Tax Form Se 2018

What is the Tax Form SE

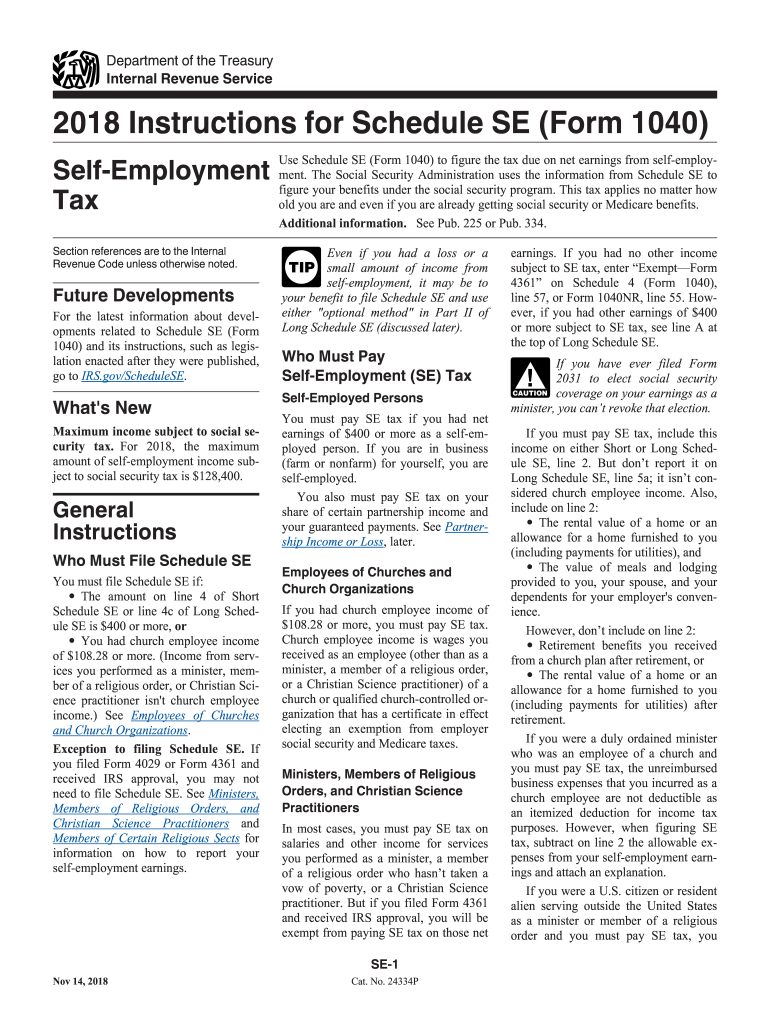

The IRS Form 1040 Schedule SE is specifically designed for self-employed individuals to calculate their self-employment tax. This tax is applicable to individuals who earn income from self-employment, which can include sole proprietors, independent contractors, and freelancers. The self-employment tax consists of Social Security and Medicare taxes, which are typically withheld from wages for employees. By filing Schedule SE, self-employed individuals ensure they contribute appropriately to these federal programs.

How to use the Tax Form SE

To use the IRS Form 1040 Schedule SE, individuals must first determine if they need to file it based on their self-employment income. If their net earnings from self-employment are $400 or more, they are required to complete this form. The form guides users through the calculation of their self-employment tax, allowing them to report their income accurately. It is important to follow the instructions carefully to ensure all calculations are correct and that the form is submitted with the main tax return.

Steps to complete the Tax Form SE

Completing the IRS Form 1040 Schedule SE involves several key steps:

- Gather all necessary financial information, including income statements and expense records.

- Calculate your net earnings from self-employment by subtracting any allowable business expenses from your gross income.

- Fill out the form by entering your net earnings and following the provided instructions to calculate the self-employment tax.

- Transfer the calculated tax amount to your Form 1040 when filing your annual tax return.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the IRS Form 1040 Schedule SE. Typically, self-employed individuals must file their tax returns, including Schedule SE, by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, self-employed individuals may opt for an extension, allowing them to file by October 15, but any taxes owed must still be paid by the original deadline to avoid penalties.

Legal use of the Tax Form SE

The IRS Form 1040 Schedule SE is legally required for self-employed individuals who meet the income threshold. Failure to file this form when necessary can result in penalties and interest on unpaid taxes. It is crucial to ensure that the information provided is accurate and complete, as the IRS may audit returns and impose fines for discrepancies. Understanding the legal implications of using this form helps ensure compliance with federal tax laws.

Required Documents

When completing the IRS Form 1040 Schedule SE, individuals should have the following documents ready:

- Records of all self-employment income, such as invoices and 1099 forms.

- Documentation of business expenses, including receipts and bank statements.

- Previous tax returns, if applicable, for reference and consistency.

Quick guide on how to complete irs 1040 se 2018 2019 form

Uncover the easiest method to complete and endorse your Tax Form Se

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior approach to complete and endorse your Tax Form Se and similar forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle paperwork swiftly and in compliance with regulatory standards - robust PDF editing, managing, safeguarding, endorsing, and sharing tools are all readily available within a user-friendly interface.

Only a few steps are necessary to finalize the completion and endorsement of your Tax Form Se:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Tax Form Se.

- Move between the fields using the Next option to ensure you don't overlook anything.

- Utilize Text, Check, and Cross tools to populate the fields with your data.

- Update the content with Text boxes or Images from the toolbar above.

- Emphasize what is essential or Obscure sections that are no longer relevant.

- Press Sign to create a legally valid eSignature using any method you prefer.

- Add the Date next to your signature and finalize your work by clicking the Done button.

Store your completed Tax Form Se in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our solution also allows for flexible file sharing. There’s no need to print out your forms when you need to submit them to the appropriate public office - do so using email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs 1040 se 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs 1040 se 2018 2019 form

How to make an electronic signature for your Irs 1040 Se 2018 2019 Form online

How to make an electronic signature for your Irs 1040 Se 2018 2019 Form in Google Chrome

How to create an eSignature for signing the Irs 1040 Se 2018 2019 Form in Gmail

How to make an eSignature for the Irs 1040 Se 2018 2019 Form right from your smart phone

How to create an eSignature for the Irs 1040 Se 2018 2019 Form on iOS

How to generate an electronic signature for the Irs 1040 Se 2018 2019 Form on Android OS

People also ask

-

What is the IRS Form 1040 Schedule SE self-employment tax?

The IRS Form 1040 Schedule SE is used by self-employed individuals to calculate their self-employment tax. This tax is essential for funding Social Security and Medicare. Understanding how to fill out this form is crucial for any self-employed taxpayer to ensure compliance with federal tax regulations.

-

How can airSlate SignNow help with submitting IRS Form 1040 Schedule SE self-employment tax?

airSlate SignNow streamlines the process of filling out and submitting IRS Form 1040 Schedule SE self-employment tax by allowing users to eSign documents securely and efficiently. By using our platform, you can quickly gather signatures and keep all documentation organized. This enhances productivity and ensures timely submissions to the IRS.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers various pricing plans to fit different business needs. Our cost-effective solutions are designed to make managing documents and signing them easy, including forms like the IRS Form 1040 Schedule SE self-employment tax. You can choose a plan that offers the features that best suit your requirements.

-

Does airSlate SignNow integrate with other accounting software for IRS Form 1040 Schedule SE self-employment tax?

Yes, airSlate SignNow integrates seamlessly with several accounting software tools, making it easier to manage your finances and prepare IRS Form 1040 Schedule SE self-employment tax. These integrations enable you to streamline your workflow and reduce errors while ensuring compliance with tax requirements.

-

What features does airSlate SignNow offer that assist with IRS Form 1040 Schedule SE self-employment tax?

airSlate SignNow provides features such as customizable templates, secure document storage, and electronic signing, which are vital for completing IRS Form 1040 Schedule SE self-employment tax efficiently. These capabilities help to simplify the process and save time for busy self-employed professionals.

-

Is airSlate SignNow suitable for freelancers preparing IRS Form 1040 Schedule SE self-employment tax?

Absolutely! airSlate SignNow is an ideal solution for freelancers who need to prepare and submit IRS Form 1040 Schedule SE self-employment tax. Our platform's user-friendly interface makes it easy to manage documents and ensure that all necessary forms are properly signed and submitted.

-

What are the benefits of using airSlate SignNow for IRS Form 1040 Schedule SE self-employment tax filings?

Using airSlate SignNow for your IRS Form 1040 Schedule SE self-employment tax filings offers several benefits, including reduced paperwork, faster processing times, and improved accuracy. Our platform allows you to easily track documents and maintain organized records, helping you stay compliant and stress-free during tax season.

Get more for Tax Form Se

Find out other Tax Form Se

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later