Form CT 3 ABC Member's Detail Report Filed by a Corporation Included in a Combined Franchise Tax Return Tax Year 2023

What is the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year

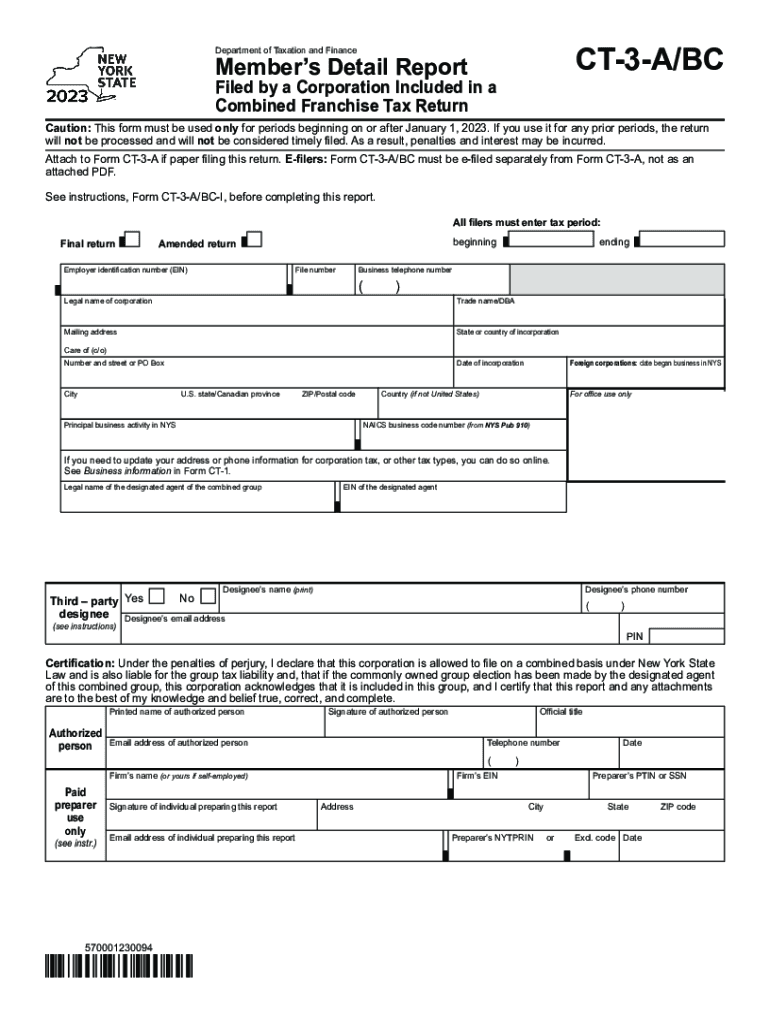

The Form CT 3 ABC Member's Detail Report is a crucial document for corporations that are part of a combined franchise tax return in the United States. This form provides detailed information about each member of the combined group, ensuring compliance with state tax regulations. It is essential for accurately reporting income, deductions, and tax credits associated with each member, which helps in determining the overall tax liability of the combined entity.

Steps to complete the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year

Completing the Form CT 3 ABC requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents for each member of the combined group.

- Fill out the identification section, including the name and taxpayer identification number for each member.

- Report the income and deductions for each member accurately, ensuring that all figures are consistent with the supporting documentation.

- Include any applicable tax credits and adjustments specific to each member.

- Review the completed form for accuracy before submission.

Key elements of the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year

Key elements of the Form CT 3 ABC include:

- Member Identification: Essential details about each corporation included in the combined return.

- Income Reporting: Comprehensive reporting of income generated by each member.

- Deductions and Credits: Information on deductions and tax credits that each member is eligible for.

- Signature Section: A declaration confirming the accuracy of the information provided.

Legal use of the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year

The legal use of Form CT 3 ABC is primarily to ensure compliance with state tax laws. Corporations must file this form when they are part of a combined franchise tax return, as it provides necessary transparency regarding the financial activities of each member. Failure to file accurately may result in penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 3 ABC are typically aligned with the overall franchise tax return deadlines. Corporations should be aware of the specific due dates for their tax year to avoid late penalties. It is advisable to check the latest updates from the state tax authority to ensure compliance with any changes in deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 3 ABC can be submitted through various methods, including:

- Online Submission: Many states offer electronic filing options through their tax websites.

- Mail: Corporations can print and mail the completed form to the appropriate tax office.

- In-Person: Some tax offices may allow in-person submissions, providing an opportunity for immediate feedback.

Quick guide on how to complete form ct 3 abc members detail report filed by a corporation included in a combined franchise tax return tax year

Prepare Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year effortlessly on any gadget

Online document management has gained signNow traction among enterprises and individuals alike. It offers a superb environmentally friendly alternative to traditional printed and signed documents, enabling you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year with ease

- Locate Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, or a sharing link, or download it onto your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Alter and eSign Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year and guarantee seamless communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 abc members detail report filed by a corporation included in a combined franchise tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 abc members detail report filed by a corporation included in a combined franchise tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year?

The Form CT 3 ABC Member's Detail Report is a document that provides detailed information about a corporation's member in the context of a combined franchise tax return. It is crucial for ensuring compliance with tax regulations for entities filing together. Understanding this form is essential for corporations looking to accurately report their tax liabilities.

-

How can airSlate SignNow help me with completing the Form CT 3 ABC Member's Detail Report?

airSlate SignNow offers an easy-to-use platform that allows you to create, edit, and eSign the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year. By streamlining document management, you can efficiently complete necessary forms without hassle, ensuring accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for tax document management?

airSlate SignNow provides flexible pricing plans that cater to different business needs, ensuring access to features like document eSigning and secure storage. This means you can effectively manage the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year at a cost that suits your budget. Check our website for specific pricing details.

-

What features does airSlate SignNow offer for handling Form CT 3 ABC Member's Detail Reports?

With airSlate SignNow, you can efficiently manage your Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year through features such as customizable templates, real-time collaboration, and secure eSigning. These tools enhance the document workflow, saving you time and ensuring precision in tax reporting.

-

Is airSlate SignNow compliant with tax regulations for eSigning documents?

Yes, airSlate SignNow meets all necessary compliance standards for eSigning, making it a reliable solution for completing documents like the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year. Our platform ensures that your eSigned documents are legally binding and secure, satisfying all regulatory requirements.

-

Can I integrate airSlate SignNow with other software I use for accounting?

Absolutely! airSlate SignNow offers various integration options with popular accounting software, allowing you to seamlessly manage documents including the Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year. This interoperability streamlines your workflow and helps maintain data consistency across platforms.

-

What benefits can I expect from using airSlate SignNow for my corporation's tax reporting?

Using airSlate SignNow for your Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year can enhance efficiency, reduce errors, and ensure timely submissions. The platform's robust features simplify the process, allowing your team to focus on important tasks while easily managing tax documentation.

Get more for Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year

- Home winterization checklist pdf form

- Claim for abandoned property california state controlleramp39s office sco ca form

- Apsocilwelfairintercaste application form

- Silver sands poker form

- The following terms of the agreement of sale are changed as stated below form

- Social security administrationform ssa222 addendum

- Identification review to keep getting benefits yo form

- Pet custody agreement template form

Find out other Form CT 3 ABC Member's Detail Report Filed By A Corporation Included In A Combined Franchise Tax Return Tax Year

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free