Withholding Tax Forms 20232024 Current Period Tax NY Gov 2023-2026

Understanding Withholding Tax Forms 2

The Withholding Tax Forms for the 2 period are essential documents used by employers in New York to report and remit taxes withheld from employee wages. These forms ensure compliance with federal and state tax regulations. They typically include information about the employee's earnings and the amount of tax withheld, which is crucial for both the employer's and employee's tax records. Understanding these forms is vital for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Withholding Tax Forms 2

Completing the Withholding Tax Forms involves several key steps:

- Gather necessary information, including employee details, wages, and withholding allowances.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check the calculations for the amount of tax withheld to avoid errors.

- Sign and date the form where indicated, confirming the accuracy of the information provided.

Following these steps will help ensure that the forms are completed correctly, minimizing the risk of issues with tax authorities.

Obtaining Withholding Tax Forms 2

Employers can obtain the Withholding Tax Forms through the New York State Department of Taxation and Finance website. The forms are typically available for download in PDF format, allowing for easy access and printing. Additionally, employers may contact the department directly for assistance or to request physical copies of the forms if needed.

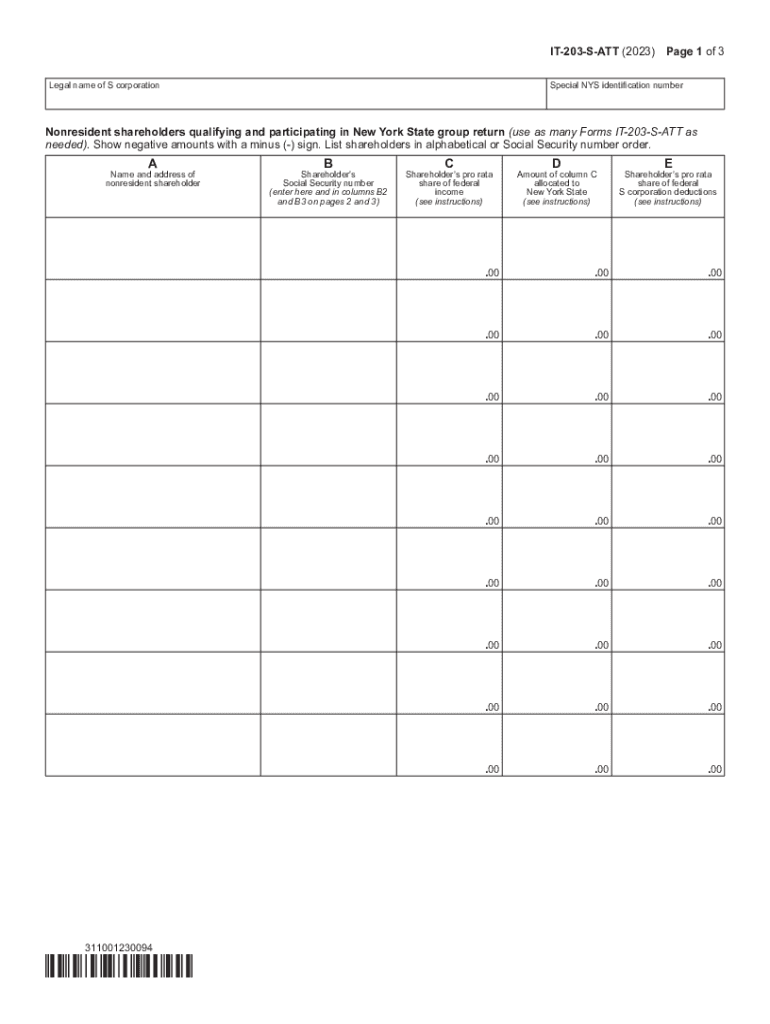

Key Elements of the Withholding Tax Forms 2

Key elements of the Withholding Tax Forms include:

- Employee identification information, such as name and Social Security number.

- Employer details, including name and Employer Identification Number (EIN).

- Wage information, detailing the total earnings for the period.

- Withholding amounts, specifying the total tax withheld from the employee's pay.

These elements are crucial for ensuring that the forms are filled out correctly and that the tax amounts reported are accurate.

Filing Deadlines for Withholding Tax Forms 2

Filing deadlines for the Withholding Tax Forms are typically set by the New York State Department of Taxation and Finance. Employers should be aware of these deadlines to ensure timely submission and avoid penalties. Generally, forms must be filed quarterly, with specific due dates for each quarter. Keeping track of these deadlines is essential for maintaining compliance with tax regulations.

Penalties for Non-Compliance with Withholding Tax Forms 2

Failure to comply with the requirements for the Withholding Tax Forms can result in significant penalties. These may include fines for late filing, incorrect reporting, or failure to withhold the correct amount of tax from employee wages. Employers should take care to adhere to all regulations to avoid these financial repercussions and ensure a smooth tax reporting process.

Quick guide on how to complete withholding tax forms 20232024 current period tax ny gov

Effortlessly Prepare Withholding Tax Forms 20232024 Current Period Tax NY gov on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Withholding Tax Forms 20232024 Current Period Tax NY gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Modify and eSign Withholding Tax Forms 20232024 Current Period Tax NY gov with Ease

- Find Withholding Tax Forms 20232024 Current Period Tax NY gov and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose how you'd like to send your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Withholding Tax Forms 20232024 Current Period Tax NY gov to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding tax forms 20232024 current period tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the withholding tax forms 20232024 current period tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to Withholding Tax Forms 20232024 Current Period Tax NY gov?

airSlate SignNow offers a seamless solution for businesses to electronically sign and manage Withholding Tax Forms 20232024 Current Period Tax NY gov. Key features include customizable templates, document tracking, and secure storage, ensuring compliance and efficiency in handling tax documents.

-

How does airSlate SignNow simplify the process of managing Withholding Tax Forms 20232024 Current Period Tax NY gov?

The platform streamlines the management of Withholding Tax Forms 20232024 Current Period Tax NY gov by allowing users to create, send, and eSign documents electronically. This reduces paper usage, speeds up the filing process, and ensures that all necessary forms are completed correctly and on time.

-

Is airSlate SignNow cost-effective for handling Withholding Tax Forms 20232024 Current Period Tax NY gov?

Yes, airSlate SignNow provides a cost-effective solution for businesses of all sizes to handle Withholding Tax Forms 20232024 Current Period Tax NY gov. With flexible pricing plans and no hidden fees, you'll save money while ensuring compliance with tax regulations.

-

How secure is airSlate SignNow for managing Withholding Tax Forms 20232024 Current Period Tax NY gov?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption methods and meets global security standards to ensure that your Withholding Tax Forms 20232024 Current Period Tax NY gov are protected throughout the signing process.

-

What integrations does airSlate SignNow offer for processing Withholding Tax Forms 20232024 Current Period Tax NY gov?

airSlate SignNow integrates seamlessly with a variety of business tools and software, enhancing workflows for handling Withholding Tax Forms 20232024 Current Period Tax NY gov. Popular integrations include CRM systems, accounting software, and cloud storage solutions, allowing for a smooth and efficient user experience.

-

Can airSlate SignNow help with compliance for Withholding Tax Forms 20232024 Current Period Tax NY gov?

Absolutely! airSlate SignNow is designed to help businesses ensure compliance with regulatory requirements for Withholding Tax Forms 20232024 Current Period Tax NY gov. Utilizing electronic signatures and automated workflows can minimize errors and adhere to state regulations effortlessly.

-

What support options are available for users managing Withholding Tax Forms 20232024 Current Period Tax NY gov?

Users of airSlate SignNow have access to comprehensive support options, including live chat, email support, and an extensive knowledge base. Whether you have questions about Withholding Tax Forms 20232024 Current Period Tax NY gov or need assistance with the platform, we’re here to help.

Get more for Withholding Tax Forms 20232024 Current Period Tax NY gov

- California notice public works form

- Attachment to notice of motion or order to show cause form

- Equipment bill of sale printable form

- Pc 212 form

- Jd cv 40a1 form

- Memorandum to depository broward county clerk of court form

- Sample motion for post conviction relief florida form

- Florida family law rules of procedure form 12902c family law financial affidavit 1003

Find out other Withholding Tax Forms 20232024 Current Period Tax NY gov

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile