Form it 203 S ATT Attachment to Form it 203 S Tax Year 2022

What is the Form IT 203 S ATT Attachment To Form IT 203 S Tax Year

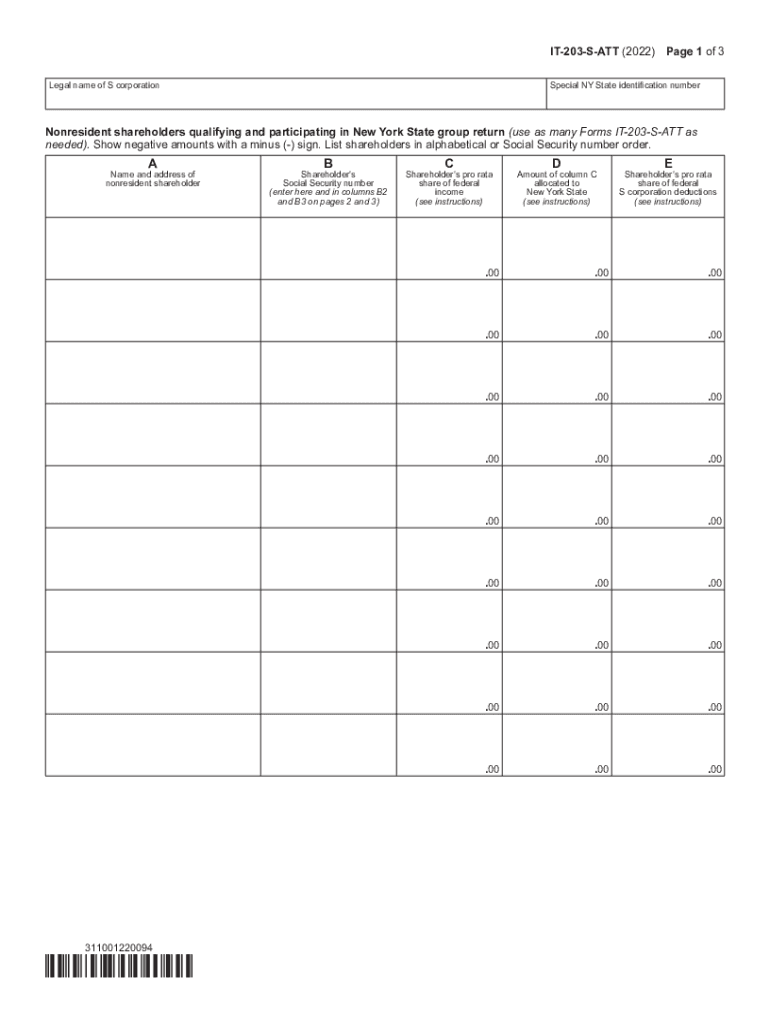

The Form IT 203 S ATT is an attachment to the Form IT 203 S, which is used for filing New York State personal income tax returns for non-residents and part-year residents. This specific attachment provides additional information regarding income earned in New York and any applicable credits or deductions. It is essential for accurately reporting income and ensuring compliance with state tax regulations.

Steps to complete the Form IT 203 S ATT Attachment To Form IT 203 S Tax Year

Completing the Form IT 203 S ATT requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documents, including W-2s and 1099s, that report income earned in New York.

- Fill out the basic information section, including your name, address, and Social Security number.

- Report your New York source income, ensuring you include all relevant figures from your documentation.

- Calculate any applicable deductions or credits that may apply to your situation.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form IT 203 S ATT Attachment To Form IT 203 S Tax Year

The Form IT 203 S ATT is legally recognized by the New York State Department of Taxation and Finance. To ensure its legal validity, it must be completed accurately and submitted by the appropriate deadline. Electronic signatures are accepted, provided they comply with state eSignature laws. Utilizing a reliable eSignature platform can help maintain compliance and ensure the document is legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 S ATT are typically aligned with the federal tax filing deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following year. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the Form IT 203 S ATT, you will need several documents:

- W-2 forms from employers reporting New York income.

- 1099 forms for any additional income sources.

- Records of any deductions or credits you plan to claim.

- Identification documents, such as your Social Security number.

Examples of using the Form IT 203 S ATT Attachment To Form IT 203 S Tax Year

This form is commonly used by individuals who have earned income in New York but reside in another state. For instance, a freelancer living in New Jersey who provides services to clients in New York would use the Form IT 203 S ATT to report their New York income. Similarly, part-time residents who earn income while temporarily living in New York must also complete this attachment to accurately report their earnings.

Quick guide on how to complete form it 203 s att attachment to form it 203 s tax year 2022

Complete Form IT 203 S ATT Attachment To Form IT 203 S Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Administer Form IT 203 S ATT Attachment To Form IT 203 S Tax Year on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Form IT 203 S ATT Attachment To Form IT 203 S Tax Year with ease

- Find Form IT 203 S ATT Attachment To Form IT 203 S Tax Year and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate issues of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form IT 203 S ATT Attachment To Form IT 203 S Tax Year to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 s att attachment to form it 203 s tax year 2022

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's att and how does it benefit my business?

airSlate SignNow's att offers a seamless way to manage electronic signatures and document workflows. By using our platform, businesses can easily send, sign, and store documents securely in one place. This not only streamlines operations but also enhances productivity and reduces paper waste.

-

How much does airSlate SignNow's att cost?

airSlate SignNow offers a variety of pricing plans to accommodate different business sizes and needs. Our plans come with flexible monthly and annual subscriptions, allowing businesses to choose the best option. Each plan includes essential features to maximize your document management efficiency.

-

What features does airSlate SignNow's att include?

airSlate SignNow's att includes a range of features such as customizable templates, document sharing, and real-time tracking of signatures. Additionally, users can integrate the platform with popular applications for enhanced workflow automation. These features make it easier to manage documents from start to finish.

-

Can I integrate airSlate SignNow's att with other software?

Yes, airSlate SignNow's att supports integrations with various software applications like Google Workspace, Salesforce, and Microsoft Teams. This allows for a more cohesive workflow and better collaboration across different platforms. Integrating these tools can help optimize your business processes.

-

Is airSlate SignNow's att secure for sensitive documents?

Absolutely, airSlate SignNow's att is designed with security in mind. We implement advanced encryption protocols and adhere to industry standards to ensure your documents are protected. This makes it a reliable choice for businesses handling sensitive information.

-

How can airSlate SignNow's att improve my team's efficiency?

By utilizing airSlate SignNow's att, your team can streamline the document signing process, reducing turnaround times dramatically. The user-friendly interface ensures that team members can quickly learn how to use it, leading to faster deployment of documents for signing. This increased efficiency can signNowly enhance overall productivity.

-

What support options are available for airSlate SignNow's att users?

AirSlate SignNow's att offers comprehensive support options including live chat, email support, and a detailed help center. Our customer service team is dedicated to helping users navigate and make the most of our platform. Additionally, we provide helpful resources and tutorials for self-guided learning.

Get more for Form IT 203 S ATT Attachment To Form IT 203 S Tax Year

- Oklahoma rent eviction form

- Title 82waters and water rights 2006 oklahoma code form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property oklahoma form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497323080 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property oklahoma form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential oklahoma form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property oklahoma form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497323084 form

Find out other Form IT 203 S ATT Attachment To Form IT 203 S Tax Year

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed