540 California Tax Table 540 California Tax Table 2021

What is the 540 California Tax Table

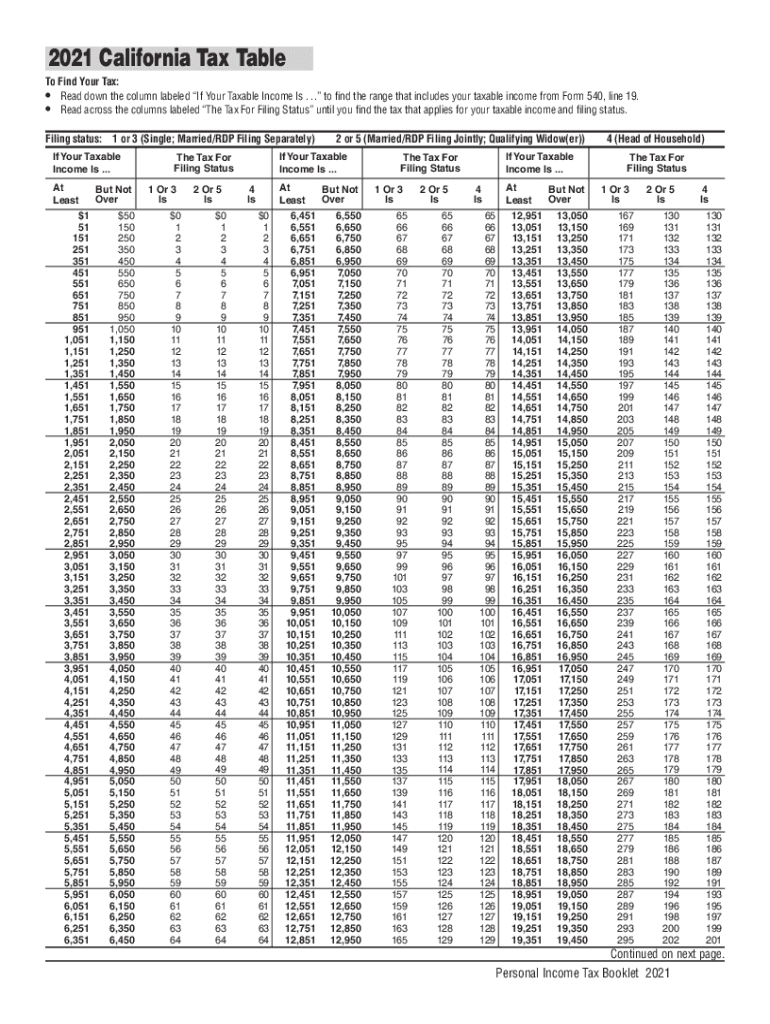

The 540 California Tax Table is a crucial document used by taxpayers in California to determine their state income tax liability. It provides a structured breakdown of tax rates based on income levels for individuals and married couples filing jointly. This table simplifies the process of calculating taxes owed by offering clear guidelines that align with the state's tax regulations. Understanding this table is essential for accurate tax reporting and compliance with California tax laws.

How to use the 540 California Tax Table

Using the 540 California Tax Table involves a few straightforward steps. First, identify your filing status, which could be single, married filing jointly, or head of household. Next, locate your total taxable income within the table. The table will indicate the corresponding tax amount based on your income range. It is important to ensure that all income sources are accounted for, as this will affect the tax calculation. For those with additional credits or deductions, further adjustments may be necessary after consulting the table.

Steps to complete the 540 California Tax Table

Completing the 540 California Tax Table requires several methodical steps. Begin by gathering all necessary financial documents, including W-2s and 1099s. Next, calculate your total income and determine your filing status. Once you have this information, refer to the tax table to find your income range and the corresponding tax amount. After calculating your tax liability, ensure that you include any applicable credits or deductions. Finally, review all entries for accuracy before submitting your tax return.

Legal use of the 540 California Tax Table

The legal use of the 540 California Tax Table is governed by state tax laws, which mandate its application for determining state income tax obligations. Utilizing this table correctly ensures compliance with California's tax regulations, reducing the risk of audits or penalties. It is essential for taxpayers to understand the legal implications of their tax filings and to use the table as a reliable resource for accurate tax calculations.

State-specific rules for the 540 California Tax Table

California has specific rules that govern the use of the 540 California Tax Table. These rules include income thresholds, tax rates, and eligibility criteria for various deductions and credits. Taxpayers must be aware of these regulations to ensure they are using the table correctly. Additionally, California may update tax rates and brackets annually, making it important to refer to the most current version of the table when filing.

Filing Deadlines / Important Dates

Filing deadlines for the 540 California Tax Table are critical for compliance. Typically, individual tax returns are due on April 15 of each year, unless that date falls on a weekend or holiday. In such cases, the deadline is extended to the next business day. It is advisable for taxpayers to stay informed about any changes to these deadlines, as extensions or special circumstances may apply, particularly in response to unforeseen events.

Examples of using the 540 California Tax Table

Examples of using the 540 California Tax Table can clarify how different income levels affect tax liability. For instance, a single filer with a taxable income of $50,000 would refer to the table to find the corresponding tax amount, which might be a specific percentage of their income. Similarly, a married couple filing jointly with a combined income of $100,000 would look up their income range to determine their tax obligation. These examples highlight the practical application of the table in real-life tax scenarios.

Quick guide on how to complete 2021 540 california tax table 2021 540 california tax table

Easily Prepare 540 California Tax Table 540 California Tax Table on Any Device

Managing documents online has gained traction among businesses and individuals. It offers a fantastic environmentally friendly solution compared to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage 540 California Tax Table 540 California Tax Table on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to Modify and eSign 540 California Tax Table 540 California Tax Table Effortlessly

- Locate 540 California Tax Table 540 California Tax Table and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and mistakes that require reprinting new copies. airSlate SignNow meets all your documentation management needs in just a few clicks from any device you choose. Modify and eSign 540 California Tax Table 540 California Tax Table and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 540 california tax table 2021 540 california tax table

Create this form in 5 minutes!

People also ask

-

What is the 540 California Tax Table?

The 540 California Tax Table is a guide provided by the California Franchise Tax Board that outlines the various tax rates applicable to individual income tax returns. Understanding this table is essential for calculating your tax liability accurately when filing your state taxes. It is optimized to help taxpayers determine their obligations under California tax laws efficiently.

-

How can I use the 540 California Tax Table when filing my taxes?

You can use the 540 California Tax Table during your tax preparation process to check the specific tax rate that applies to your income level. By cross-referencing your taxable income with the rates in the table, you can ensure accurate and compliant tax filings. This helps in minimizing mistakes that could result in audits or penalties.

-

Are there features in airSlate SignNow that help with the 540 California Tax Table?

Yes, airSlate SignNow includes features that facilitate easy document signing and sharing, which can be beneficial when filing your tax forms that require the 540 California Tax Table. You can easily send tax documents for electronic signatures and track the signing process. This streamlines your workflow, especially during tax season.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit different business needs. Customers can explore various tiers that provide features like unlimited document signing and access to integrations. This ensures that you can effectively manage documents related to the 540 California Tax Table without exceeding your budget.

-

Is airSlate SignNow beneficial for businesses dealing with the 540 California Tax Table?

Absolutely, airSlate SignNow is specifically designed to support businesses by simplifying their document management process. For companies in California, utilizing the 540 California Tax Table can improve compliance and accuracy in tax reporting. Additionally, it enhances collaboration when multiple stakeholders need to review or sign tax-related documents.

-

What integrations does airSlate SignNow offer for tax documents?

airSlate SignNow offers seamless integrations with various accounting and document management software. This allows businesses to effortlessly incorporate the 540 California Tax Table into their existing workflow. By integrating with popular platforms, users can ensure that all their tax documents are accurate and easily accessible.

-

Can I track my document statuses when using airSlate SignNow for the 540 California Tax Table?

Yes, one of the key features of airSlate SignNow is the ability to track document statuses in real-time. This means you can monitor who has viewed, signed, or interacted with your documents related to the 540 California Tax Table. This transparency helps you maintain control and accountability during the tax filing process.

Get more for 540 California Tax Table 540 California Tax Table

- Anatomical gift form 497322584

- Ohio burial form

- Employment or job termination package ohio form

- Newly widowed individuals package ohio form

- Employment interview package ohio form

- Employment employee personnel file package ohio form

- Assignment of mortgage package ohio form

- Assignment of lease package ohio form

Find out other 540 California Tax Table 540 California Tax Table

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template