Net Operating Loss NOL Computation and NOL AndDisaster Loss Limitations Individuals, Estates, and Trusts Form 3805V Net Operatin 2021-2026

Understanding the Net Operating Loss (NOL) Computation

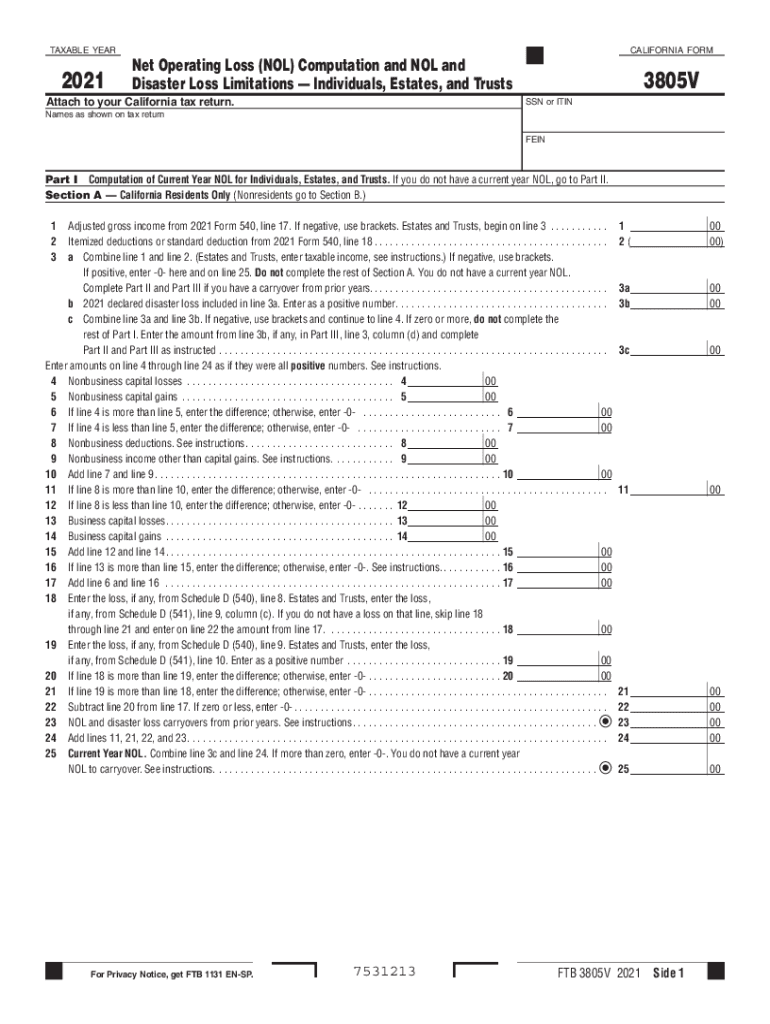

The 2017 FTB 3805V form is designed to help individuals, estates, and trusts calculate their Net Operating Loss (NOL) and any disaster loss limitations. A Net Operating Loss occurs when allowable deductions exceed gross income for a tax year. This form is crucial for taxpayers who have experienced financial losses, allowing them to potentially offset taxable income in other years. The computation involves specific calculations that determine the amount of loss that can be carried forward or back to prior tax years, providing significant tax relief.

Steps to Complete the 2017 FTB 3805V Form

Completing the 2017 FTB 3805V form requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Calculate your total income and allowable deductions for the year.

- Determine your NOL by subtracting your total income from your allowable deductions.

- Fill out the form by entering your calculated NOL and any applicable disaster loss amounts.

- Review the form for accuracy and ensure all required signatures are included.

Legal Use of the 2017 FTB 3805V Form

The 2017 FTB 3805V form is legally recognized for reporting Net Operating Losses and disaster losses. It must be filed accurately to comply with IRS regulations. The form provides a structured way to document losses, ensuring that taxpayers can claim their rightful deductions. Adhering to the guidelines set forth by the IRS and state tax authorities is essential for the form to be considered valid and legally binding.

Key Elements of the 2017 FTB 3805V Form

Several key elements must be included when filling out the 2017 FTB 3805V form:

- Your complete personal information, including Social Security number and address.

- The calculated NOL amount for the current tax year.

- Any disaster loss amounts that may apply, including the type of disaster and dates.

- Signature and date to certify the accuracy of the information provided.

Obtaining the 2017 FTB 3805V Form

The 2017 FTB 3805V form can be obtained through the California Franchise Tax Board's website or by contacting their office directly. It is available in a fillable PDF format, making it easier for taxpayers to complete the form digitally. Additionally, many tax preparation software programs include the form, allowing for seamless integration into the tax filing process.

Filing Deadlines for the 2017 FTB 3805V Form

Timely filing of the 2017 FTB 3805V form is crucial to avoid penalties. Typically, the deadline aligns with the standard tax filing date for individuals, which is April 15. However, if you are filing for an extension, be aware of the extended deadlines and ensure the form is submitted by that date to maintain compliance with tax regulations.

Quick guide on how to complete 2021 net operating loss nol computation and nol anddisaster loss limitations individuals estates and trusts form 3805v 2021 net

Complete Net Operating Loss NOL Computation And NOL AndDisaster Loss Limitations Individuals, Estates, And Trusts Form 3805V Net Operatin effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to retrieve the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Net Operating Loss NOL Computation And NOL AndDisaster Loss Limitations Individuals, Estates, And Trusts Form 3805V Net Operatin on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Net Operating Loss NOL Computation And NOL AndDisaster Loss Limitations Individuals, Estates, And Trusts Form 3805V Net Operatin with ease

- Obtain Net Operating Loss NOL Computation And NOL AndDisaster Loss Limitations Individuals, Estates, And Trusts Form 3805V Net Operatin and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details using tools that airSlate SignNow provides especially for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Net Operating Loss NOL Computation And NOL AndDisaster Loss Limitations Individuals, Estates, And Trusts Form 3805V Net Operatin and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 net operating loss nol computation and nol anddisaster loss limitations individuals estates and trusts form 3805v 2021 net

Create this form in 5 minutes!

People also ask

-

What is the 2017 ftb 3805v form and why is it important?

The 2017 ftb 3805v form is vital for California taxpayers who experience a change in their income. This form helps individuals claim a credit for taxes that were overpaid. Understanding and filling out the 2017 ftb 3805v accurately ensures taxpayers receive the refunds they're entitled to.

-

How can airSlate SignNow help with completing the 2017 ftb 3805v?

airSlate SignNow streamlines the process of completing the 2017 ftb 3805v form by allowing users to easily fill out, sign, and send documents electronically. This eliminates paperwork hassles and speeds up the submission process. Users can be confident that their form is completed accurately and promptly.

-

What features does airSlate SignNow offer for managing the 2017 ftb 3805v?

With airSlate SignNow, users can benefit from features like document templates, customizable workflows, and real-time tracking for the 2017 ftb 3805v form. These tools enhance efficiency and ensure all necessary signatures are collected without delays. Additionally, the platform ensures documents are stored securely and are easily accessible.

-

What is the pricing structure for airSlate SignNow services related to the 2017 ftb 3805v?

airSlate SignNow offers a cost-effective subscription model designed to suit various business needs when handling the 2017 ftb 3805v form. Pricing varies based on the number of users and features required. Customers can choose a plan that fits their budget while still accessing all necessary tools for document management.

-

Is airSlate SignNow compliant with legal standards for the 2017 ftb 3805v?

Yes, airSlate SignNow is fully compliant with legal standards required for eSigning and document transactions, including forms like the 2017 ftb 3805v. This compliance ensures that electronic signatures are legally binding and secure, providing peace of mind when submitting important tax documents.

-

Can airSlate SignNow integrate with other tools for processing the 2017 ftb 3805v?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tools and applications, facilitating the workflow for processing the 2017 ftb 3805v. Users can combine airSlate SignNow with accounting software or CRM systems to enhance productivity and efficiency signNowly.

-

What are the benefits of using airSlate SignNow for the 2017 ftb 3805v?

Using airSlate SignNow for the 2017 ftb 3805v provides numerous benefits, including fast processing times and reduced paper usage. The platform's user-friendly interface allows individuals to handle their tax forms without hassle. Ultimately, it saves time, reduces errors, and ensures compliance with necessary regulations.

Get more for Net Operating Loss NOL Computation And NOL AndDisaster Loss Limitations Individuals, Estates, And Trusts Form 3805V Net Operatin

- Ohio identity form

- Identity theft by known imposter package ohio form

- Organizing your personal assets package ohio form

- Essential documents for the organized traveler package ohio form

- Essential documents for the organized traveler package with personal organizer ohio form

- Letters of recommendation package ohio form

- Ohio construction or mechanics lien package individual ohio form

- Ohio construction or mechanics lien package corporation or llc ohio form

Find out other Net Operating Loss NOL Computation And NOL AndDisaster Loss Limitations Individuals, Estates, And Trusts Form 3805V Net Operatin

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later