Form 12153 Request for a Collection Due Process OrHow to Request a Form 12153 Collection Due Process HearingHow to Request a for 2022-2026

Understanding Form 12153: Request for a Collection Due Process Hearing

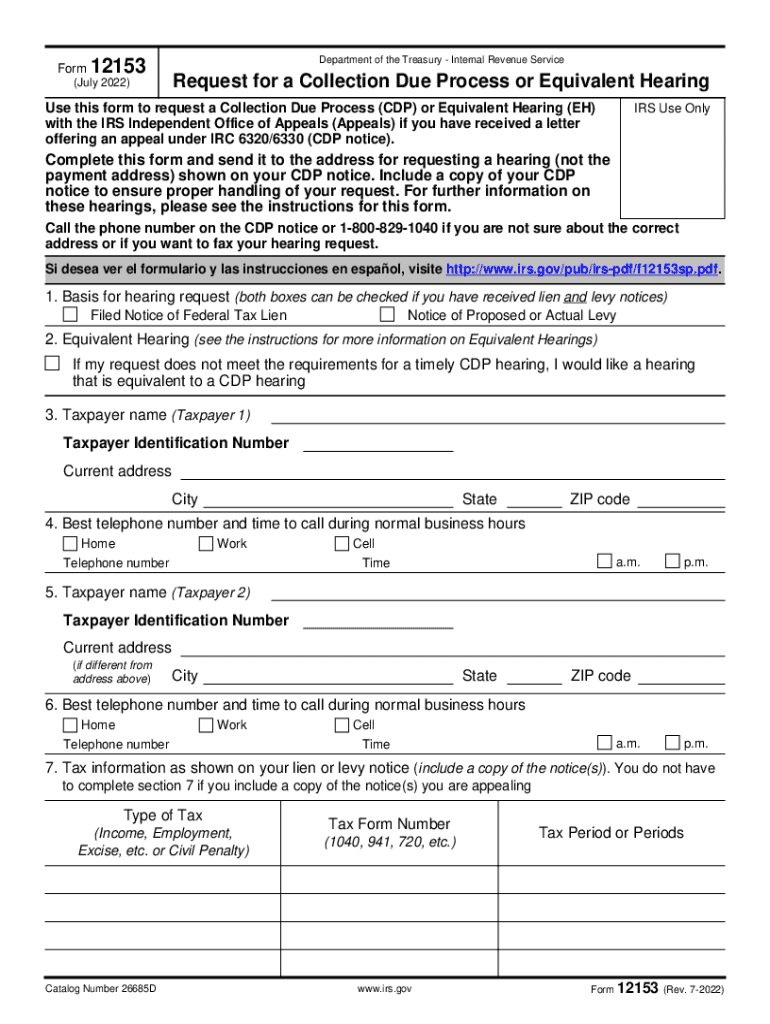

The Form 12153 is a critical document used by taxpayers to request a Collection Due Process (CDP) hearing with the Internal Revenue Service (IRS). This form is essential for individuals who have received a notice of intent to levy or a notice of federal tax lien. By submitting this form, taxpayers can appeal the IRS's collection actions and seek a fair hearing regarding their tax situation.

To be eligible to use Form 12153, taxpayers must act within a specified timeframe after receiving the notice. Typically, this period is thirty days from the date of the notice. Completing this form accurately is vital, as it initiates the process for a hearing where taxpayers can present their case and potentially resolve their tax issues.

Steps to Complete Form 12153

Filling out Form 12153 requires careful attention to detail to ensure that all necessary information is included. Here are the key steps to follow:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of notice you received from the IRS, as this will help clarify the context of your request.

- Provide a detailed explanation of your reasons for requesting a CDP hearing. This section allows you to outline any disputes you have with the IRS's claims.

- Sign and date the form to validate your request. An unsigned form may lead to delays or rejection.

Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Obtaining Form 12153

Taxpayers can easily obtain Form 12153 from the IRS website or through various tax preparation services. The form is available in a fillable PDF format, allowing for straightforward completion online. It is advisable to download the most current version of the form to ensure compliance with the latest IRS guidelines.

Additionally, taxpayers can also request a physical copy of the form by contacting the IRS directly or visiting a local IRS office. Having the correct version of Form 12153 is crucial for a successful hearing request.

Legal Use of Form 12153

Form 12153 serves a specific legal purpose within the framework of tax law. By submitting this form, taxpayers are asserting their rights to challenge IRS collection actions. The legal basis for using this form is rooted in the Internal Revenue Code, which provides taxpayers with the opportunity to appeal decisions made by the IRS regarding tax liabilities.

It is important to understand that submitting this form does not guarantee a favorable outcome. However, it does provide a structured process for taxpayers to present their case and potentially reach a resolution.

IRS Guidelines for Form 12153

The IRS has established guidelines that govern the use and submission of Form 12153. These guidelines outline the eligibility criteria, required documentation, and the procedures for requesting a CDP hearing. Taxpayers should familiarize themselves with these guidelines to ensure compliance and to enhance their chances of a successful hearing.

Key aspects of the guidelines include the timeframe for submission, the types of notices that qualify for a hearing, and the information required to substantiate the request. Adhering to these guidelines is essential for a smooth process.

Filing Deadlines for Form 12153

Timeliness is crucial when submitting Form 12153. Taxpayers must file the form within thirty days of receiving the IRS notice of intent to levy or lien. Missing this deadline can result in the loss of the right to a CDP hearing, making it imperative to act quickly.

In some cases, taxpayers may be able to request an extension, but this is not guaranteed. Therefore, it is advisable to complete and submit the form as soon as possible after receiving the notice.

Quick guide on how to complete form 12153 request for a collection due process orhow to request a form 12153 collection due process hearinghow to request a

Easily Prepare Form 12153 Request For A Collection Due Process OrHow To Request A Form 12153 Collection Due Process HearingHow To Request A For on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Form 12153 Request For A Collection Due Process OrHow To Request A Form 12153 Collection Due Process HearingHow To Request A For on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Form 12153 Request For A Collection Due Process OrHow To Request A Form 12153 Collection Due Process HearingHow To Request A For Effortlessly

- Obtain Form 12153 Request For A Collection Due Process OrHow To Request A Form 12153 Collection Due Process HearingHow To Request A For and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 12153 Request For A Collection Due Process OrHow To Request A Form 12153 Collection Due Process HearingHow To Request A For to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 12153 request for a collection due process orhow to request a form 12153 collection due process hearinghow to request a

Create this form in 5 minutes!

People also ask

-

What is the IRS tax equivalent download feature in airSlate SignNow?

The IRS tax equivalent download feature in airSlate SignNow allows users to obtain necessary tax documentation effortlessly. This feature streamlines the process of managing and signing tax forms, ensuring compliance with IRS requirements. By utilizing this tool, businesses can simplify their tax management tasks.

-

How much does the IRS tax equivalent download feature cost?

The pricing for airSlate SignNow varies based on the subscription plan you choose, which includes access to the IRS tax equivalent download feature. Plans are designed to meet various business needs and budgets, making it a cost-effective solution. For specific pricing details, visit our website or contact our sales team.

-

What are the main benefits of using airSlate SignNow for IRS tax equivalent downloads?

Using airSlate SignNow for IRS tax equivalent downloads provides several benefits, including increased efficiency, reduced paperwork, and enhanced document security. This tool helps businesses stay organized and maintain accurate records of tax-related documents. Additionally, it simplifies the eSigning process, saving you time and effort.

-

Can I integrate airSlate SignNow with other software for IRS tax equivalent downloads?

Yes, airSlate SignNow offers integrations with various software platforms, allowing seamless access to IRS tax equivalent downloads. Integrate with popular tools like CRM systems or accounting software to enhance your workflow. This connectivity ensures that all your tax documents are easily manageable and accessible.

-

Is the IRS tax equivalent download secure?

Absolutely! Security is a top priority for airSlate SignNow, and our platform offers robust measures to protect your IRS tax equivalent downloads. We use advanced encryption protocols and secure storage solutions, ensuring that your sensitive tax documents remain confidential and secure at all times.

-

What types of documents can I download using the IRS tax equivalent download feature?

With the IRS tax equivalent download feature, you can access a variety of tax-related documents, including forms and necessary filings. This functionality is designed to assist you in preparing and managing your tax obligations efficiently. Easily prepare for tax season with all relevant documents at your fingertips.

-

How user-friendly is the IRS tax equivalent download process?

The IRS tax equivalent download process in airSlate SignNow is designed with user experience in mind, making it straightforward and intuitive. Users can quickly navigate through the platform to access and download IRS forms. Even those with minimal tech skills can easily utilize this feature without any hassle.

Get more for Form 12153 Request For A Collection Due Process OrHow To Request A Form 12153 Collection Due Process HearingHow To Request A For

- Revised uniform anatomical gift act donation kentucky

- Employment hiring process package kentucky form

- Kentucky anatomical form

- Employment or job termination package kentucky form

- Newly widowed individuals package kentucky form

- Employment interview package kentucky form

- Employment employee personnel file package kentucky form

- Assignment of mortgage package kentucky form

Find out other Form 12153 Request For A Collection Due Process OrHow To Request A Form 12153 Collection Due Process HearingHow To Request A For

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien