Annual Application for Exemption from Collection of Louisiana Sales 2024

Overview of the Annual Application for Exemption from Collection of Louisiana Sales

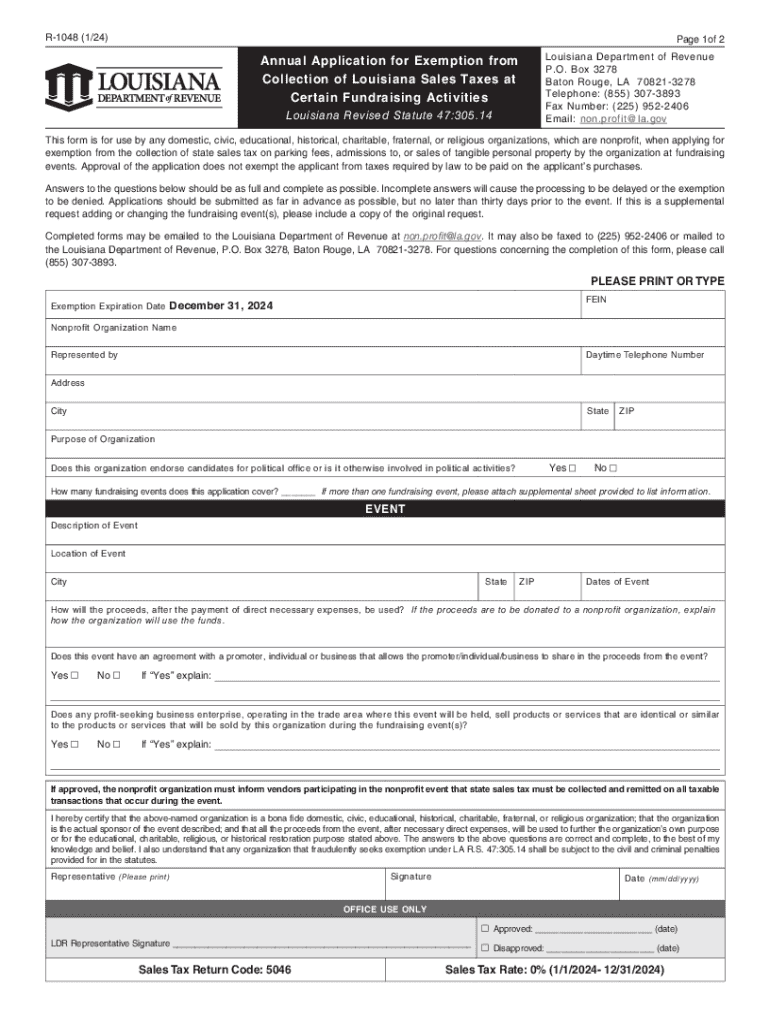

The Annual Application for Exemption from Collection of Louisiana Sales is a crucial document for businesses seeking to exempt certain sales from taxation. This form is primarily used by eligible entities to request an exemption from sales tax collection for specific purchases or transactions. Understanding the purpose and requirements of this form is essential for compliance and financial planning.

Steps to Complete the Annual Application for Exemption from Collection of Louisiana Sales

Completing the Annual Application involves several key steps:

- Gather necessary information, including business details and tax identification numbers.

- Clearly identify the types of purchases for which the exemption is being requested.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the application for any errors or omissions before submission.

- Submit the completed application by the specified deadline to the appropriate state authority.

Eligibility Criteria for the Annual Application for Exemption from Collection of Louisiana Sales

To qualify for the exemption, applicants must meet specific eligibility criteria. Generally, the following entities may apply:

- Non-profit organizations that meet state requirements.

- Government entities purchasing goods for official use.

- Businesses operating in specific industries that qualify for exemptions.

It is important to review the criteria carefully to ensure compliance and successful application.

Required Documents for the Annual Application for Exemption from Collection of Louisiana Sales

When submitting the Annual Application, applicants must provide certain documents to support their request. These may include:

- Proof of business registration and tax identification.

- Documentation demonstrating eligibility for the exemption.

- Any additional forms or information requested by the state authority.

Having these documents ready can streamline the application process and reduce delays.

Form Submission Methods for the Annual Application for Exemption from Collection of Louisiana Sales

The Annual Application can be submitted through various methods, including:

- Online submission via the state’s tax portal.

- Mailing a physical copy of the application to the designated office.

- In-person submission at local tax offices for immediate processing.

Choosing the appropriate submission method can affect the processing time and ease of tracking the application status.

Key Elements of the Annual Application for Exemption from Collection of Louisiana Sales

Understanding the key elements of the application is vital for successful completion. The form typically includes:

- Business name and contact information.

- Tax identification number and relevant business licenses.

- Detailed descriptions of the goods or services for which exemptions are sought.

Each section must be filled out with accurate information to avoid complications during the review process.

Create this form in 5 minutes or less

Find and fill out the correct annual application for exemption from collection of louisiana sales

Create this form in 5 minutes!

How to create an eSignature for the annual application for exemption from collection of louisiana sales

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the r 1048 Louisiana 2024 form and why is it important?

The r 1048 Louisiana 2024 form is a crucial document for businesses operating in Louisiana, as it outlines specific tax obligations. Understanding this form is essential for compliance and avoiding penalties. airSlate SignNow can help streamline the process of filling out and submitting the r 1048 Louisiana 2024 form efficiently.

-

How can airSlate SignNow assist with the r 1048 Louisiana 2024 form?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the r 1048 Louisiana 2024 form. With its intuitive interface, users can quickly complete the form and ensure all necessary information is included. This saves time and reduces the risk of errors in submission.

-

What are the pricing options for using airSlate SignNow for the r 1048 Louisiana 2024?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those needing to manage the r 1048 Louisiana 2024 form. Plans are designed to be cost-effective, ensuring that businesses can access essential features without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the r 1048 Louisiana 2024?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing the r 1048 Louisiana 2024 form. These features enhance efficiency and ensure that your documents are handled securely. Additionally, users can track the status of their documents in real-time.

-

Can airSlate SignNow integrate with other software for the r 1048 Louisiana 2024 process?

Yes, airSlate SignNow offers integrations with various software solutions, making it easier to manage the r 1048 Louisiana 2024 form alongside your existing tools. This seamless integration helps streamline workflows and enhances productivity. You can connect with popular applications to ensure a smooth process.

-

What are the benefits of using airSlate SignNow for the r 1048 Louisiana 2024?

Using airSlate SignNow for the r 1048 Louisiana 2024 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, allowing for faster approvals and submissions. This ultimately helps businesses stay compliant and focused on their core operations.

-

Is airSlate SignNow user-friendly for completing the r 1048 Louisiana 2024?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the r 1048 Louisiana 2024 form. The platform features a straightforward interface that guides users through the process, ensuring that even those with minimal technical skills can navigate it effectively.

Get more for Annual Application For Exemption From Collection Of Louisiana Sales

Find out other Annual Application For Exemption From Collection Of Louisiana Sales

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online