048 quickly. This easiness enhances user adoption and ensures that your team can effectively manage document signing right away.

Get more for R 1048 121 Louisiana Department Of Revenue

- Js 44 civil cover sheet federal district court new york form

- Lead based paint disclosure new york form

- Lead based paint disclosure for rental transaction new york form

- New york lease form

- Sample cover letter for filing of llc articles or certificate with secretary of state new york form

- Supplemental residential lease forms package new york

- Landlord tenant form 497321722

- Name change instructions and forms package for an adult new york

Find out other R 1048 121 Louisiana Department Of Revenue

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free