Redoak Form

What is the Redoak

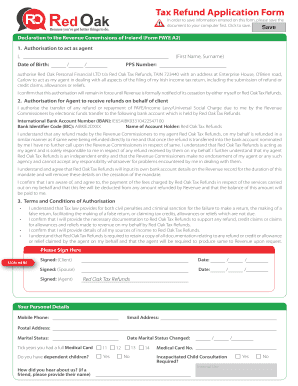

The Redoak is a specific tax form used in the United States to facilitate the process of claiming tax refunds. This form is designed to streamline the submission of necessary information to the IRS, ensuring that taxpayers can efficiently process their refunds. Understanding the Redoak is crucial for anyone looking to navigate their tax obligations and entitlements effectively.

How to use the Redoak

Using the Redoak involves several key steps. First, gather all necessary documentation, including income statements and previous tax returns. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, you can submit it electronically or via traditional mail, depending on your preference and the requirements of your tax situation. Utilizing an electronic signature solution can simplify the signing process, making it easier to finalize your submission.

Steps to complete the Redoak

Completing the Redoak requires careful attention to detail. Follow these steps:

- Collect all relevant tax documents, such as W-2s and 1099s.

- Fill out the Redoak form with accurate personal and financial information.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, ensuring compliance with eSignature laws.

- Submit the form either online or by mailing it to the appropriate IRS address.

IRS Guidelines

The IRS has established specific guidelines for the use of the Redoak. It is essential to adhere to these guidelines to ensure that your submission is accepted and processed without delays. This includes understanding eligibility criteria, filing deadlines, and any documentation required to support your claims. Familiarizing yourself with these guidelines can help prevent common mistakes that may lead to penalties or delays in receiving your tax refund.

Required Documents

When preparing to submit the Redoak, certain documents are necessary to support your claims. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Previous year’s tax return for reference

- Any relevant receipts or documentation that support deductions or credits claimed

Having these documents ready will streamline the process and help ensure that your Redoak is completed accurately.

Penalties for Non-Compliance

Failing to comply with IRS regulations regarding the Redoak can result in significant penalties. Common consequences include delayed refunds, fines, and potential audits. It is crucial to ensure that all information provided is accurate and submitted on time to avoid these issues. Understanding the implications of non-compliance can motivate taxpayers to take the necessary steps to file correctly and on schedule.

Quick guide on how to complete redoak

Complete Redoak effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Redoak on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most efficient way to modify and eSign Redoak with ease

- Find Redoak and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your PC.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Redoak and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the redoak

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a red oaks tax refund?

A red oaks tax refund refers to the returns that individuals or businesses may qualify for based on their financial activities in Red Oaks. It is essential to understand the eligibility criteria and documentation required to ensure you maximize your potential refund.

-

How does airSlate SignNow help with red oaks tax refund documentation?

AirSlate SignNow simplifies the process of preparing and sending the necessary documents for your red oaks tax refund. With its user-friendly eSignature functionality, you can quickly collect required signatures and ensure all paperwork is completed efficiently.

-

What are the pricing options for airSlate SignNow when filing for a red oaks tax refund?

AirSlate SignNow offers various pricing plans to accommodate different users' needs, starting with a free trial. Choosing the right plan can help you manage your documents effectively while pursuing your red oaks tax refund without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for processing my red oaks tax refund?

Yes, airSlate SignNow integrates seamlessly with multiple platforms like Google Drive and Dropbox. This allows users to streamline their documentation process and enhance their efficiency when preparing for their red oaks tax refund.

-

What are the benefits of using airSlate SignNow for red oaks tax refund submissions?

Using airSlate SignNow for your red oaks tax refund submissions comes with numerous benefits, including time savings and improved accuracy. The platform's intuitive interface enables users to handle their tax documentation with ease and confidence, reducing the risk of errors.

-

Is technical support available for airSlate SignNow users preparing for a red oaks tax refund?

Absolutely! airSlate SignNow provides dedicated technical support to assist users while preparing their red oaks tax refund filings. Whether you need help navigating the platform or have questions about document requirements, our support team is here to assist you.

-

Are the documents signed through airSlate SignNow valid for red oaks tax refund submissions?

Yes, documents signed through airSlate SignNow are legally binding and acceptable for red oaks tax refund submissions. The platform complies with eSignature regulations, ensuring that your filings are recognized by relevant authorities.

Get more for Redoak

Find out other Redoak

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document