APPLICATION for REFUND Cleveland 2024-2026

Understanding the RITA Form 10A

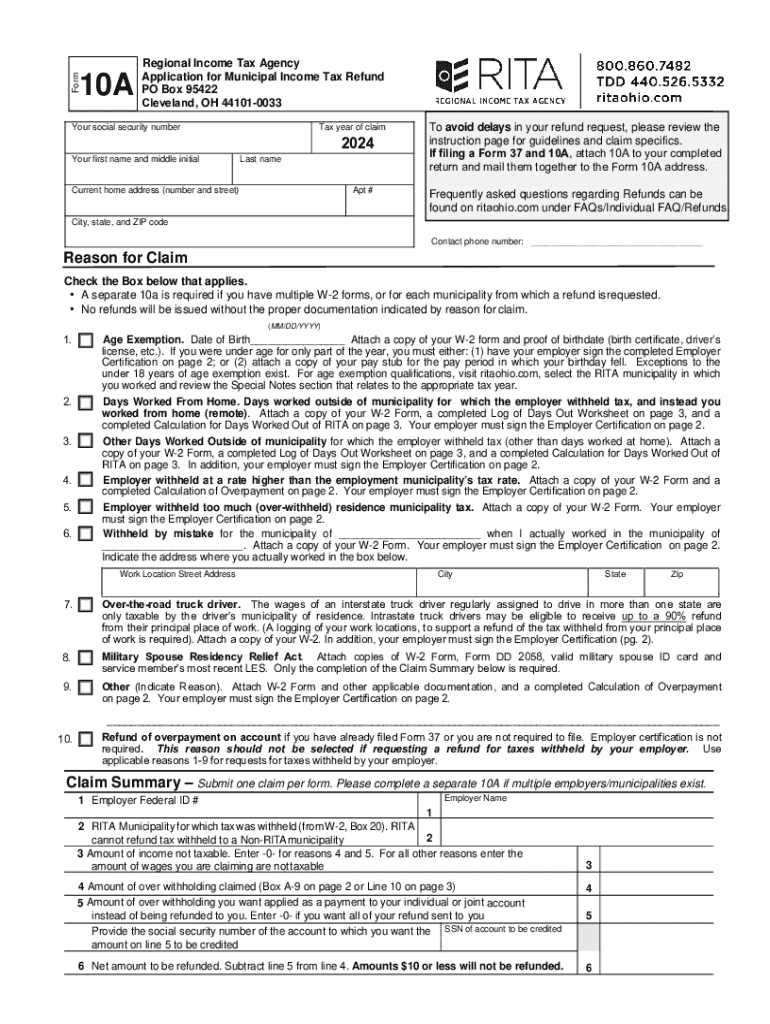

The RITA Form 10A, also known as the Application for Refund, is a crucial document for individuals who have overpaid their municipal income taxes in Cleveland, Ohio. This form allows taxpayers to request a refund for excess payments made during the tax year. It is essential to understand the specific criteria and eligibility requirements to ensure a successful refund application.

Steps to Complete the RITA Form 10A

Completing the RITA Form 10A involves several key steps:

- Gather necessary information, including your Social Security number, tax identification number, and details of your income.

- Ensure you have documentation of your overpayment, such as W-2 forms or other tax documents.

- Fill out the form accurately, providing all required information, including your contact details and the reason for the refund request.

- Review the completed form for any errors or omissions before submission.

Required Documents for RITA Form 10A

When submitting the RITA Form 10A, certain documents are necessary to support your application:

- Proof of income, such as W-2s or 1099 forms.

- Documentation of municipal tax payments made during the year.

- A copy of the completed RITA Form 10A itself.

Form Submission Methods for RITA Form 10A

Taxpayers have multiple options for submitting the RITA Form 10A:

- Online Submission: Many taxpayers prefer to submit their forms electronically through the RITA online portal.

- Mail Submission: Completed forms can be mailed to the appropriate RITA office, ensuring they are postmarked by the filing deadline.

- In-Person Submission: Taxpayers may also choose to submit their forms in person at designated RITA locations.

Eligibility Criteria for RITA Form 10A

To qualify for a refund using the RITA Form 10A, taxpayers must meet specific eligibility criteria:

- Must be a resident of a municipality that participates in the RITA program.

- Must have overpaid municipal income taxes during the tax year in question.

- Must file the form within the designated time frame, typically within three years from the date of the overpayment.

Application Process and Approval Time for RITA Form 10A

The application process for the RITA Form 10A is straightforward but may take some time:

- After submission, RITA will review the application and supporting documents.

- Approval times can vary but typically range from four to six weeks, depending on the volume of applications received.

- Taxpayers may receive communication regarding the status of their application during this period.

Create this form in 5 minutes or less

Find and fill out the correct application for refund cleveland

Create this form in 5 minutes!

How to create an eSignature for the application for refund cleveland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rita form 10a and how can airSlate SignNow help?

The rita form 10a is a specific document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign the rita form 10a, streamlining your workflow and ensuring compliance with all necessary regulations.

-

How much does it cost to use airSlate SignNow for the rita form 10a?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage the rita form 10a efficiently.

-

What features does airSlate SignNow offer for managing the rita form 10a?

airSlate SignNow provides a range of features for the rita form 10a, including customizable templates, secure eSigning, and real-time tracking. These features help you manage your documents effectively and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for the rita form 10a?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage the rita form 10a alongside your existing tools. This integration capability enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the rita form 10a?

Using airSlate SignNow for the rita form 10a provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. These advantages help businesses save time and resources while ensuring compliance.

-

Is airSlate SignNow user-friendly for completing the rita form 10a?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the rita form 10a. The intuitive interface allows users to navigate the platform effortlessly, even without prior experience.

-

How secure is airSlate SignNow when handling the rita form 10a?

Security is a top priority for airSlate SignNow. When handling the rita form 10a, your documents are protected with advanced encryption and secure storage, ensuring that sensitive information remains confidential and safe from unauthorized access.

Get more for APPLICATION FOR REFUND Cleveland

- Brief medication questionnaire pdf form

- Medrad checklist competencies form

- College of the mainland transcript 30065774 form

- Tracing music notes pdf form

- Nys discharge certificate form

- Salary certificate in arabic word format

- Stallion breeder report form fillable twhbea mares bred reported by stallion

- Impressed current cathodic protection system 60day inspection log for year ust owners and operators must inspect impressed form

Find out other APPLICATION FOR REFUND Cleveland

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors