SUT 451 PDF Vermont Department of Taxes 2022-2026

What is the SUT 451 form?

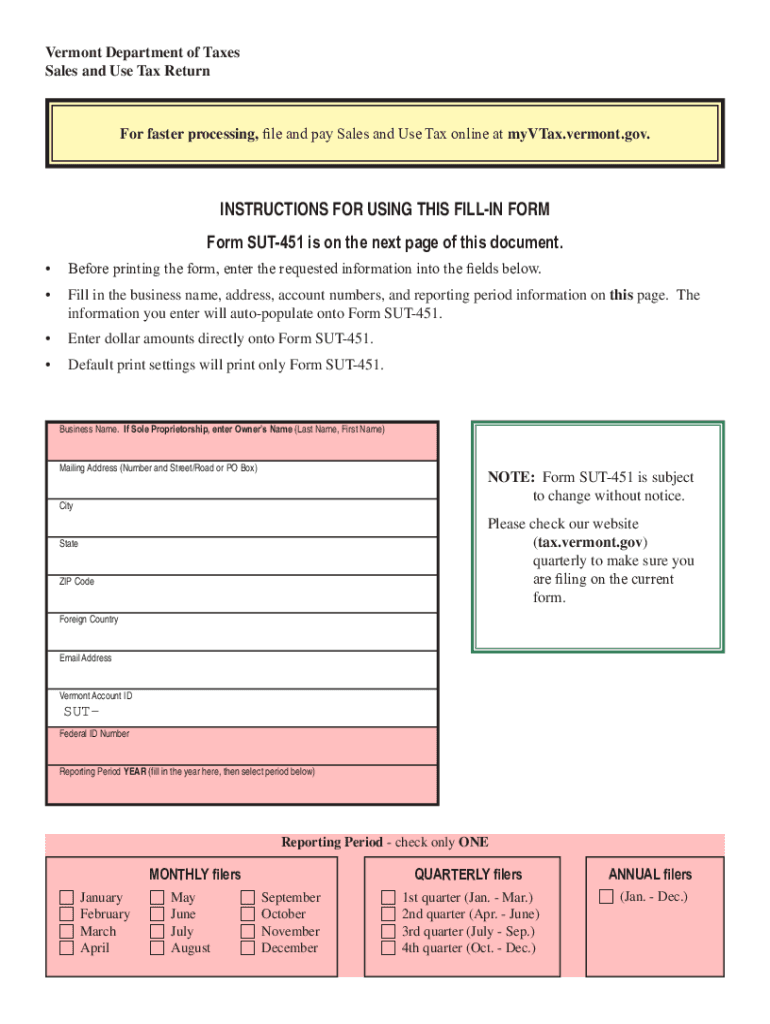

The SUT 451 form is a tax document issued by the Vermont Department of Taxes. It is primarily used for reporting sales and use tax for businesses operating within the state. This form allows businesses to accurately report the tax they have collected from customers and remit it to the state. Understanding the purpose and requirements of the SUT 451 form is essential for compliance with Vermont tax laws.

Steps to complete the SUT 451 form

Completing the SUT 451 form involves several key steps to ensure accurate reporting and compliance. Here is a simplified process to follow:

- Gather all necessary financial records, including sales receipts and tax collected.

- Fill in the business information, including name, address, and tax identification number.

- Report total sales and the amount of sales tax collected during the reporting period.

- Calculate any adjustments or exemptions applicable to your business.

- Sign and date the form to certify that the information provided is accurate.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the SUT 451 form to avoid penalties. Generally, businesses must file this form on a quarterly basis, with specific due dates set by the Vermont Department of Taxes. Keeping track of these deadlines helps ensure timely compliance and prevents any late fees.

Form Submission Methods

The SUT 451 form can be submitted in multiple ways to accommodate different business needs. Businesses can choose to file the form online through the Vermont Department of Taxes website, or they may opt to submit a paper version via mail. In-person submissions may also be available at designated tax offices. Each method has its own requirements, so it is important to choose the one that best fits your situation.

Legal use of the SUT 451 form

The SUT 451 form is legally binding when completed correctly and submitted on time. Compliance with the regulations set forth by the Vermont Department of Taxes ensures that businesses fulfill their tax obligations. Failure to properly use this form can result in penalties, including fines or interest on unpaid taxes. Understanding the legal implications of the SUT 451 form is essential for maintaining good standing with state tax authorities.

Key elements of the SUT 451 form

Several key elements must be included when completing the SUT 451 form to ensure it is valid. These elements include:

- Accurate identification of the business and its tax identification number.

- Total sales reported for the period.

- Amount of sales tax collected from customers.

- Details of any exemptions or adjustments claimed.

- Signature of the authorized representative certifying the information.

Quick guide on how to complete sut 451pdf vermont department of taxes

Effortlessly Prepare SUT 451 pdf Vermont Department Of Taxes on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the essential tools to create, edit, and electronically sign your documents quickly without delays. Manage SUT 451 pdf Vermont Department Of Taxes on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

Effortlessly Modify and eSign SUT 451 pdf Vermont Department Of Taxes

- Obtain SUT 451 pdf Vermont Department Of Taxes and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Select signNow sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and hit the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign SUT 451 pdf Vermont Department Of Taxes and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sut 451pdf vermont department of taxes

Create this form in 5 minutes!

People also ask

-

What is the Vermont SUT and how does it relate to airSlate SignNow?

The Vermont SUT, or Vermont Sales and Use Tax, influences how businesses calculate tax on transactions. With airSlate SignNow, businesses can streamline document signing, ensuring compliance with state taxes like the Vermont SUT. Our platform allows for easy documentation and management of your tax obligations.

-

How can airSlate SignNow help with compliance for Vermont SUT?

AirSlate SignNow helps ensure compliance with the Vermont SUT by providing verified document templates that adhere to regional tax regulations. Our eSigning platform allows you to create and maintain necessary documentation accurately. This minimizes the risk of errors related to the Vermont SUT documentation.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers competitive pricing tailored for businesses of all sizes. Our plans are designed to provide value for those managing Vermont SUT documents and other essential paperwork. Explore our pricing page for detailed options that fit your organization's needs.

-

What features does airSlate SignNow offer to manage SUT documentation?

With airSlate SignNow, you can create, send, and manage documents efficiently while ensuring that your Vermont SUT requirements are met. Key features include customizable templates, team collaboration tools, and secure eSignature capabilities. These tools simplify the handling of tax-related paperwork.

-

Can airSlate SignNow integrate with other accounting tools for Vermont SUT management?

Yes, airSlate SignNow seamlessly integrates with several accounting software solutions that help manage Vermont SUT. This integration facilitates real-time data sharing and simplifies tax compliance processes. Ensure that your documents align with the necessary tax filing requirements effortlessly.

-

What benefits does airSlate SignNow provide for small businesses in Vermont?

For small businesses in Vermont, airSlate SignNow offers an affordable solution for managing documents related to the state’s SUT. Our platform enhances efficiency and accuracy while reducing operational costs. This can lead to signNow time savings and improved compliance for Vermont SUT obligations.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore our features for managing Vermont SUT documentation. This trial gives you the opportunity to experience the benefits of streamlined eSignatures without any upfront commitment. Take advantage of this offer to see how it fits your business needs.

Get more for SUT 451 pdf Vermont Department Of Taxes

Find out other SUT 451 pdf Vermont Department Of Taxes

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF