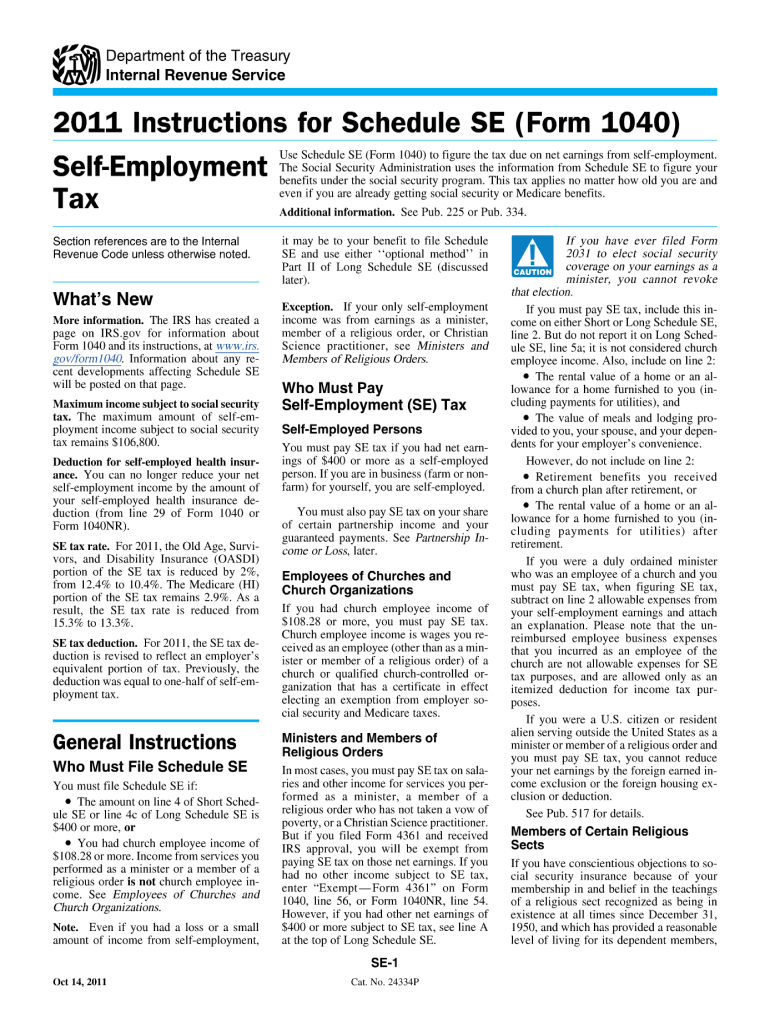

Form Se 2011

What is the Form Se

The Form Se is a specific document used for various purposes, including tax reporting and compliance. It is essential for individuals and businesses to understand its function and significance within the U.S. legal framework. The form may require details about income, deductions, or other financial information, making it crucial for accurate reporting to the IRS.

How to use the Form Se

Using the Form Se involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, ensuring that all sections are completed. After completing the form, review it for accuracy before submission. Utilizing digital tools can simplify this process, allowing for easy edits and secure submissions.

Steps to complete the Form Se

Completing the Form Se requires a methodical approach to ensure compliance and accuracy. Follow these steps:

- Gather all necessary documentation, including income records and previous filings.

- Fill in personal information accurately, including your name, address, and Social Security number.

- Complete the relevant sections based on your financial situation, ensuring all figures are correct.

- Review the entire form for any errors or omissions.

- Submit the form electronically or by mail, depending on your preference and requirements.

Legal use of the Form Se

The legal use of the Form Se is governed by IRS regulations and guidelines. It is important to ensure that the form is filled out correctly to avoid penalties. The form must be submitted by the specified deadlines to maintain compliance with tax laws. Additionally, using a reputable electronic signature solution can enhance the legal validity of the document, ensuring that it meets all necessary requirements.

Required Documents

When preparing to complete the Form Se, several documents are typically required. These include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation of any deductions or credits you plan to claim.

- Identification documents, including your Social Security number.

Form Submission Methods

The Form Se can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online submission via the IRS e-filing system, which is secure and efficient.

- Mailing a physical copy to the appropriate IRS address, ensuring that it is postmarked by the deadline.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete form se 2011

Effortlessly Prepare Form Se on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without hindrance. Manage Form Se using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form Se with Ease

- Acquire Form Se and click Get Form to begin.

- Make use of the provided tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature utilizing the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form Se to ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form se 2011

Create this form in 5 minutes!

How to create an eSignature for the form se 2011

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is Form Se in airSlate SignNow?

Form Se is a powerful feature within airSlate SignNow that allows users to create and manage electronic forms efficiently. It streamlines the process of collecting data and signatures, making it easy to send documents for eSigning. With Form Se, businesses can enhance their workflow and ensure that all necessary information is captured accurately.

-

How much does it cost to use Form Se with airSlate SignNow?

The pricing for using Form Se with airSlate SignNow is competitive and varies based on the plan you choose. You can explore different subscription options that cater to various business needs, ensuring you get the best value for your investment. Each plan includes access to Form Se and its features, allowing you to manage your documents effortlessly.

-

What features does Form Se offer?

Form Se offers a range of features designed to simplify document management and eSigning. Users can create customizable forms, set up automated workflows, and track the status of their documents in real-time. Additionally, Form Se integrates seamlessly with other tools, enhancing business operations.

-

Can I integrate Form Se with other applications?

Yes, Form Se can be integrated with various applications and platforms to enhance its functionality. airSlate SignNow supports integrations with popular business software, making it easier for users to connect their existing tools. This flexibility allows businesses to streamline their processes effectively.

-

What are the benefits of using Form Se for my business?

Using Form Se can signNowly boost your business efficiency by automating document workflows and reducing turnaround times. It eliminates the need for paper-based forms, promoting a more sustainable approach while ensuring that signatures are gathered securely and promptly. By choosing Form Se, you empower your team to focus on more critical tasks.

-

Is Form Se user-friendly for teams with varying tech skills?

Absolutely! Form Se is designed to be intuitive and user-friendly, catering to teams with varying levels of technical expertise. The straightforward interface allows users to create and send forms quickly, ensuring that everyone in your organization can utilize its features without extensive training.

-

How does Form Se ensure the security of my documents?

Form Se prioritizes the security of your documents through robust encryption and compliance with industry standards. airSlate SignNow implements advanced security measures to protect sensitive information during transmission and storage. You can trust that your data is safe while using Form Se.

Get more for Form Se

- 2020 form 1099 a acquisition or abandonment of secured property

- 2020 instructions forforms 1099 miscand 1099 nec instructions forforms 1099 miscand 1099 nec miscellaneous income

- 2020 form 1099 misc miscellaneous income

- Pdf general instructions for forms w 2 and w 3 pdf internal revenue

- 2020 form 1096 annual summary and transmittal of us information returns

- Form 1099bpdf attention copy a of this form is provided

- 2019 form 1099 div internal revenue servicean official

- 2020 form 1099 k payment card and third party network transactions

Find out other Form Se

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement