California Tax Table California Tax Table 2022-2026

Understanding the California Tax Table

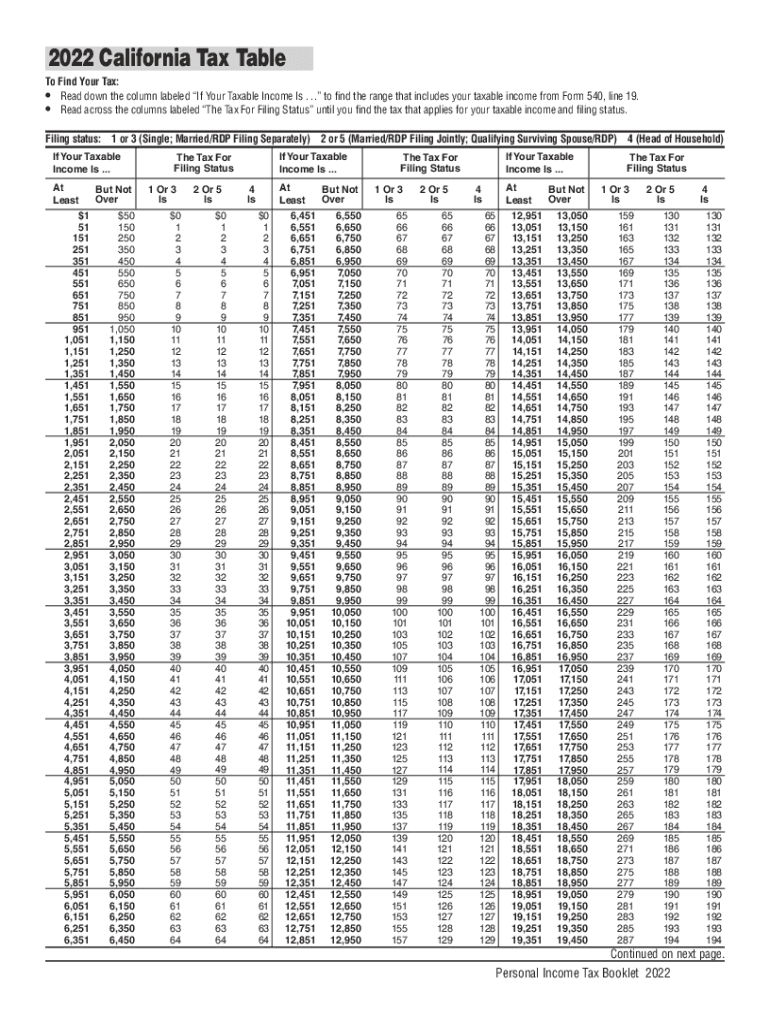

The California tax table is a crucial resource for taxpayers in California, as it outlines the income tax rates applicable for various income brackets. This table is updated annually to reflect changes in tax laws and rates, ensuring that taxpayers have the most accurate information for their filings. For the year 2024, the California tax rates will vary based on income levels, affecting both individuals and businesses. Familiarity with these rates can help taxpayers estimate their tax liability and plan their finances accordingly.

How to Use the California Tax Table

Using the California tax table involves identifying your taxable income and locating the corresponding tax rate. To begin, determine your total income for the year, including wages, interest, and any other sources. Next, refer to the 2024 tax table to find the applicable tax bracket based on your income level. This will guide you in calculating your state income tax. It is essential to ensure that you are using the correct table for the specific tax year, as rates and brackets may change annually.

Steps to Complete the California Tax Table

Completing the California tax table requires several steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including W-2 forms and any additional income statements. Follow these steps:

- Calculate your total income for the year.

- Identify any deductions or credits you may be eligible for.

- Locate the appropriate tax bracket in the California tax table for your income level.

- Apply the tax rate to your taxable income to determine your state tax liability.

- Complete your tax return using the calculated figures.

Legal Use of the California Tax Table

The California tax table is legally binding and must be used in accordance with state tax laws. Taxpayers are required to report their income accurately and apply the correct tax rates as outlined in the table. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is important for taxpayers to stay informed about any changes to the tax table to ensure they are meeting their legal obligations.

Key Elements of the California Tax Table

Several key elements define the California tax table and its application:

- Income Brackets: The table categorizes income into specific brackets, each with its own tax rate.

- Tax Rates: Each bracket has a corresponding tax rate, which may vary based on filing status, such as single or married filing jointly.

- Deductions and Credits: Taxpayers may be eligible for various deductions and credits that can affect their overall tax liability.

- Annual Updates: The table is updated each year to reflect changes in tax laws and economic conditions.

Filing Deadlines and Important Dates

Taxpayers should be aware of key deadlines associated with the California tax table. Typically, the state tax return is due on April 15 of each year, aligning with federal tax deadlines. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Additionally, taxpayers should keep track of any extensions or changes to filing dates that may be announced by the California Franchise Tax Board.

Quick guide on how to complete 2022 california tax table 2022 california tax table

Complete California Tax Table California Tax Table seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage California Tax Table California Tax Table on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to change and eSign California Tax Table California Tax Table effortlessly

- Locate California Tax Table California Tax Table and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, monotonous form navigation, or errors that necessitate reprinting documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign California Tax Table California Tax Table and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 california tax table 2022 california tax table

Create this form in 5 minutes!

How to create an eSignature for the 2022 california tax table 2022 california tax table

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA tax table income and why is it important?

The CA tax table income refers to the various income brackets set by the California state tax authority. Understanding this table is crucial for individuals and businesses to accurately calculate their tax obligations. Utilizing the CA tax table income can help minimize overpayment and optimize your financial planning.

-

How can airSlate SignNow assist with calculating CA tax table income?

airSlate SignNow provides tools that streamline the document management process, including tax form submissions. While it doesn’t calculate taxes directly, it allows users to easily access and fill out necessary documents that reference the CA tax table income. This simplifies the process of ensuring compliance and accuracy in tax submissions.

-

Is airSlate SignNow suitable for tax professionals handling CA tax table income?

Yes, airSlate SignNow is an excellent choice for tax professionals who manage multiple clients' tax documents. Its features allow for efficient eSigning and document sharing, making it easier to collaborate on forms related to the CA tax table income. This efficiency can help save time and improve client satisfaction.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet different business needs, ensuring cost-effectiveness. The pricing plans provide access to a range of features that can help users manage documents related to the CA tax table income effortlessly. You can select a plan based on your volume of usage and required functionalities.

-

Can airSlate SignNow integrate with accounting software that uses CA tax table income?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software applications that calculate the CA tax table income. This integration boosts efficiency by allowing data transfer between platforms, simplifying the document management process for tax-related tasks.

-

What benefits does airSlate SignNow provide for managing tax documents?

One major benefit of airSlate SignNow is its user-friendly interface that simplifies the eSigning and document management process. It reduces turnaround times for signing important documents related to the CA tax table income, allowing businesses to operate more efficiently. Additionally, it ensures secure storage and easy retrieval of documents.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like the CA tax table income. The platform uses advanced encryption protocols and compliance measures to protect user data. This focus on security helps ensure that all tax-related documents remain confidential and secure.

Get more for California Tax Table California Tax Table

- Tenants maintenance repair request form south dakota

- Guaranty attachment to lease for guarantor or cosigner south dakota form

- Amendment to lease or rental agreement south dakota form

- Warning notice due to complaint from neighbors south dakota form

- Lease subordination agreement south dakota form

- Apartment rules and regulations south dakota form

- Agreed cancellation of lease south dakota form

- Amendment of residential lease south dakota form

Find out other California Tax Table California Tax Table

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple