Transmittal of Wage and Tax Statements OHIO it 3Transmittal of Wage and Tax Statements OHIO it 3Fill Ohio it 3 Transmittal of W 2021

What is the Transmittal Of Wage And Tax Statements Ohio IT-3?

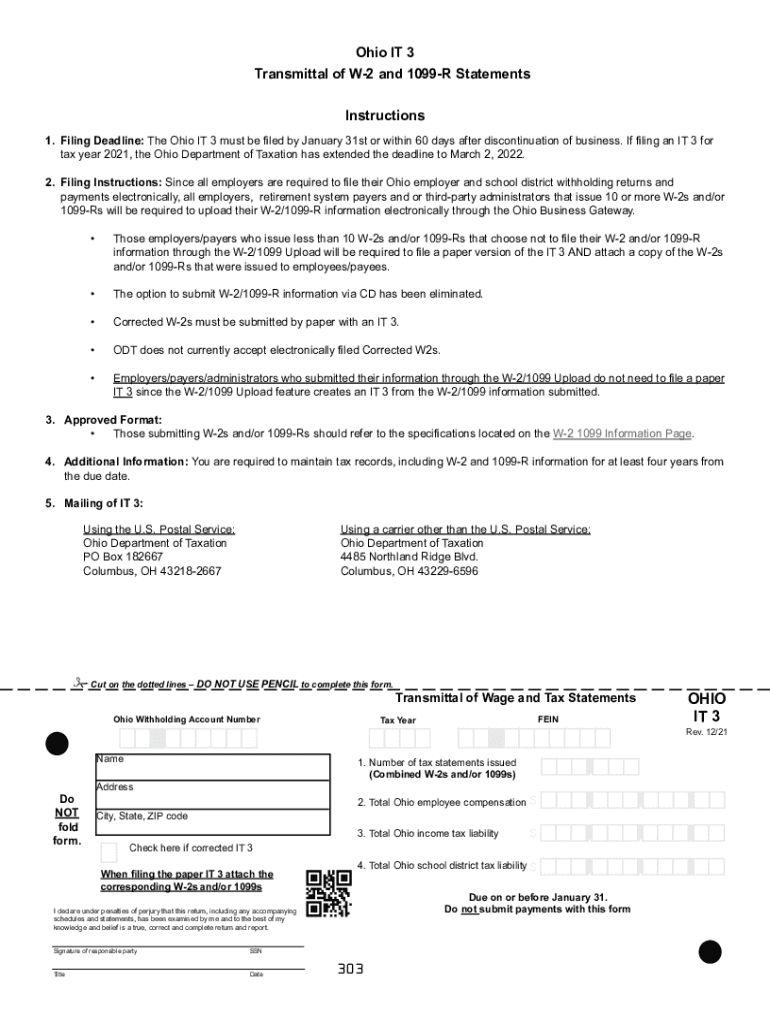

The Transmittal of Wage and Tax Statements Ohio IT-3 is a crucial document for employers in Ohio. It serves as a summary of the W-2 forms that employers issue to their employees. This form is essential for reporting wages, tips, and other compensation, as well as the taxes withheld from those earnings. It consolidates the information from all W-2s issued by an employer during the tax year and is submitted to the Ohio Department of Taxation. Understanding its purpose helps ensure compliance with state tax regulations.

Steps to Complete the Transmittal Of Wage And Tax Statements Ohio IT-3

Completing the Ohio IT-3 involves several key steps that employers should follow to ensure accuracy and compliance:

- Gather all W-2 forms issued to employees for the tax year.

- Fill out the IT-3 form, ensuring that all required fields are completed, including employer information and total wages reported.

- Double-check the accuracy of the information, particularly the totals and employee identification numbers.

- Submit the completed form to the Ohio Department of Taxation by the designated deadline.

Legal Use of the Transmittal Of Wage And Tax Statements Ohio IT-3

The Ohio IT-3 is legally binding when completed correctly and submitted on time. It must comply with the state’s tax regulations, which dictate how employers report wages and taxes withheld. Failure to submit the IT-3 can lead to penalties, including fines and interest on unpaid taxes. Employers should ensure that they maintain accurate records and submit the form in accordance with Ohio law to avoid potential legal issues.

Filing Deadlines for the Transmittal Of Wage And Tax Statements Ohio IT-3

Employers must adhere to specific filing deadlines when submitting the Ohio IT-3. Typically, the form is due by the end of January following the tax year in which the W-2 forms were issued. This deadline ensures that the state receives timely information for tax processing. Employers should mark their calendars and prepare their documentation in advance to meet this important timeline.

Required Documents for Filing the Ohio IT-3

To complete the Transmittal of Wage and Tax Statements Ohio IT-3, employers must have the following documents:

- All W-2 forms issued to employees for the reporting year.

- Employer identification number (EIN) for accurate reporting.

- Any relevant payroll records that support the figures reported on the W-2 forms.

State-Specific Rules for the Transmittal Of Wage And Tax Statements Ohio IT-3

Ohio has specific rules regarding the completion and submission of the IT-3. Employers must ensure that they follow these regulations, which may include electronic filing requirements for larger employers or specific formatting guidelines. Being aware of these state-specific rules helps employers avoid mistakes that could lead to penalties or delays in processing.

Quick guide on how to complete transmittal of wage and tax statements ohio it 3transmittal of wage and tax statements ohio it 3fill ohio it 3 transmittal of w

Effortlessly Prepare Transmittal Of Wage And Tax Statements OHIO IT 3Transmittal Of Wage And Tax Statements OHIO IT 3Fill Ohio IT 3 Transmittal Of W on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally-friendly substitute for conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your documents quickly without any holdups. Manage Transmittal Of Wage And Tax Statements OHIO IT 3Transmittal Of Wage And Tax Statements OHIO IT 3Fill Ohio IT 3 Transmittal Of W on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Optimal Method to Modify and eSign Transmittal Of Wage And Tax Statements OHIO IT 3Transmittal Of Wage And Tax Statements OHIO IT 3Fill Ohio IT 3 Transmittal Of W with Ease

- Obtain Transmittal Of Wage And Tax Statements OHIO IT 3Transmittal Of Wage And Tax Statements OHIO IT 3Fill Ohio IT 3 Transmittal Of W and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you choose. Modify and eSign Transmittal Of Wage And Tax Statements OHIO IT 3Transmittal Of Wage And Tax Statements OHIO IT 3Fill Ohio IT 3 Transmittal Of W and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct transmittal of wage and tax statements ohio it 3transmittal of wage and tax statements ohio it 3fill ohio it 3 transmittal of w

Create this form in 5 minutes!

People also ask

-

What is the Transmittal Of Wage And Tax Statements OHIO IT 3?

The Transmittal Of Wage And Tax Statements OHIO IT 3 is a critical form used by businesses in Ohio to report W-2 and 1099 information. This document consolidates employee wage details and tax data for proper state reporting. Understanding and completing the Ohio IT 3 is essential for compliance with state tax regulations.

-

How can airSlate SignNow assist with completing the Transmittal Of Wage And Tax Statements OHIO IT 3?

airSlate SignNow provides a seamless solution for filling out the Transmittal Of Wage And Tax Statements OHIO IT 3. With its user-friendly interface, businesses can easily input necessary information and ensure that all forms are completed accurately. This reduces errors and saves time, making it ideal for efficient reporting.

-

What are the benefits of using airSlate SignNow for Ohio IT 3 Filing?

Using airSlate SignNow for Ohio IT 3 Filing streamlines the process, enhancing compliance and reducing paperwork. The platform enables electronic signatures and secure document management, ensuring that all submissions meet state requirements efficiently. Additionally, it provides a cost-effective solution for businesses of all sizes.

-

Are there any integrations available for the airSlate SignNow platform?

Yes, airSlate SignNow offers various integrations with popular accounting and payroll software, enhancing its functionality. This allows users to easily sync employee data and streamline the process of completing the Transmittal Of Wage And Tax Statements OHIO IT 3. Integrating with your existing tools can signNowly improve workflow efficiency.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit the needs of different businesses, from small startups to large enterprises. Each plan includes access to essential features for completing the Transmittal Of Wage And Tax Statements OHIO IT 3 efficiently. You can select the plan that best aligns with your document management and eSignature requirements.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents through advanced encryption and GDPR-compliance measures. When dealing with sensitive information like the Transmittal Of Wage And Tax Statements OHIO IT 3, you can trust that your data is protected. Regular security assessments and updates further safeguard your information.

-

Can airSlate SignNow help with specific reporting requirements like Ohio 1099 Reporting Requirements?

Absolutely, airSlate SignNow supports various filing requirements, including Ohio 1099 Reporting Requirements. The platform provides templates and guidance for accurate document preparation, ensuring that you comply with state regulations. This comprehensive approach simplifies the entire filing process, making it easier for businesses.

Get more for Transmittal Of Wage And Tax Statements OHIO IT 3Transmittal Of Wage And Tax Statements OHIO IT 3Fill Ohio IT 3 Transmittal Of W

- Legal last will and testament form for widow or widower with minor children new york

- Form widower 497322042

- Ny last will testament form

- Legal last will and testament form for divorced and remarried person with mine yours and ours children new york

- Last will testament 497322045 form

- Written revocation of will new york form

- Ny testament form

- Notice to beneficiaries of being named in will new york form

Find out other Transmittal Of Wage And Tax Statements OHIO IT 3Transmittal Of Wage And Tax Statements OHIO IT 3Fill Ohio IT 3 Transmittal Of W

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast