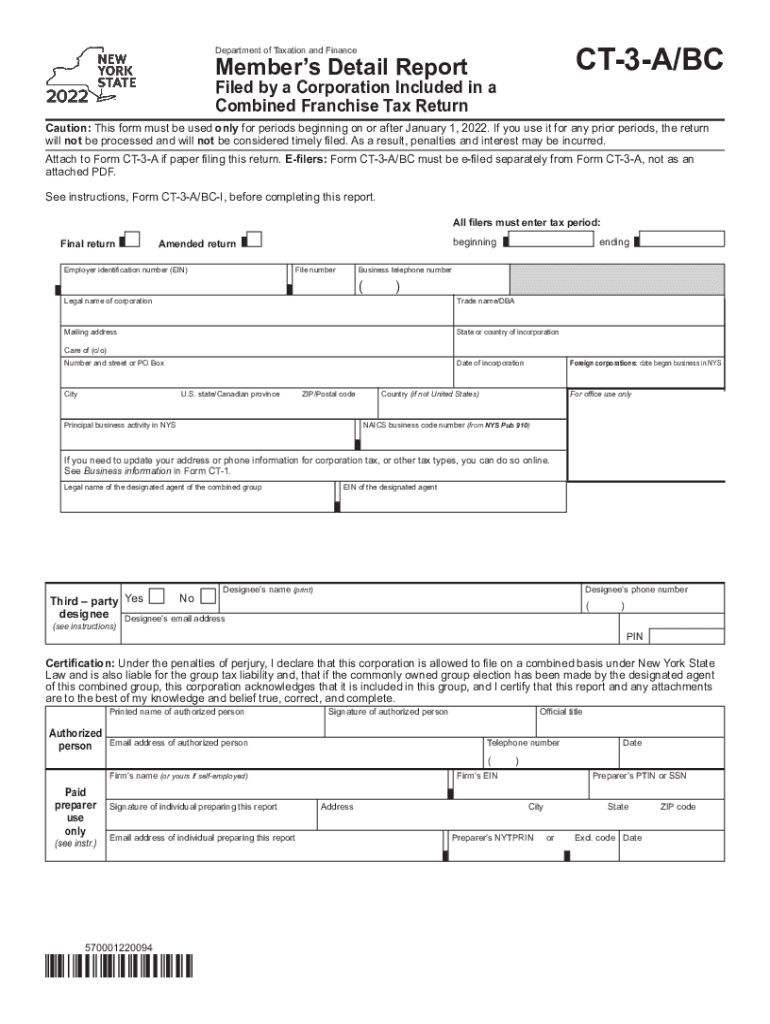

Form CT 3 ABC Member's Detail Report Filed by ADepartment of Taxation and Finance Instructions for FormForm CT 3 ABC Member 2022

What is the Form CT 3 ABC Member's Detail Report?

The Form CT 3 ABC Member's Detail Report is a tax document filed with the Department of Taxation and Finance in the United States. This report is essential for businesses that are part of a combined filing group, allowing them to detail the income, deductions, and credits of each member in the group. This form ensures transparency and compliance with state tax regulations, providing necessary information to calculate the overall tax liability for the combined group.

Steps to Complete the Form CT 3 ABC Member's Detail Report

Completing the Form CT 3 ABC Member's Detail Report involves several key steps:

- Gather necessary financial documents for each member of the combined group.

- Fill out the identification section with the name and identification number of each member.

- Detail the income, deductions, and credits for each member as required by the form.

- Ensure that all calculations are accurate and reflect the financial activities of the members.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Form CT 3 ABC Member's Detail Report

The Form CT 3 ABC Member's Detail Report is legally binding when completed and submitted in accordance with state laws. It must be signed by an authorized representative of the business. The information provided in this form is subject to verification by tax authorities, and inaccuracies can lead to penalties. Therefore, it is crucial to ensure that all information is truthful and complete to avoid legal issues.

Filing Deadlines for the Form CT 3 ABC Member's Detail Report

Filing deadlines for the Form CT 3 ABC Member's Detail Report typically align with the corporate tax return deadlines. Businesses should be aware of the specific due dates to avoid late filing penalties. It is advisable to check the Department of Taxation and Finance website for the most current deadlines and any extensions that may apply.

Form Submission Methods

The Form CT 3 ABC Member's Detail Report can be submitted through various methods:

- Online submission through the Department of Taxation and Finance portal.

- Mailing a paper copy to the appropriate tax office.

- In-person submission at designated tax offices.

Required Documents for the Form CT 3 ABC Member's Detail Report

To complete the Form CT 3 ABC Member's Detail Report, businesses need to gather several documents, including:

- Financial statements for each member of the combined group.

- Previous tax returns to ensure consistency in reporting.

- Records of income, deductions, and credits for accurate reporting.

Quick guide on how to complete form ct 3 abc members detail report filed by adepartment of taxation and finance instructions for formform ct 3 abc members

Effortlessly Prepare Form CT 3 ABC Member's Detail Report Filed By ADepartment Of Taxation And Finance Instructions For FormForm CT 3 ABC Member on Any Device

Managing documents online has surged in popularity among businesses and individuals. It offers an excellent eco-friendly replacement for traditional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Handle Form CT 3 ABC Member's Detail Report Filed By ADepartment Of Taxation And Finance Instructions For FormForm CT 3 ABC Member on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Form CT 3 ABC Member's Detail Report Filed By ADepartment Of Taxation And Finance Instructions For FormForm CT 3 ABC Member with Ease

- Locate Form CT 3 ABC Member's Detail Report Filed By ADepartment Of Taxation And Finance Instructions For FormForm CT 3 ABC Member and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form CT 3 ABC Member's Detail Report Filed By ADepartment Of Taxation And Finance Instructions For FormForm CT 3 ABC Member and maintain effective communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 abc members detail report filed by adepartment of taxation and finance instructions for formform ct 3 abc members

Create this form in 5 minutes!

People also ask

-

What is the purpose of the Form CT 3 ABC Member's Detail Report Filed By A Department Of Taxation And Finance Instructions For Form CT 3 ABC Member's Detail Report Filed By A?

The Form CT 3 ABC Member's Detail Report Filed By A is designed to collect detailed information about members of an S Corporation for tax purposes. This form helps ensure compliance with state taxation regulations and provides vital data to the Department of Taxation and Finance. Properly completing this report can help avoid potential penalties and ensure smoother tax processing.

-

How does airSlate SignNow assist in filing the Form CT 3 ABC Member's Detail Report Filed By A?

airSlate SignNow streamlines the process for submitting the Form CT 3 ABC Member's Detail Report Filed By A by providing an intuitive platform for document preparation and electronic signatures. Users can easily create, modify, and send the report while ensuring all necessary members' details are included. This eliminates paperwork hassles and simplifies compliance efforts.

-

What features does airSlate SignNow offer for the Form CT 3 ABC Member's Detail Report Filed By A?

airSlate SignNow offers features such as customizable templates, electronic signatures, real-time collaboration, and secure storage for documents like the Form CT 3 ABC Member's Detail Report Filed By A. These functionalities enhance efficiency and ensure your reports are filed correctly and on time. Additionally, tracking tools help monitor the status of your submissions.

-

Is airSlate SignNow a cost-effective solution for filing the Form CT 3 ABC Member's Detail Report Filed By A?

Yes, airSlate SignNow is a cost-effective solution for efficiently managing and filing the Form CT 3 ABC Member's Detail Report Filed By A. With competitive pricing plans and eliminating the need for printing and shipping, it ultimately reduces costs associated with document management. Investing in this platform can lead to signNow savings for businesses.

-

Are there any integrations available for filing the Form CT 3 ABC Member's Detail Report Filed By A?

airSlate SignNow offers numerous integrations with popular software, enabling seamless workflows for filing the Form CT 3 ABC Member's Detail Report Filed By A. Whether using accounting software or document management systems, these integrations enhance productivity. Businesses can attach and send reports directly from their existing platforms without any disruptions.

-

What are the benefits of using airSlate SignNow for the Form CT 3 ABC Member's Detail Report Filed By A?

Using airSlate SignNow for the Form CT 3 ABC Member's Detail Report Filed By A offers various benefits, including increased efficiency, enhanced team collaboration, and improved compliance management. Users can complete their reports faster and with fewer errors, which ultimately helps streamline their tax filing process. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Can I track the status of my Form CT 3 ABC Member's Detail Report Filed By A submission using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form CT 3 ABC Member's Detail Report Filed By A submission. You can receive notifications at key stages, ensuring you stay informed about your document's progress. This feature helps in managing deadlines and maintaining transparency in your filing process.

Get more for Form CT 3 ABC Member's Detail Report Filed By ADepartment Of Taxation And Finance Instructions For FormForm CT 3 ABC Member

Find out other Form CT 3 ABC Member's Detail Report Filed By ADepartment Of Taxation And Finance Instructions For FormForm CT 3 ABC Member

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF