California Form 540 Schedule D California Capital Gain or 2020

What is the California Form 540 Schedule D?

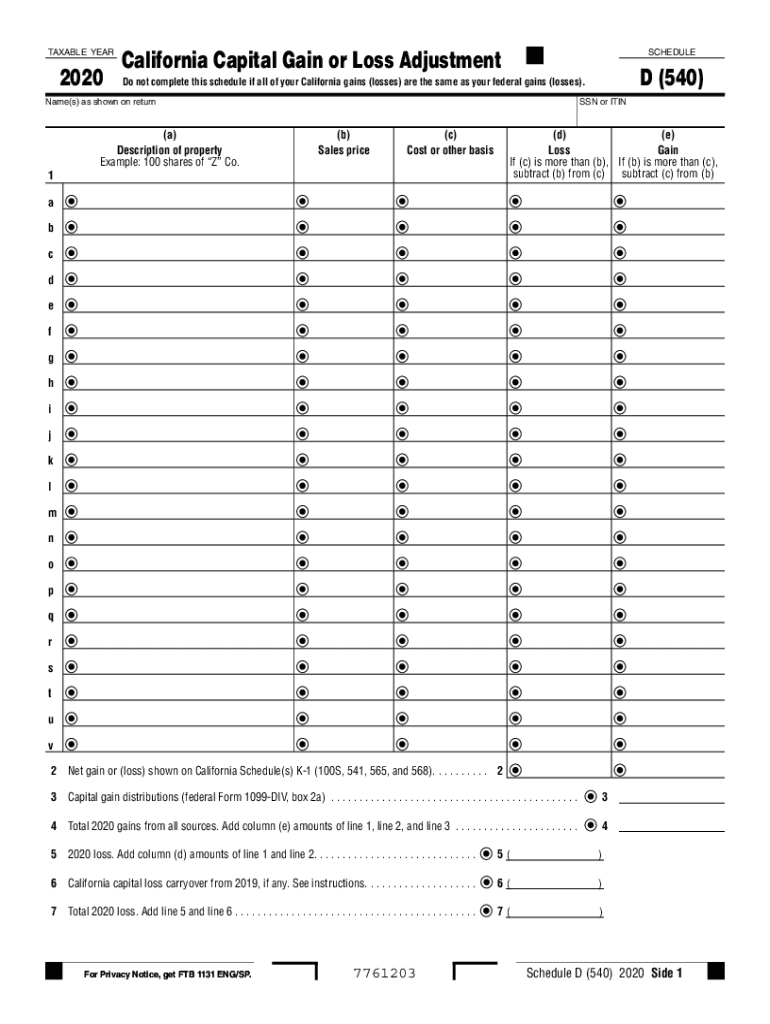

The California Form 540 Schedule D is a tax form used to report capital gains and losses for individuals filing their California state income tax returns. This form is essential for taxpayers who have sold assets such as stocks, bonds, or real estate during the tax year, as it helps determine the taxable income from these transactions. Understanding the purpose of Schedule D is crucial for accurate tax reporting and compliance with state regulations.

Steps to Complete the California Form 540 Schedule D

Completing the California Form 540 Schedule D involves several steps to ensure accurate reporting of capital gains and losses. Here is a simplified process:

- Gather necessary documents, including records of asset purchases, sales, and any associated costs.

- Determine the type of assets sold and categorize them as short-term or long-term based on the holding period.

- Calculate the gain or loss for each asset by subtracting the purchase price from the sale price.

- Complete the form by entering the total gains and losses in the appropriate sections.

- Transfer the net gain or loss to your California Form 540 for overall tax calculation.

Legal Use of the California Form 540 Schedule D

The California Form 540 Schedule D must be completed according to state tax laws to ensure it is legally binding. It is important to provide accurate information, as discrepancies can lead to penalties or audits. The form complies with the California Revenue and Taxation Code, which governs the reporting of capital gains and losses. Using reliable electronic tools, like signNow, can help ensure that the form is filled out correctly and securely.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 540 Schedule D align with the overall tax return deadlines. Typically, individual taxpayers must file their California income tax returns by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to keep track of any changes to filing dates to avoid late penalties.

Examples of Using the California Form 540 Schedule D

Taxpayers may encounter various scenarios requiring the use of the California Form 540 Schedule D. For instance, if an individual sells stocks they purchased for $1,000 for $1,500, they would report a $500 capital gain. Conversely, if they sold a property for $200,000 that they bought for $250,000, they would report a $50,000 capital loss. These examples illustrate the importance of accurately reporting both gains and losses on the form.

Required Documents for California Form 540 Schedule D

To complete the California Form 540 Schedule D, taxpayers should gather several key documents, including:

- Purchase and sale records for all assets sold during the tax year.

- Documentation of any improvements made to properties, as these can affect the cost basis.

- Statements from financial institutions showing transactions related to stocks or bonds.

- Any previous tax returns that may provide context for carryover losses.

Quick guide on how to complete california form 540 schedule d california capital gain or

Effortlessly Prepare California Form 540 Schedule D California Capital Gain Or on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage California Form 540 Schedule D California Capital Gain Or on any device using airSlate SignNow's Android or iOS applications, and enhance any document-oriented process today.

The Easiest Way to Edit and Electronically Sign California Form 540 Schedule D California Capital Gain Or

- Obtain California Form 540 Schedule D California Capital Gain Or and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign California Form 540 Schedule D California Capital Gain Or to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 540 schedule d california capital gain or

Create this form in 5 minutes!

How to create an eSignature for the california form 540 schedule d california capital gain or

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the schedule d 540 used for?

The schedule d 540 is used to report capital gains and losses for California state tax purposes. It helps individuals and businesses accurately track their investment activities, ensuring compliance with state regulations. Understanding how to fill out this form is crucial for anyone experiencing gains or losses in their investments.

-

How can airSlate SignNow help with completing a schedule d 540?

airSlate SignNow streamlines the process of filling out a schedule d 540 by allowing users to eSign documents securely and efficiently. Our platform provides templates and integration options to simplify tax preparation for professionals and individuals alike. This ensures that your schedule d 540 is completed correctly and filed on time.

-

Is there a cost associated with using airSlate SignNow for schedule d 540?

Yes, airSlate SignNow offers a cost-effective subscription model that can support the needs of individuals and businesses dealing with the schedule d 540. Various pricing tiers are available to ensure that you only pay for the features that you need. Investing in airSlate SignNow can ultimately save you time and reduce errors in your tax filings.

-

Can I integrate airSlate SignNow with other tax software for schedule d 540?

Absolutely! airSlate SignNow offers seamless integration with various tax software, making the process of dealing with your schedule d 540 much easier. This enables clients to sync their data efficiently, enhancing productivity while ensuring all necessary documents are signed and stored securely.

-

What features does airSlate SignNow offer for handling the schedule d 540?

airSlate SignNow provides features such as document tracking, customizable templates, and secure eSigning, all of which are beneficial when handling your schedule d 540. Additionally, our intuitive interface makes it easier to manage documents and ensure every step of the filing process is streamlined for you. These features are designed to save you time and enhance accuracy.

-

How does eSigning help with the schedule d 540?

eSigning simplifies the process of completing your schedule d 540 because you can gather signatures remotely, eliminating the need for printing and scanning documents. With airSlate SignNow, you can securely sign and send your tax forms in just a few clicks, ensuring compliance and minimizing delays. This digital approach also enhances the security and integrity of your sensitive financial information.

-

What are the benefits of using airSlate SignNow for tax filings including the schedule d 540?

Using airSlate SignNow for tax filings such as the schedule d 540 offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform provides a comprehensive solution for document management that can signNowly simplify the filing process. Many users experience reduced errors and faster processing times, allowing for a smoother tax experience.

Get more for California Form 540 Schedule D California Capital Gain Or

Find out other California Form 540 Schedule D California Capital Gain Or

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online