Form 3805V, Net Operation Loss NOL Computation and NOL 2020

What is the Form 3805V, Net Operation Loss NOL Computation And NOL

The Form 3805V is a crucial document used in California for reporting Net Operating Losses (NOL) for tax purposes. This form allows businesses to calculate and claim their NOLs, which can provide significant tax relief by enabling them to offset taxable income in future years. The form is specifically designed for taxpayers who have incurred losses in prior years and seek to apply these losses against their taxable income in the current or future tax years. Understanding the purpose of Form 3805V is essential for ensuring compliance with California tax regulations and maximizing potential tax benefits.

How to use the Form 3805V, Net Operation Loss NOL Computation And NOL

Using Form 3805V involves several steps to ensure accurate reporting of Net Operating Losses. Taxpayers must first gather relevant financial information, including income statements and prior year tax returns. The form requires detailed calculations of the NOL, which can be complex depending on the taxpayer's circumstances. After completing the calculations, the form should be reviewed for accuracy before submission. It is important to keep a copy of the completed form for personal records and future reference. Utilizing digital tools can simplify this process, allowing for easier calculations and secure storage of the completed form.

Steps to complete the Form 3805V, Net Operation Loss NOL Computation And NOL

Completing Form 3805V involves a systematic approach to ensure all necessary information is accurately reported. Here are the key steps:

- Gather all financial documents, including income statements and prior year tax returns.

- Calculate the NOL by determining the total losses incurred during the applicable tax years.

- Fill out the form, ensuring all sections are completed accurately, including the calculations for the NOL.

- Review the form for any errors or omissions before finalizing.

- Submit the completed form to the California Franchise Tax Board, either electronically or by mail.

Legal use of the Form 3805V, Net Operation Loss NOL Computation And NOL

The legal use of Form 3805V is governed by California tax laws, which stipulate that taxpayers must accurately report their Net Operating Losses to claim any tax benefits. The form must be completed in accordance with the guidelines provided by the California Franchise Tax Board to ensure compliance. Failure to adhere to these regulations can result in penalties or denial of the NOL claim. It is advisable for taxpayers to consult with tax professionals to understand the legal implications and ensure that their use of the form aligns with current tax laws.

Eligibility Criteria for Form 3805V, Net Operation Loss NOL Computation And NOL

Eligibility to use Form 3805V is primarily determined by the nature of the taxpayer's business and the occurrence of a Net Operating Loss. Generally, businesses that have sustained losses in prior tax years and wish to apply those losses against future taxable income can utilize this form. Specific eligibility criteria include:

- The business must be operating in California.

- The losses must be documented and verifiable through financial records.

- Taxpayers must have filed the appropriate tax returns for the years in which the losses occurred.

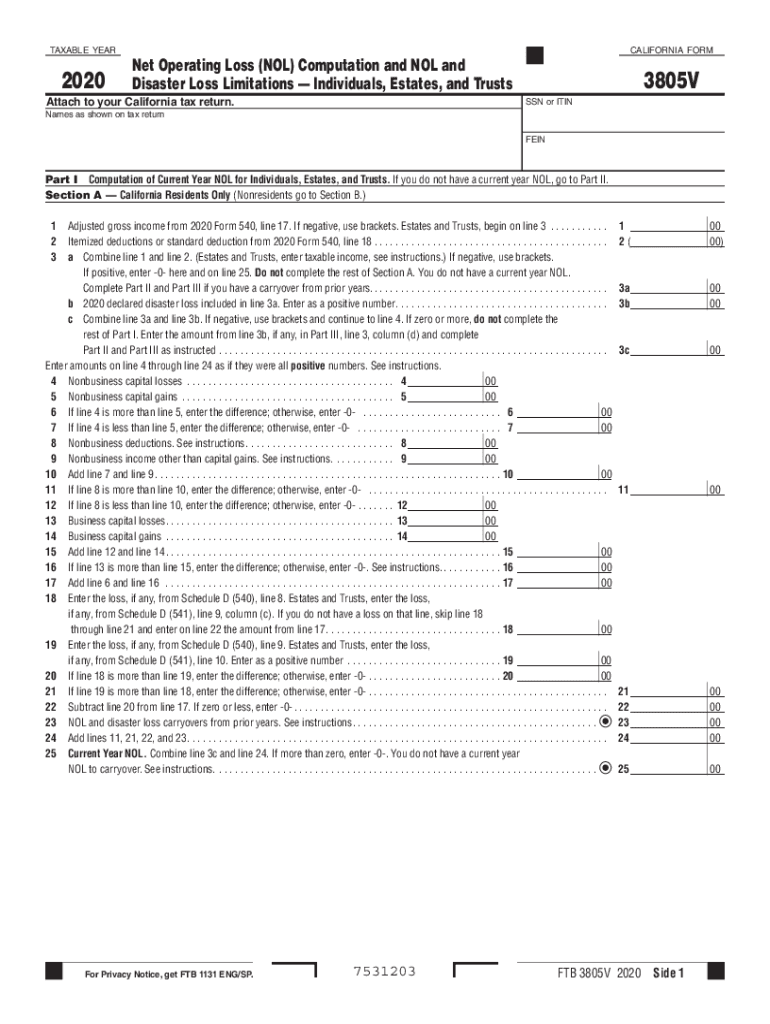

Key elements of the Form 3805V, Net Operation Loss NOL Computation And NOL

Form 3805V includes several key elements essential for accurately reporting Net Operating Losses. Important sections of the form consist of:

- Identification of the taxpayer, including name, address, and taxpayer identification number.

- Details of the NOL calculation, including the amount of losses and the tax years in which they occurred.

- Signature and date to certify the accuracy of the information provided.

Quick guide on how to complete 2020 form 3805v net operation loss nol computation and nol

Prepare Form 3805V, Net Operation Loss NOL Computation And NOL effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 3805V, Net Operation Loss NOL Computation And NOL on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered processes today.

How to modify and eSign Form 3805V, Net Operation Loss NOL Computation And NOL with ease

- Find Form 3805V, Net Operation Loss NOL Computation And NOL and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting documents. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 3805V, Net Operation Loss NOL Computation And NOL to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 3805v net operation loss nol computation and nol

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3805v net operation loss nol computation and nol

The way to make an e-signature for your PDF online

The way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the 3805v and how does it work?

The 3805v is a powerful feature of airSlate SignNow that enables businesses to digitally sign and send documents with ease. It streamlines the signing process, allowing users to create, send, and receive signed documents efficiently. With the 3805v, you can ensure secure and legally binding signatures in minutes.

-

How much does the 3805v feature cost?

Pricing for the 3805v feature within airSlate SignNow varies based on the selected subscription plan. airSlate offers a range of options to suit different business needs, making it a cost-effective solution. You can visit our pricing page for the most accurate and up-to-date information about costs associated with the 3805v.

-

What benefits does the 3805v offer for businesses?

The 3805v provides numerous benefits such as increased efficiency, reduced paperwork, and improved workflow. By using airSlate SignNow's 3805v feature, your team can save time on document handling and enhance collaboration. Additionally, the 3805v ensures that your documents are secure and compliant with industry regulations.

-

What features are included with the 3805v?

The 3805v includes features such as customizable templates, bulk sending, and real-time tracking of document status. These capabilities make it easy for users to manage documents and monitor the signing process. With the 3805v, you can also integrate your documents with other platforms for a seamless experience.

-

Can the 3805v integrate with other software?

Yes, the 3805v seamlessly integrates with various software applications, enhancing your workflow. With integrations available for CRM systems, cloud storage services, and project management tools, the 3805v fits well into any business environment. This versatility allows users to leverage existing tools while utilizing airSlate SignNow.

-

Is the 3805v secure for sensitive documents?

Absolutely, the 3805v prioritizes security by employing advanced encryption and authentication methods. This ensures that all documents signed using airSlate SignNow’s 3805v feature are protected from unauthorized access. Your sensitive information remains confidential and compliant with data protection regulations.

-

How can I get started with the 3805v?

Getting started with the 3805v is simple—just sign up for an airSlate SignNow account and explore the features available. Our user-friendly interface makes it easy to navigate and utilize the 3805v for your document signing needs. There are also plenty of resources and tutorials to help you make the most out of the 3805v.

Get more for Form 3805V, Net Operation Loss NOL Computation And NOL

Find out other Form 3805V, Net Operation Loss NOL Computation And NOL

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure