California Tax Table 2007

What is the California Tax Table

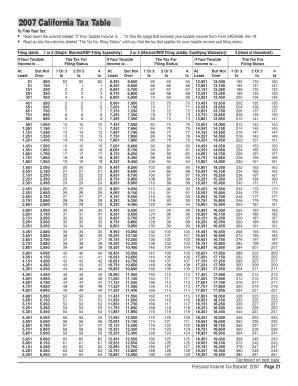

The California Tax Table is a crucial resource used by taxpayers to determine their state income tax obligations. It provides a structured format that outlines various income levels and the corresponding tax rates applicable for the tax year. For the year 2020, the tax table is specifically designed for Form 540, which is the California Resident Income Tax Return. Understanding this table is essential for accurately calculating the amount owed or the refund expected when filing state taxes.

How to use the California Tax Table

Using the California Tax Table involves a straightforward process. First, identify your filing status, which can be single, married filing jointly, married filing separately, or head of household. Next, locate your taxable income within the table. The tax table will indicate the tax amount owed based on your income bracket. It is important to follow the table closely to ensure that the correct tax rate is applied. This method simplifies the calculation of state taxes, making it easier for taxpayers to fulfill their obligations accurately.

Steps to complete the California Tax Table

Completing the California Tax Table requires several steps to ensure accuracy. Begin by gathering your financial documents, including W-2 forms and any other income statements. Next, fill out Form 540 with your personal information and total income. Once you have determined your taxable income, refer to the California Tax Table for the applicable tax rate. Calculate your tax liability based on the table, and ensure that all figures are accurately recorded on your tax return. Finally, review your completed Form 540 for any errors before submission.

Legal use of the California Tax Table

The legal use of the California Tax Table is governed by state tax regulations. It is essential for taxpayers to utilize the table correctly to comply with California tax laws. The table is designed to provide accurate tax calculations, which are necessary for filing a legally binding tax return. Misuse or miscalculation based on the tax table can lead to penalties or audits by the California Franchise Tax Board. Therefore, understanding and applying the tax table correctly is vital for maintaining compliance with state tax requirements.

Key elements of the California Tax Table

The California Tax Table consists of several key elements that are essential for taxpayers. These include:

- Income brackets: The table categorizes income into various ranges, each associated with a specific tax rate.

- Filing status: Different rates apply based on whether you are single, married, or head of household.

- Tax rates: The table specifies the percentage of tax owed for each income bracket.

- Standard deductions: These may affect your taxable income and are accounted for when using the table.

Examples of using the California Tax Table

Examples can clarify how to use the California Tax Table effectively. For instance, if a single taxpayer has a taxable income of $50,000, they would locate this amount in the tax table to find the corresponding tax rate. If the table indicates a tax of $4,500 for this income level, the taxpayer would record this amount on their Form 540. Similarly, a married couple with a combined income of $100,000 would follow the same process, ensuring they refer to the appropriate section of the table for their filing status.

Quick guide on how to complete california tax table 2019

Complete California Tax Table effortlessly on any gadget

Online document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage California Tax Table on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign California Tax Table without any hassle

- Obtain California Tax Table and click Get Form to begin.

- Utilize the tools we provide to complete your paperwork.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you wish to deliver your form, either by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign California Tax Table and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california tax table 2019

Create this form in 5 minutes!

People also ask

-

What is the 2020 form 540 tax table?

The 2020 form 540 tax table provides California taxpayers with a guide to determine their state income tax rates. It outlines the tax brackets and corresponding rates that apply to different income levels, helping individuals accurately calculate their tax liabilities.

-

How can I access the 2020 form 540 tax table?

You can access the 2020 form 540 tax table online through the California Franchise Tax Board's official website. Additionally, airSlate SignNow allows you to securely sign and submit your tax documents, including those based on the 2020 form 540 tax table.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as electronic signatures, document templates, and cloud storage to streamline tax document management. With these tools, you can ensure that your tax forms, including those referencing the 2020 form 540 tax table, are completed and filed efficiently.

-

Is airSlate SignNow suitable for businesses preparing taxes?

Yes, airSlate SignNow is an excellent choice for businesses preparing taxes. Its integration capabilities allow for smooth collaboration on tax forms, including the 2020 form 540 tax table, ensuring all documents are completed and signed in a timely manner.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Each plan includes access to essential features, making it a cost-effective solution for managing documents related to the 2020 form 540 tax table and other tax filings.

-

Can airSlate SignNow integrate with accounting software?

Yes, airSlate SignNow integrates with popular accounting software, enhancing your tax filing process. These integrations allow you to pull in data easily to fill in forms like the 2020 form 540 tax table, ensuring accuracy and efficiency.

-

How secure is my data with airSlate SignNow?

airSlate SignNow prioritizes security and employs robust encryption to protect your data. You can confidently manage documents, such as those relevant to the 2020 form 540 tax table, knowing that your information is safeguarded against unauthorized access.

Get more for California Tax Table

Find out other California Tax Table

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy