CCA Division of Taxation 2021

What is the CCA Division of Taxation?

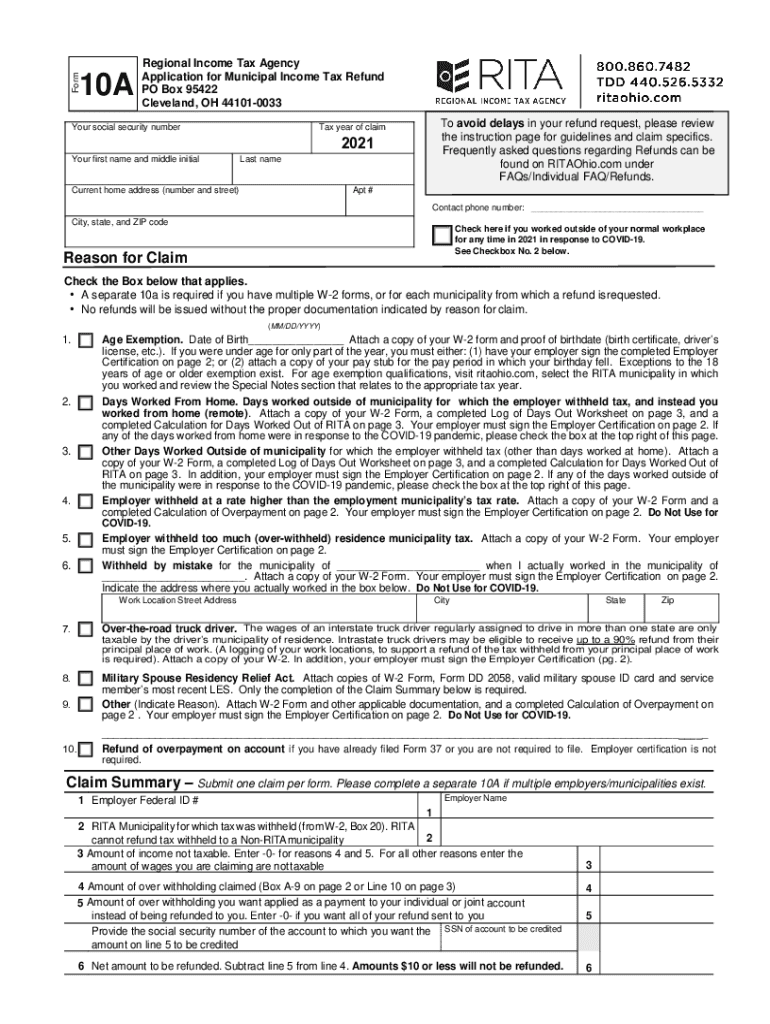

The CCA Division of Taxation, also known as the Ohio Department of Taxation, is responsible for administering various tax laws in the state of Ohio. This division oversees the collection of state taxes, the processing of tax returns, and the issuance of refunds. It plays a crucial role in ensuring compliance with tax regulations and providing support to taxpayers in understanding their obligations. The division also offers resources and guidance related to forms like the Ohio Rita Form 10A, which is essential for residents and businesses in managing their tax affairs.

Steps to Complete the CCA Division of Taxation

Completing the Ohio Rita Form 10A involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including personal identification details and income records. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission. Once the form is completed, you can submit it electronically or via mail, depending on your preference. Keeping a copy of the submitted form for your records is advisable, as it may be needed for future reference.

Legal Use of the CCA Division of Taxation

The legal use of the CCA Division of Taxation, particularly concerning the Ohio Rita Form 10A, is governed by state tax laws. This form is used to report income and calculate tax liabilities accurately. To ensure that your submission is legally valid, it is essential to comply with all relevant regulations and guidelines set forth by the division. Utilizing electronic signature tools that meet legal standards can also enhance the legitimacy of your submission, providing an additional layer of security and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Rita Form 10A are critical for compliance with state tax laws. Typically, the form must be submitted by a specific date each year, often aligning with the federal tax filing deadline. It is essential to stay informed about any changes to these dates, as missing a deadline can result in penalties or interest charges. Taxpayers should mark these important dates on their calendars and ensure that all required documentation is prepared well in advance to avoid last-minute issues.

Required Documents

When completing the Ohio Rita Form 10A, certain documents are required to support your submission. These may include proof of income, such as W-2 forms or 1099 statements, as well as any relevant deductions or credits you plan to claim. Having these documents ready will help streamline the completion process and ensure that your form is accurate. It is advisable to keep copies of all submitted documents for your records, as they may be requested by the CCA Division of Taxation during audits or reviews.

Form Submission Methods

The Ohio Rita Form 10A can be submitted through various methods, offering flexibility for taxpayers. You may choose to file the form online, which is often the quickest and most efficient option. Alternatively, you can submit a paper version of the form via mail. Each submission method has its own set of guidelines, so it is important to follow the instructions provided by the CCA Division of Taxation to ensure that your form is processed correctly and in a timely manner.

Quick guide on how to complete cca division of taxation

Effortlessly Prepare CCA Division Of Taxation on Any Device

Digital document management has become widely accepted by businesses and individuals alike. It offers an ideal environmentally friendly solution to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage CCA Division Of Taxation on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign CCA Division Of Taxation with Ease

- Locate CCA Division Of Taxation and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign CCA Division Of Taxation and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cca division of taxation

Create this form in 5 minutes!

People also ask

-

What is the Ohio RITA Form 10A?

The Ohio RITA Form 10A is a tax form used by businesses to report income and calculate municipal income tax obligations. It is essential for businesses operating in different municipalities within Ohio. Using airSlate SignNow simplifies the process of completing and submitting the Ohio RITA Form 10A electronically.

-

How does airSlate SignNow help with the Ohio RITA Form 10A?

airSlate SignNow streamlines the completion and signing of the Ohio RITA Form 10A by providing an intuitive platform for document management. Users can easily upload, edit, and eSign their forms, ensuring compliance with tax regulations. This saves time and minimizes errors associated with traditional paper filing.

-

Is there a cost associated with using airSlate SignNow for the Ohio RITA Form 10A?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including features specifically designed for handling forms like the Ohio RITA Form 10A. You can choose from monthly or annual subscriptions, making it a cost-effective solution for businesses of any size. Check the pricing page for specific details.

-

What are the key features of airSlate SignNow for handling the Ohio RITA Form 10A?

Key features of airSlate SignNow include eSignature capabilities, customizable templates, secure document storage, and real-time tracking. These features make it easier to manage the Ohio RITA Form 10A and ensure that all signers have completed their parts promptly. The platform also allows for seamless integration with other tools your business may use.

-

Can I integrate airSlate SignNow with other applications for handling the Ohio RITA Form 10A?

Absolutely! airSlate SignNow offers integrations with a variety of popular business applications such as Salesforce, Google Drive, and Microsoft Office. This feature allows you to streamline your workflow, making it easier to access and manage the Ohio RITA Form 10A alongside other documents and tools you use daily.

-

What benefits can I expect from using airSlate SignNow for the Ohio RITA Form 10A?

Using airSlate SignNow for the Ohio RITA Form 10A provides numerous benefits, including enhanced efficiency, reduced turnaround times, and improved accuracy when completing the form. Additionally, the secure eSignature feature ensures that your submissions are legally binding and compliant with Ohio regulations.

-

Is airSlate SignNow secure for submitting the Ohio RITA Form 10A?

Yes, security is a top priority at airSlate SignNow. The platform employs advanced encryption protocols to protect your documents, including the Ohio RITA Form 10A. You can confidently submit your forms knowing that your sensitive information is safeguarded against unauthorized access.

Get more for CCA Division Of Taxation

- Quitclaim deed from husband and wife to three individuals as joint tenants with the right of survivorship new york form

- New york form 497321913

- New york warranty 497321914 form

- Condominium deed from individual to husband and wife as joint tenants new york form

- New york form 497321916

- Warranty deed for husband and wife to three individuals as tenants in common new york form

- Warranty deed from individual to husband and wife as joint tenants new york form

- New york form 497321919

Find out other CCA Division Of Taxation

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice