Irs Form 12153 Fill in 2011

What is the IRS Form 12153 Fill In

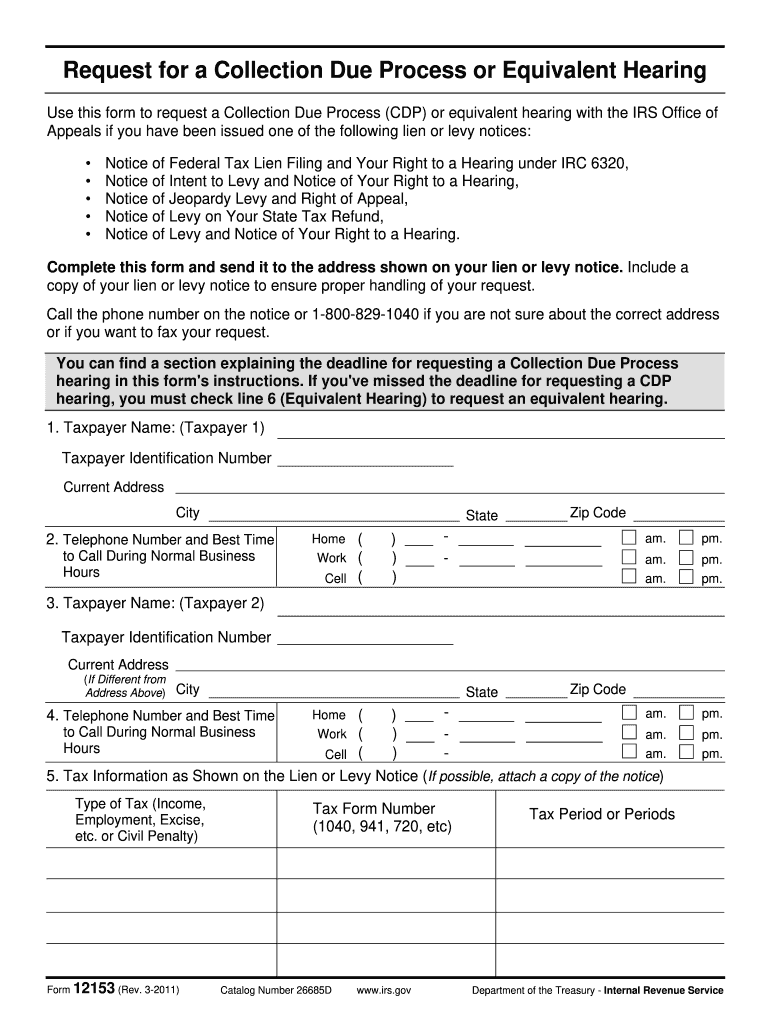

The IRS Form 12153, also known as the Request for a Collection Due Process or Equivalent Hearing, is a crucial document for taxpayers facing collection actions from the IRS. This form allows individuals to request a hearing regarding the IRS's intent to levy or garnish wages. By submitting this form, taxpayers can dispute the IRS's actions and seek a resolution before further collection measures are taken. Understanding this form is essential for anyone who wishes to protect their rights and ensure compliance with tax regulations.

How to Use the IRS Form 12153 Fill In

Using the IRS Form 12153 involves a straightforward process. First, you need to download the form from the IRS website or obtain it from a tax professional. Once you have the form, fill it out completely, providing accurate information about your identity, tax situation, and the specific issues you wish to contest. It is important to clearly state your reasons for requesting a hearing and any supporting documentation that may strengthen your case. After completing the form, submit it to the appropriate IRS office, ensuring you keep a copy for your records.

Steps to Complete the IRS Form 12153 Fill In

Completing the IRS Form 12153 requires attention to detail. Follow these steps to ensure accuracy:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of notice you received from the IRS that prompted your request for a hearing.

- Clearly explain your reasons for disputing the IRS's actions in the designated section.

- Attach any relevant documents that support your case, such as payment records or correspondence with the IRS.

- Review the completed form for any errors before submitting it to the IRS.

Legal Use of the IRS Form 12153 Fill In

The IRS Form 12153 is legally recognized as a formal request for a hearing, making it an essential tool for taxpayers. When completed correctly and submitted within the appropriate timeframe, it protects your rights against aggressive collection actions. The form must be filed within thirty days of receiving a notice of intent to levy to ensure that you can contest the IRS's decision effectively. Understanding the legal implications of this form is vital to navigating the tax system and safeguarding your financial interests.

Form Submission Methods

Submitting the IRS Form 12153 can be done through various methods. Taxpayers have the option to file the form by mail, sending it directly to the IRS office indicated on the notice they received. Alternatively, some taxpayers may choose to submit the form in person at their local IRS office. It is crucial to ensure that the form is sent to the correct address and that you keep a copy of the submission for your records. Digital submission options are not currently available for this form, so traditional methods remain the standard.

Filing Deadlines / Important Dates

Filing the IRS Form 12153 within the specified deadlines is critical for maintaining your rights. The form must be submitted within thirty days of receiving a notice of intent to levy or seize property. Missing this deadline may result in the loss of your right to a hearing, making it essential to act promptly. Keeping track of these important dates ensures that you can effectively challenge any IRS actions against you.

Quick guide on how to complete irs form 12153 fill in 2011

Complete Irs Form 12153 Fill In effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Irs Form 12153 Fill In on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Irs Form 12153 Fill In effortlessly

- Obtain Irs Form 12153 Fill In and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, cumbersome form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 12153 Fill In to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 12153 fill in 2011

Create this form in 5 minutes!

How to create an eSignature for the irs form 12153 fill in 2011

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is Irs Form 12153 Fill In used for?

Irs Form 12153 Fill In is a request form to appeal a tax decision made by the IRS. It allows taxpayers to contest certain IRS actions and provides essential information for their case. Properly completing this form can signNowly influence the outcome of your appeal.

-

How can airSlate SignNow assist with Irs Form 12153 Fill In?

airSlate SignNow allows you to easily create, fill out, and eSign Irs Form 12153 Fill In within minutes. Our platform simplifies the complex process of document management, ensuring your forms are submitted accurately and securely. You'll save time while ensuring compliance with IRS requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to fit various business needs, starting with a free trial. The pricing is designed to provide cost-effective solutions for sending and eSigning documents, including forms like Irs Form 12153 Fill In. Choose the plan that works best for your organization, and upgrade as needed.

-

Can I integrate airSlate SignNow with other tools and software?

Yes, airSlate SignNow offers numerous integrations with popular platforms such as Salesforce, Google Drive, and Microsoft Office. This capability allows you to seamlessly manage your documents and easily process Irs Form 12153 Fill In alongside your existing tools. Integration ensures your workflow remains efficient and organized.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents provides increased efficiency and security. With our intuitive interface, you'll find it easy to navigate through forms like Irs Form 12153 Fill In. Additionally, electronic signatures are legally binding and expedite the review process, allowing you to focus on what matters most.

-

Is airSlate SignNow compliant with legal requirements?

Yes, airSlate SignNow complies with all necessary legal requirements for electronic signatures and document management. Our platform ensures that documents like Irs Form 12153 Fill In are processed in accordance with federal laws. You can confidently use our services, knowing you are protected and compliant.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your documents. This ensures that forms like Irs Form 12153 Fill In remain confidential and safeguarded against unauthorized access. Your data security is our top priority.

Get more for Irs Form 12153 Fill In

- Ga intent form

- Letter tenant rent 497303717 form

- Harassment 497303718 form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children georgia form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure georgia form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497303721 form

- Georgia unearned application form

- Ga tenant form

Find out other Irs Form 12153 Fill In

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation