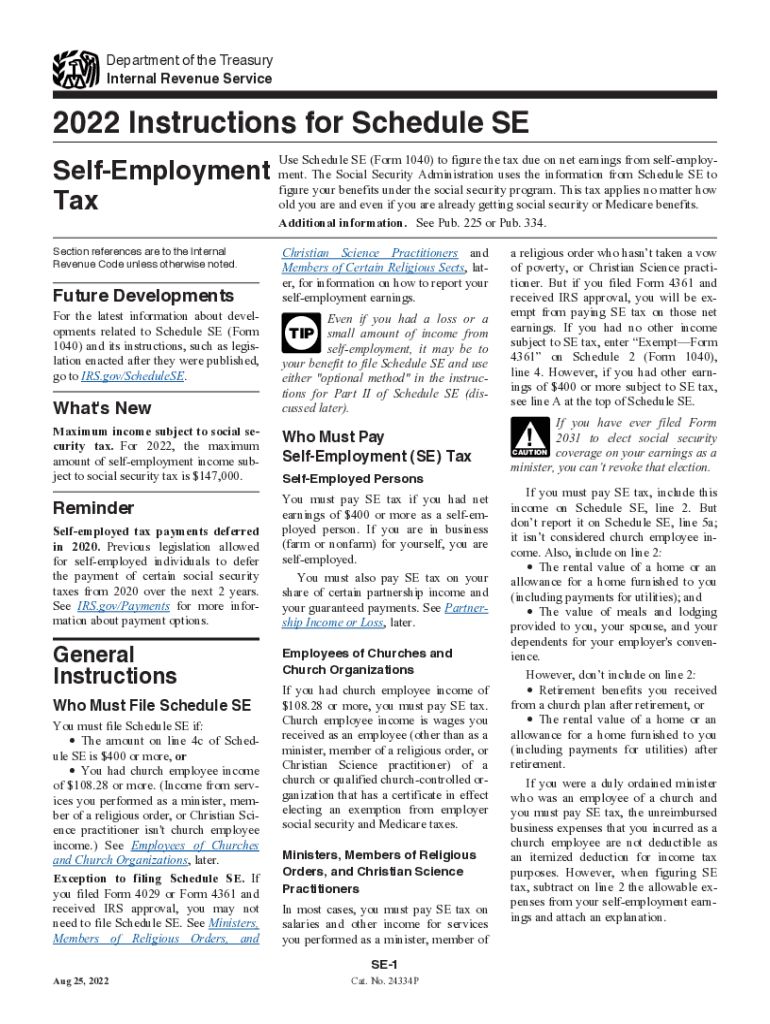

Instructions for IRS Form 1040 Schedule SE "Self Employment Tax" 2022-2026

Understanding the IRS Form 1040 Schedule SE

The IRS Form 1040 Schedule SE is used to calculate self-employment tax for individuals who earn income through self-employment. This form is essential for reporting income and determining the amount of tax owed to the IRS. The self-employment tax consists of Social Security and Medicare taxes primarily for individuals who work for themselves. Understanding how to fill out this form accurately is crucial for compliance with federal tax regulations.

Steps to Complete the IRS Form 1040 Schedule SE

Completing the Schedule SE involves several steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather your income information, including any 1099 forms or income statements.

- Calculate your net earnings from self-employment by subtracting your business expenses from your total income.

- Use the net earnings figure to determine the self-employment tax rate, which is typically fifteen point three percent.

- Fill out the Schedule SE form, entering your net earnings and calculating the total self-employment tax owed.

- Transfer the calculated tax amount to your Form 1040 when filing your annual return.

Key Elements of the IRS Form 1040 Schedule SE

Several key elements are crucial when filling out the Schedule SE:

- Net Earnings: This is the primary figure used to calculate your self-employment tax.

- Tax Rate: The self-employment tax rate is fifteen point three percent, which includes both Social Security and Medicare taxes.

- Exemptions: Certain income types may be exempt from self-employment tax, such as some rental income.

- Payment Due Date: Ensure you are aware of the filing deadlines to avoid penalties.

Legal Use of the IRS Form 1040 Schedule SE

The Schedule SE is a legally binding document that must be completed accurately to avoid potential legal issues with the IRS. Proper completion ensures that self-employed individuals fulfill their tax obligations, which helps maintain compliance with federal tax laws. Failure to report income or pay the correct self-employment tax can lead to penalties and interest on unpaid taxes.

Filing Deadlines for the IRS Form 1040 Schedule SE

It is important to be aware of the deadlines for filing the Schedule SE. Typically, the form must be submitted along with your annual Form 1040 by April fifteenth of the following tax year. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Obtaining the IRS Form 1040 Schedule SE

The Schedule SE form can be easily obtained from the IRS website or through tax preparation software. It is available in a downloadable PDF format, which can be printed and filled out manually. Many tax software programs also include the necessary forms and instructions for completing the Schedule SE, making it easier for self-employed individuals to file their taxes accurately.

Quick guide on how to complete instructions for irs form 1040 schedule se ampquotself employment taxampquot

Complete Instructions For IRS Form 1040 Schedule SE "Self employment Tax" effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, enabling you to obtain the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and electronically sign your documents quickly without hindrances. Manage Instructions For IRS Form 1040 Schedule SE "Self employment Tax" on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Instructions For IRS Form 1040 Schedule SE "Self employment Tax" effortlessly

- Find Instructions For IRS Form 1040 Schedule SE "Self employment Tax" and click on Get Form to begin.

- Utilize the tools we provide to submit your form.

- Select pertinent sections of your documents or mask sensitive data using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, laborious form navigation, or errors that require the printing of new document versions. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Instructions For IRS Form 1040 Schedule SE "Self employment Tax" and ensure superior communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for irs form 1040 schedule se ampquotself employment taxampquot

Create this form in 5 minutes!

People also ask

-

What is the self employment tax 2020 according to the IRS?

The self employment tax 2020 is a tax consisting of Social Security and Medicare taxes for individuals who work for themselves. Self-employed individuals must report their earnings and pay this tax if their net earnings are $400 or more. Understanding this tax is crucial for accurate income reporting and tax filing.

-

How does self employment tax 2020 affect my overall tax liability?

The self employment tax 2020 contributes signNowly to your total tax liability, as it is calculated based on your net earnings from self-employment. This tax is in addition to your income tax, which means you should factor it into your financial planning. Using tools like airSlate SignNow can help streamline documentation related to your self-employment tax processes.

-

What deductions can I claim to reduce my self employment tax 2020?

To lower your self employment tax 2020, you can claim deductions such as business expenses, home office deductions, and retirement plan contributions. These deductions lower your taxable income, reducing your overall tax liability. Staying organized with invoicing and receipts can be facilitated using airSlate SignNow's eSignature features.

-

How can airSlate SignNow help me manage documents related to self employment tax 2020?

airSlate SignNow provides an easy-to-use platform for managing documents relevant to your self employment tax 2020. You can effortlessly send and eSign tax documents, ensuring all necessary paperwork is completed accurately and on time. This efficiency can save you valuable time and reduce stress during tax season.

-

Is there a specific deadline for filing self employment tax 2020?

Yes, the deadline for filing self employment tax 2020 aligns with the standard tax deadline, which is usually April 15th of the following year. If you miss this deadline, you could face penalties. Utilizing airSlate SignNow can help you prepare and send your tax documents promptly to avoid any late filings.

-

Can I easily share my self employment tax 2020 forms with my accountant using airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely share your self employment tax 2020 forms with your accountant or tax preparer. By eSigning and sending documents directly through the platform, you keep your information organized and accessible for your financial advisor to review and file.

-

What features does airSlate SignNow offer for self employed individuals regarding tax preparation?

airSlate SignNow offers a range of features perfect for self employed individuals, including templates for tax documents, secure eSigning, and easy sharing options. These features help you manage your paperwork related to self employment tax 2020 efficiently, streamlining your overall tax preparation process. With an intuitive platform, you’ll find tax management much less daunting.

Get more for Instructions For IRS Form 1040 Schedule SE "Self employment Tax"

Find out other Instructions For IRS Form 1040 Schedule SE "Self employment Tax"

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online