Form 540 Schedule D "California Capital Gain or Loss Adjustment 2022-2026

Understanding the 2020 Schedule D Form

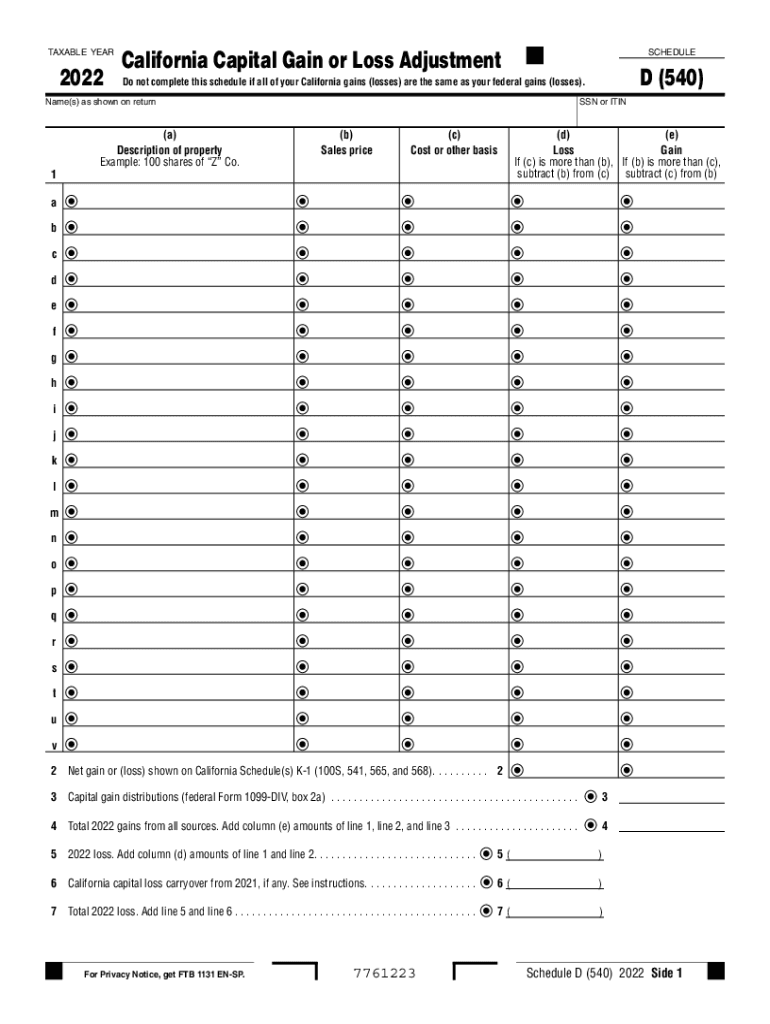

The 2020 Schedule D form, also known as the California Capital Gain or Loss Adjustment, is a crucial document for taxpayers in the United States. This form is used to report capital gains and losses from the sale of assets, such as stocks, bonds, and real estate. It helps individuals calculate their taxable income and determine their tax liability. Understanding how to properly fill out this form is essential for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the 2020 Schedule D Form

Completing the 2020 Schedule D form requires careful attention to detail. Start by gathering all relevant financial documents, including records of asset purchases and sales. Follow these steps:

- List all capital gains and losses from the sale of assets.

- Calculate the total capital gains and losses for the year.

- Determine if any losses can offset gains, following IRS guidelines.

- Complete the relevant sections of the form, ensuring all figures are accurate.

- Review the completed form for any errors before submission.

Key Elements of the 2020 Schedule D Form

The 2020 Schedule D form consists of several key sections that taxpayers must understand. These include:

- Short-term gains and losses: Report gains and losses from assets held for one year or less.

- Long-term gains and losses: Report gains and losses from assets held for more than one year.

- Net capital gain or loss: Calculate the overall gain or loss for the year, which affects tax liability.

- Carryover amounts: Include any capital losses from prior years that can be applied to the current year's gains.

Legal Use of the 2020 Schedule D Form

The 2020 Schedule D form is legally binding when filled out correctly and submitted to the IRS. It is essential to adhere to all IRS guidelines to ensure that the form is accepted. Any inaccuracies or omissions can lead to penalties or audits. Using a reliable electronic signature platform can enhance the legal validity of the document, ensuring compliance with eSignature laws.

Filing Deadlines for the 2020 Schedule D Form

Timely filing of the 2020 Schedule D form is critical to avoid penalties. The standard deadline for submitting this form is typically April fifteenth of the following tax year. However, if you file for an extension, you may have until October fifteenth to submit your tax return, including the Schedule D. It is important to keep track of these dates to ensure compliance.

Examples of Using the 2020 Schedule D Form

Understanding practical scenarios can help clarify how to use the 2020 Schedule D form effectively. For instance:

- A taxpayer sells stock purchased for $1,000 for $1,500, resulting in a $500 gain.

- A homeowner sells a rental property for $300,000, having purchased it for $250,000, leading to a $50,000 gain.

- Offsetting a $5,000 capital gain with a $2,000 capital loss from another investment.

These examples illustrate how to report gains and losses accurately and the importance of maintaining detailed records for each transaction.

Quick guide on how to complete form 540 schedule d ampquotcalifornia capital gain or loss adjustment

Effortlessly Prepare Form 540 Schedule D "California Capital Gain Or Loss Adjustment on Any Device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 540 Schedule D "California Capital Gain Or Loss Adjustment on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form 540 Schedule D "California Capital Gain Or Loss Adjustment with Ease

- Retrieve Form 540 Schedule D "California Capital Gain Or Loss Adjustment and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 540 Schedule D "California Capital Gain Or Loss Adjustment and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 540 schedule d ampquotcalifornia capital gain or loss adjustment

Create this form in 5 minutes!

People also ask

-

What is the 2020 Schedule D Form and why is it important?

The 2020 Schedule D Form is used to report capital gains and losses from the sale of assets. It is crucial for taxpayers to accurately report their financial activities to ensure compliance with IRS regulations. This form can signNowly impact your tax liability, making it essential for accurate financial planning.

-

How can airSlate SignNow assist with the 2020 Schedule D Form?

AirSlate SignNow streamlines the process of preparing and signing the 2020 Schedule D Form. With our eSignature capabilities, you can easily send the form for signatures, ensuring that your documents are legally binding and securely archived. Our platform simplifies the workflow, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the 2020 Schedule D Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different user needs and budgets. You can choose a plan that fits your requirements while utilizing our tools for the 2020 Schedule D Form. Our platform is designed to be cost-effective, providing great value for your eSigning needs.

-

Can I integrate airSlate SignNow with other accounting software for my 2020 Schedule D Form?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software solutions, making it easy to manage your 2020 Schedule D Form alongside your financial documents. These integrations enhance your workflow, allowing for automatic data transfer and better document management.

-

What features does airSlate SignNow offer for the 2020 Schedule D Form?

AirSlate SignNow provides features like customizable templates, bulk sending, and secure storage specifically tailored for the 2020 Schedule D Form. You can create a streamlined signing process and track document status in real time. This makes managing your tax documents efficient and straightforward.

-

Is airSlate SignNow user-friendly for preparing the 2020 Schedule D Form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to prepare the 2020 Schedule D Form. The intuitive interface allows users to navigate seamlessly through the signing process without needing extensive technical skills. Our goal is to empower businesses to manage their documentation effortlessly.

-

How does airSlate SignNow ensure the security of my 2020 Schedule D Form?

AirSlate SignNow prioritizes security by implementing industry-leading encryption protocols for all documents, including the 2020 Schedule D Form. Your sensitive information is protected throughout the signing and storage processes. We also adhere to compliance regulations, ensuring your documents are safe and secure.

Get more for Form 540 Schedule D "California Capital Gain Or Loss Adjustment

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497323034 form

- Landlord tenant damage form

- Ok landlord tenant form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497323037 form

- Letter from tenant to landlord about insufficient notice of rent increase oklahoma form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease oklahoma form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase oklahoma form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant oklahoma form

Find out other Form 540 Schedule D "California Capital Gain Or Loss Adjustment

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF