Ohio it 3 Transmittal of W 2 Statements Instructions Fill Io 2022-2026

What is the Ohio IT 3 Transmittal of W-2 Statements?

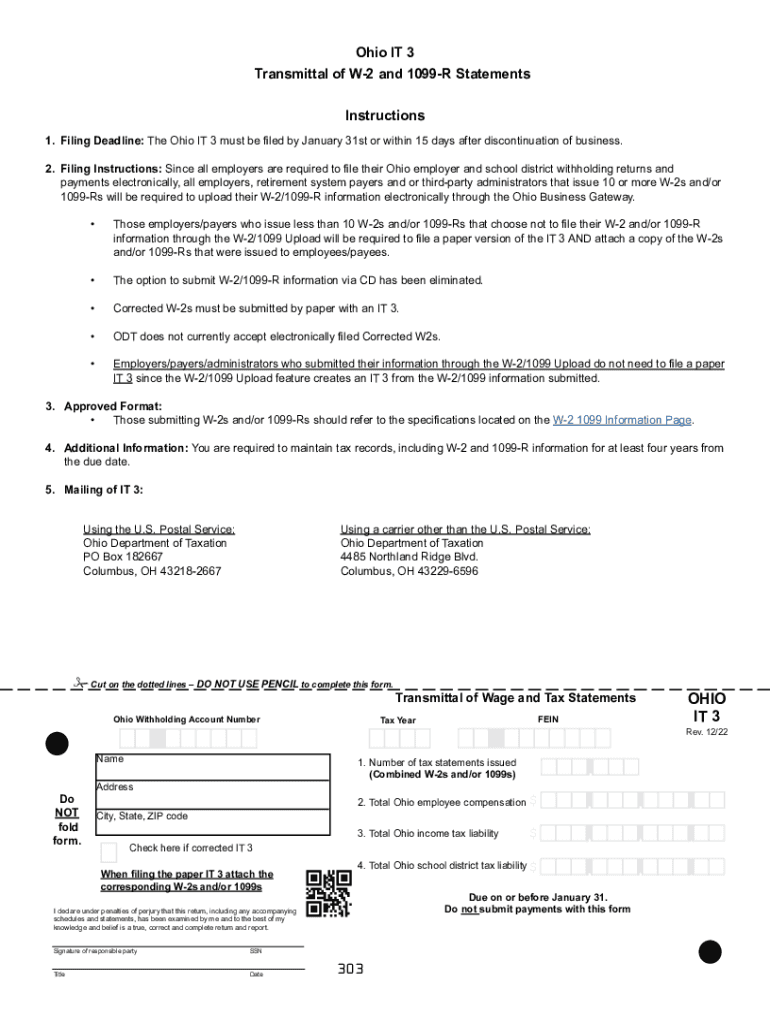

The Ohio IT 3 form is a crucial document used for reporting W-2 statements to the Ohio Department of Taxation. Employers are required to submit this form to transmit employee wage and tax information accurately. It serves as a summary of the W-2 forms issued to employees, detailing the total wages paid and the taxes withheld for state income tax purposes. Understanding the purpose of the Ohio IT 3 is essential for compliance with state tax regulations and ensuring that employees' tax information is reported correctly.

Steps to Complete the Ohio IT 3 Transmittal of W-2 Statements

Completing the Ohio IT 3 form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather all W-2 forms issued to employees for the tax year.

- Fill in the employer's information, including name, address, and federal employer identification number (FEIN).

- Enter the total number of W-2 forms being submitted.

- Summarize the total wages and taxes withheld as reported on the W-2 forms.

- Review the completed form for accuracy before submission.

Ensure that all information is accurate to avoid penalties and ensure proper processing by the Ohio Department of Taxation.

Filing Deadlines for the Ohio IT 3 Form

It is important to be aware of the filing deadlines for the Ohio IT 3 form to avoid penalties. Employers must submit the form by the last day of January following the tax year in which the W-2 forms were issued. For example, for W-2s issued in 2023, the Ohio IT 3 must be filed by January 31, 2024. Timely submission ensures compliance with state regulations and helps maintain good standing with the Ohio Department of Taxation.

Required Documents for Filing the Ohio IT 3 Form

When preparing to file the Ohio IT 3 form, employers should have the following documents ready:

- All W-2 forms issued to employees for the tax year.

- Employer's federal employer identification number (FEIN).

- Records of wages paid and taxes withheld for each employee.

- Any previous year’s Ohio IT 3 forms for reference, if necessary.

Having these documents organized will streamline the process of completing and filing the Ohio IT 3 form.

Legal Use of the Ohio IT 3 Transmittal of W-2 Statements

The Ohio IT 3 form must be completed and filed in accordance with state tax laws. It is legally binding and serves as an official record of wage and tax reporting for employees. Employers are responsible for ensuring that the information reported is accurate and complete. Filing the form incorrectly or failing to file it can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of the Ohio IT 3 is essential for employers.

Who Issues the Ohio IT 3 Form?

The Ohio IT 3 form is issued by the Ohio Department of Taxation. Employers must use the official form provided by the state to ensure compliance with tax regulations. The department updates the form periodically, so it is important for employers to use the most current version when filing. This ensures that all required information is captured accurately and meets the state’s reporting standards.

Quick guide on how to complete ohio it 3 transmittal of w 2 statements instructions fillio

Effortlessly Prepare Ohio IT 3 Transmittal Of W 2 Statements Instructions Fill io on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without complications. Handle Ohio IT 3 Transmittal Of W 2 Statements Instructions Fill io on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to Modify and Electronically Sign Ohio IT 3 Transmittal Of W 2 Statements Instructions Fill io with Ease

- Obtain Ohio IT 3 Transmittal Of W 2 Statements Instructions Fill io and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ohio IT 3 Transmittal Of W 2 Statements Instructions Fill io and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio it 3 transmittal of w 2 statements instructions fillio

Create this form in 5 minutes!

How to create an eSignature for the ohio it 3 transmittal of w 2 statements instructions fillio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help my business in Ohio?

airSlate SignNow is a powerful eSigning solution that allows businesses in Ohio to send and sign documents quickly and securely. It streamlines the signing process, making it easy for teams to manage agreements without the hassle of printing and scanning. With airSlate SignNow, Ohio businesses can improve their efficiency and reduce operational costs.

-

What pricing plans are available for airSlate SignNow for businesses in Ohio?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in Ohio. Whether you're a small startup or a large enterprise, there is a plan designed to fit your budget. All pricing plans provide access to essential features, ensuring that you get the best value for your investment.

-

What key features does airSlate SignNow provide for Ohio users?

Ohio users of airSlate SignNow can benefit from a variety of key features, including customizable templates, real-time tracking, and secure cloud storage. These features help streamline document management while ensuring compliance with legal standards. Moreover, airSlate SignNow’s user-friendly interface makes it easy to navigate and utilize all functionalities effectively.

-

How can airSlate SignNow benefit businesses in Ohio?

For businesses in Ohio, airSlate SignNow enhances productivity by automating the document signing process. This results in quicker turnaround times and improved customer satisfaction. Additionally, the platform’s eSigning capability eliminates paper waste, contributing to a more eco-friendly approach to business operations.

-

Can airSlate SignNow integrate with other software commonly used in Ohio?

Yes, airSlate SignNow seamlessly integrates with a wide range of popular software used by businesses in Ohio, including CRM systems and project management tools. This ensures that your workflow remains uninterrupted, and you can manage your documents alongside your existing tools. Integrations enhance the platform's versatility, making it an excellent choice for diverse business needs.

-

Is airSlate SignNow secure for handling sensitive documents in Ohio?

Absolutely, airSlate SignNow takes security seriously, providing robust encryption methods to protect sensitive documents for Ohio users. The platform complies with industry standards and regulations, ensuring that your data remains secure during transmission and storage. You can trust airSlate SignNow to manage your most confidential documents safely.

-

How quickly can I start using airSlate SignNow for my Ohio business?

Getting started with airSlate SignNow is quick and straightforward for Ohio businesses. You can sign up online and create an account in just a few minutes. With easy-to-follow setup instructions, you'll be sending documents for eSigning almost immediately.

Get more for Ohio IT 3 Transmittal Of W 2 Statements Instructions Fill io

Find out other Ohio IT 3 Transmittal Of W 2 Statements Instructions Fill io

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement