Instructions for Forms CT 3 a General Business Corporation 2024-2026

What is the Instructions For Forms CT 3 A General Business Corporation

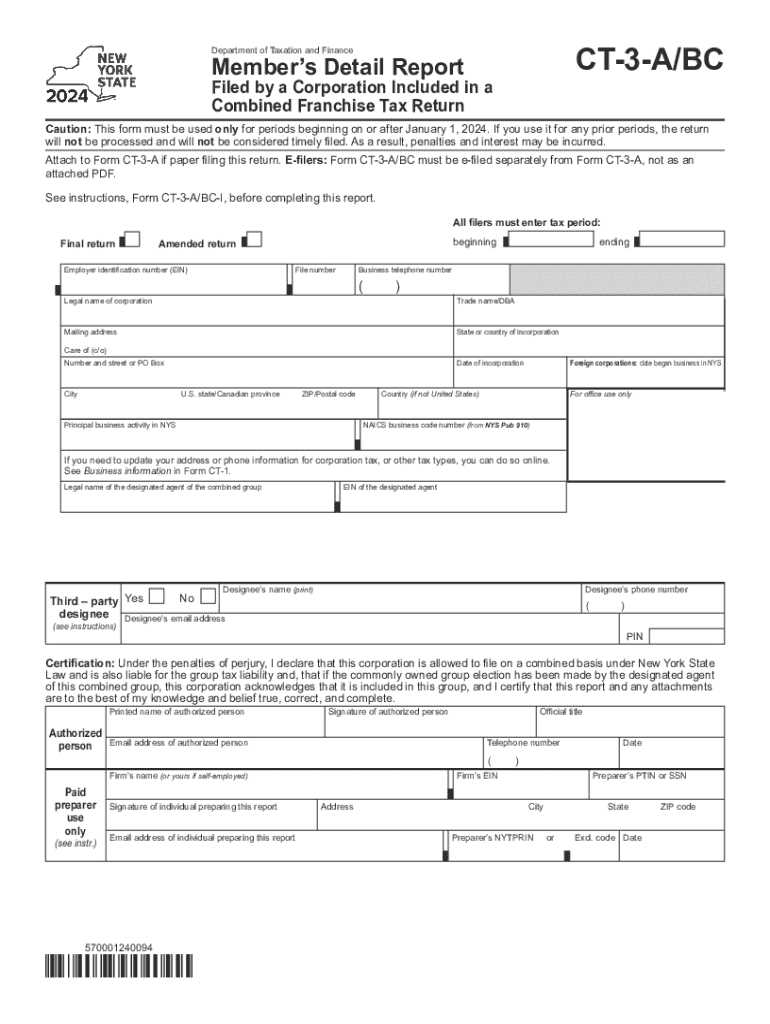

The Instructions For Forms CT 3 A General Business Corporation provide essential guidance for businesses operating as general corporations in the United States. This document outlines the necessary steps and requirements for completing the CT-3A form, which is crucial for reporting corporate income, calculating taxes owed, and ensuring compliance with state regulations. Understanding these instructions is vital for accurate and timely filing.

Steps to complete the Instructions For Forms CT 3 A General Business Corporation

Completing the CT-3A form involves several key steps:

- Gather required financial documents, including income statements and balance sheets.

- Review the instructions thoroughly to understand each section of the form.

- Fill out the form accurately, ensuring all information is current and correct.

- Double-check calculations to avoid errors in tax liability.

- Submit the completed form by the designated deadline to avoid penalties.

Legal use of the Instructions For Forms CT 3 A General Business Corporation

The Instructions For Forms CT 3 A General Business Corporation serve a legal purpose by ensuring that corporations comply with state tax laws. Proper use of these instructions helps businesses avoid legal issues, including fines and penalties for incorrect filings. Adhering to the guidelines ensures that a corporation meets its legal obligations and maintains good standing with state authorities.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines associated with the CT-3A form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. Missing this deadline may result in late fees or penalties, so it is essential to mark these dates on the calendar and prepare in advance.

Required Documents

To successfully complete the CT-3A form, several documents are necessary:

- Financial statements, including profit and loss statements.

- Balance sheets that reflect the corporation's financial position.

- Previous tax returns, if applicable, for reference.

- Any supporting documentation for deductions or credits claimed.

Form Submission Methods (Online / Mail / In-Person)

The CT-3A form can be submitted through various methods to accommodate different preferences:

- Online submission through the state’s tax portal, which offers a convenient and efficient option.

- Mailing a printed version of the form to the designated tax office.

- In-person submission at local tax offices, which may provide immediate assistance if needed.

Create this form in 5 minutes or less

Find and fill out the correct instructions for forms ct 3 a general business corporation

Create this form in 5 minutes!

How to create an eSignature for the instructions for forms ct 3 a general business corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Forms CT 3 A General Business Corporation?

The Instructions For Forms CT 3 A General Business Corporation provide detailed guidance on how to complete the CT-3-A form, which is essential for reporting corporate income in New York. This document outlines the necessary steps, required information, and filing deadlines to ensure compliance with state regulations.

-

How can airSlate SignNow assist with the Instructions For Forms CT 3 A General Business Corporation?

airSlate SignNow simplifies the process of completing and submitting the Instructions For Forms CT 3 A General Business Corporation by allowing users to eSign and send documents securely. Our platform ensures that all necessary forms are filled out correctly and can be submitted directly to the relevant authorities.

-

What features does airSlate SignNow offer for managing corporate documents?

airSlate SignNow offers a range of features including customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing the Instructions For Forms CT 3 A General Business Corporation, ensuring that all documents are organized and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Forms CT 3 A General Business Corporation?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the process of handling the Instructions For Forms CT 3 A General Business Corporation, making it a cost-effective solution for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for managing corporate filings?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing the Instructions For Forms CT 3 A General Business Corporation. This integration allows for better data management and improved efficiency in your corporate filing processes.

-

What are the benefits of using airSlate SignNow for corporate document management?

Using airSlate SignNow for corporate document management, including the Instructions For Forms CT 3 A General Business Corporation, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and compliance, saving you time and resources.

-

How does airSlate SignNow ensure the security of my corporate documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your corporate documents. When handling sensitive information related to the Instructions For Forms CT 3 A General Business Corporation, you can trust that your data is safe and secure.

Get more for Instructions For Forms CT 3 A General Business Corporation

- Letter tenant demand form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises florida form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles florida form

- Florida repairs form

- Letter landlord tenant 497302957 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession florida form

- Fl illegal form

- Letter from landlord to tenant about time of intent to enter premises florida form

Find out other Instructions For Forms CT 3 A General Business Corporation

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template