Important Changes to the Tax Year Form 10A 2020

Key elements of the Important Changes To The Tax Year Form 10A

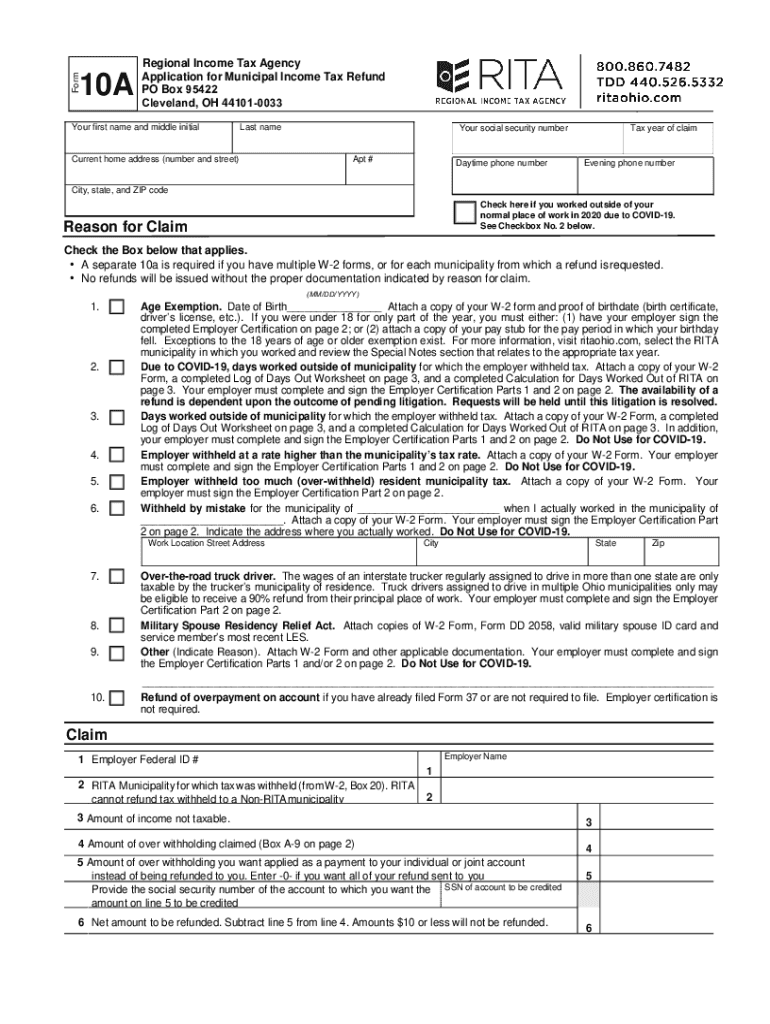

The Important Changes To The Tax Year Form 10A includes several key elements that taxpayers should be aware of to ensure accurate filing. These elements typically encompass changes in tax rates, deductions, and credits that may affect the overall tax liability. It's crucial to review any revisions to eligibility criteria for specific deductions, as well as updates regarding income thresholds that may influence tax calculations. Understanding these key components can help taxpayers maximize their refunds and minimize liabilities.

Steps to complete the Important Changes To The Tax Year Form 10A

Completing the Important Changes To The Tax Year Form 10A involves a series of straightforward steps. First, gather all necessary documents, such as W-2s, 1099s, and any other income statements. Next, review the latest instructions for the form to familiarize yourself with any updates. Fill out the form carefully, ensuring all information is accurate and complete. After completing the form, double-check for any errors before submitting. Finally, choose your preferred submission method, whether online or by mail, to ensure timely processing.

Filing Deadlines / Important Dates

Awareness of filing deadlines and important dates is essential for timely submission of the Important Changes To The Tax Year Form 10A. Generally, the tax filing deadline for individuals is April 15, unless it falls on a weekend or holiday, in which case it may be extended. Additionally, taxpayers should be mindful of any extensions that may be applicable. Keeping track of these deadlines helps avoid penalties and ensures that any potential refunds are processed without delay.

Eligibility Criteria

Eligibility criteria for the Important Changes To The Tax Year Form 10A can vary based on several factors, including income level, filing status, and residency. Taxpayers must meet specific income thresholds to qualify for certain deductions or credits. It's important to review the eligibility requirements outlined in the form instructions to determine if you qualify. Understanding these criteria can help taxpayers accurately assess their tax situation and ensure compliance with regulations.

Legal use of the Important Changes To The Tax Year Form 10A

The Important Changes To The Tax Year Form 10A is legally recognized as a valid document for tax purposes when completed and submitted according to the established guidelines. To ensure its legal standing, taxpayers must adhere to the requirements set forth by the IRS, including proper signatures and dates. Utilizing a compliant eSignature solution can further enhance the form's validity when submitting electronically. Understanding the legal implications of the form helps taxpayers navigate their responsibilities effectively.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Important Changes To The Tax Year Form 10A. The most convenient method is online submission, which allows for quicker processing and confirmation of receipt. Alternatively, forms can be mailed to the appropriate IRS address, ensuring that they are postmarked by the filing deadline. In-person submission may also be available at designated IRS offices, providing an option for those who prefer direct interaction. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete important changes to the tax year 2020 form 10a

Complete Important Changes To The Tax Year Form 10A effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Important Changes To The Tax Year Form 10A on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to alter and eSign Important Changes To The Tax Year Form 10A with ease

- Find Important Changes To The Tax Year Form 10A and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Select important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to send your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Important Changes To The Tax Year Form 10A and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct important changes to the tax year 2020 form 10a

Create this form in 5 minutes!

How to create an eSignature for the important changes to the tax year 2020 form 10a

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is Rita 10a online and how does it work?

Rita 10a online refers to a digital signature service that allows users to easily sign documents electronically. With airSlate SignNow, you can upload your documents, add signatures, and send them securely, all in one platform. This solution streamlines the signing process, making it faster and more efficient for businesses.

-

What are the main features of Rita 10a online?

Rita 10a online offers a variety of features including customizable templates, multi-user access, and real-time tracking of document status. These functionalities are designed to enhance productivity and ensure that your signing process is both efficient and secure. With airSlate SignNow, you can also integrate your existing workflows for a seamless experience.

-

How much does Rita 10a online cost?

The pricing for Rita 10a online varies based on the plan you choose. airSlate SignNow offers flexible pricing tiers, catering to businesses of all sizes. You can easily select a plan that fits your budget while ensuring you get the necessary features for your document signing needs.

-

Is Rita 10a online secure for my documents?

Yes, Rita 10a online is designed with security in mind. airSlate SignNow uses advanced encryption technologies to protect your documents during transmission and storage. This ensures that your sensitive information remains confidential and secure while using our electronic signature service.

-

Can I integrate Rita 10a online with other tools?

Absolutely! Rita 10a online can seamlessly integrate with a variety of third-party applications, enhancing your workflow. airSlate SignNow allows connectivity with tools like Google Drive, Dropbox, and CRM systems, enabling you to manage your documents more efficiently.

-

Who can benefit from using Rita 10a online?

Rita 10a online is beneficial for businesses of all sizes, from startups to large enterprises. Organizations looking to streamline their document management processes can leverage airSlate SignNow to reduce turnaround time for contracts, agreements, and other important documents.

-

Is there a free trial available for Rita 10a online?

Yes, airSlate SignNow offers a free trial for Rita 10a online so you can explore its features before committing to a paid plan. This gives potential users the opportunity to test drive the platform and understand how it can meet their electronic signing needs.

Get more for Important Changes To The Tax Year Form 10A

Find out other Important Changes To The Tax Year Form 10A

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document